Key Insights:

- Crypto markets have corrected to $2.36T mcap from $2.6T in a week.

- Bitcoin struggles to cross $100k as profit booking intensifies.

- Memecoins, too, have extended their losses since yesterday.

- Among revival candidates, Algorand and Worldcoin show high potential.

Crypto markets extended their losses today, with most cryptos in red. Though this correction is well within the normal course of the markets, it wiped out more than $1.7 billion in nominal value from derivatives markets and $240 billion from spot markets in the last 24 hours.

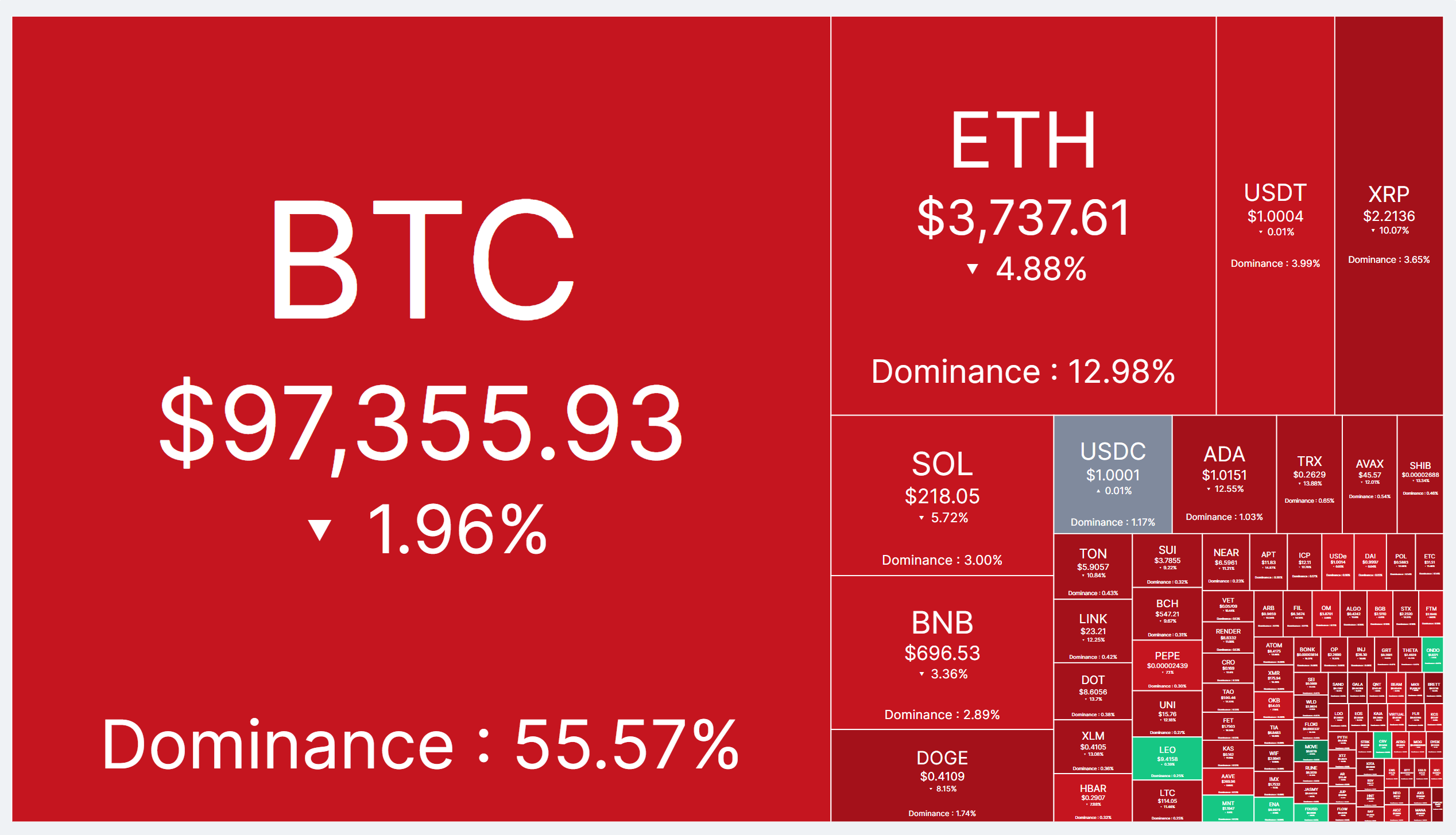

Crypto Market Heatmap Today

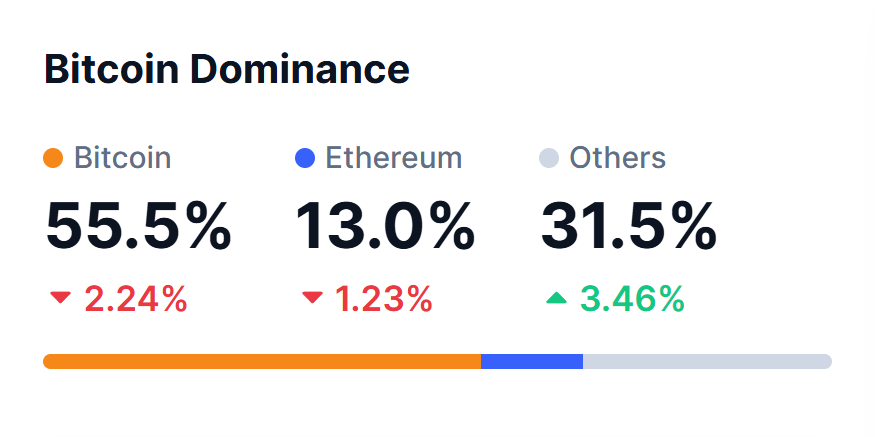

Bitcoin has retraced to $97k levels from a peak of $98.5k yesterday. However, it has gained in terms of market dominance from 53.9% yesterday to 55.5% today. Lately, there has been a virtual race among top asset management companies to acquire Bitcoin.

Among them, MicroStrategy has been a clear winner after it acquired $15.5 billion worth of Bitcoins this quarter.

Ethereum, too, has slightly receded to $3700 levels after crossing $4000 earlier yesterday. Ethereum has lately been gaining market cap, and its dominance is at its monthly peak of 13% at press time. Ethereum’s stellar performance comes from the strong performance of its ETFs and a strong demand for ETH from whales and in retail markets.

The top altcoin trio XRP, SOL, and BNB saw some major corrections. XRP corrected 10% since yesterday and reached $2.21, leading the trio in losses. SOL corrected lesser at 5.5% to reach $217 due to ETF news, and BNB corrected the least among them with 3.1% and reached a price of $694 at press time.

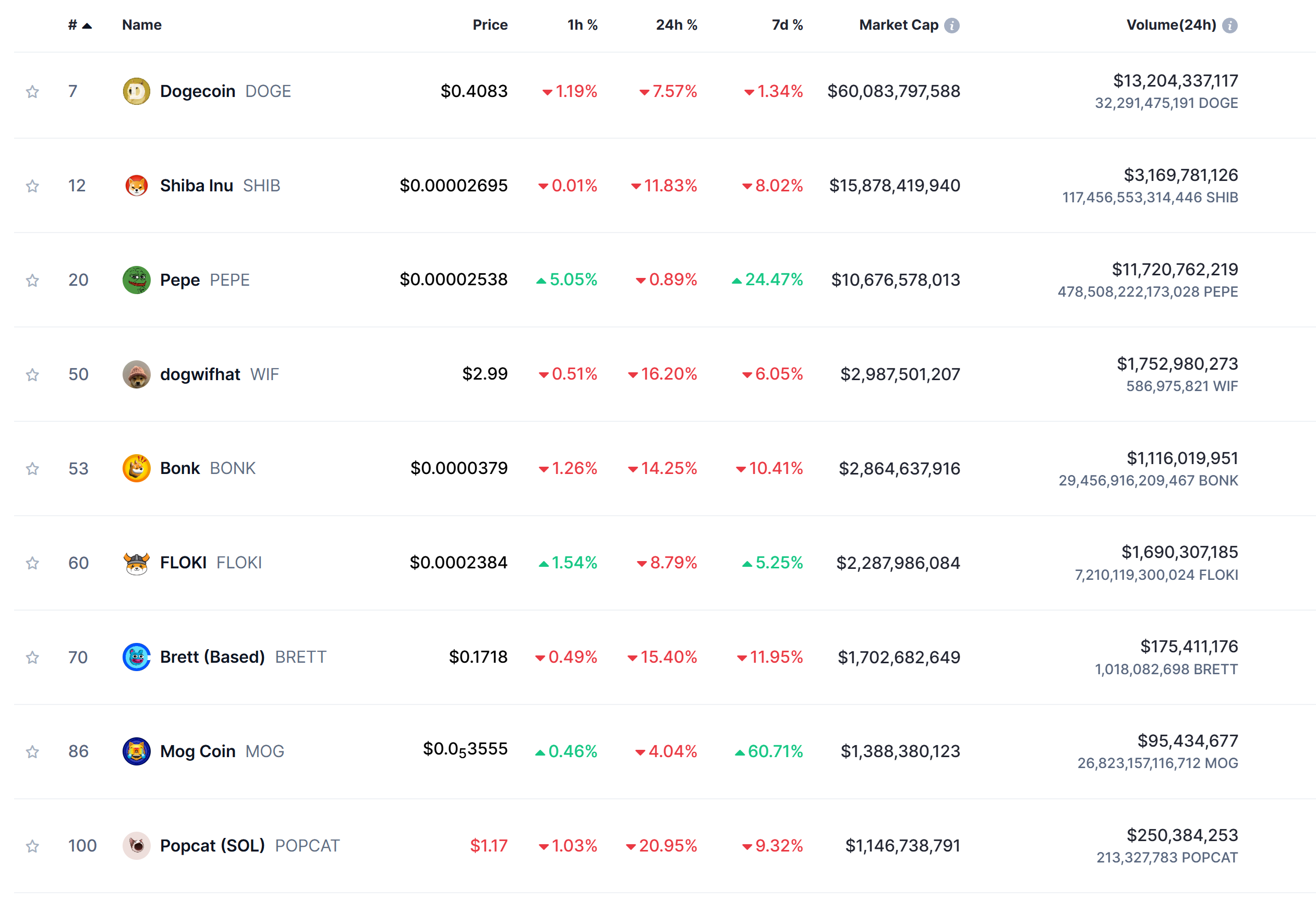

Memecoins extended their losses since yesterday. The top losers among major memecoins today were Popcat (21%), dogwifhat(17%), Brett (16%), and Bonk(15%). Among larger memecoins, SHIB corrected 12.2%, and DOGE corrected 7.6% in the last 24 hours, reaching $0.000027 and $0.40, respectively, at press time.

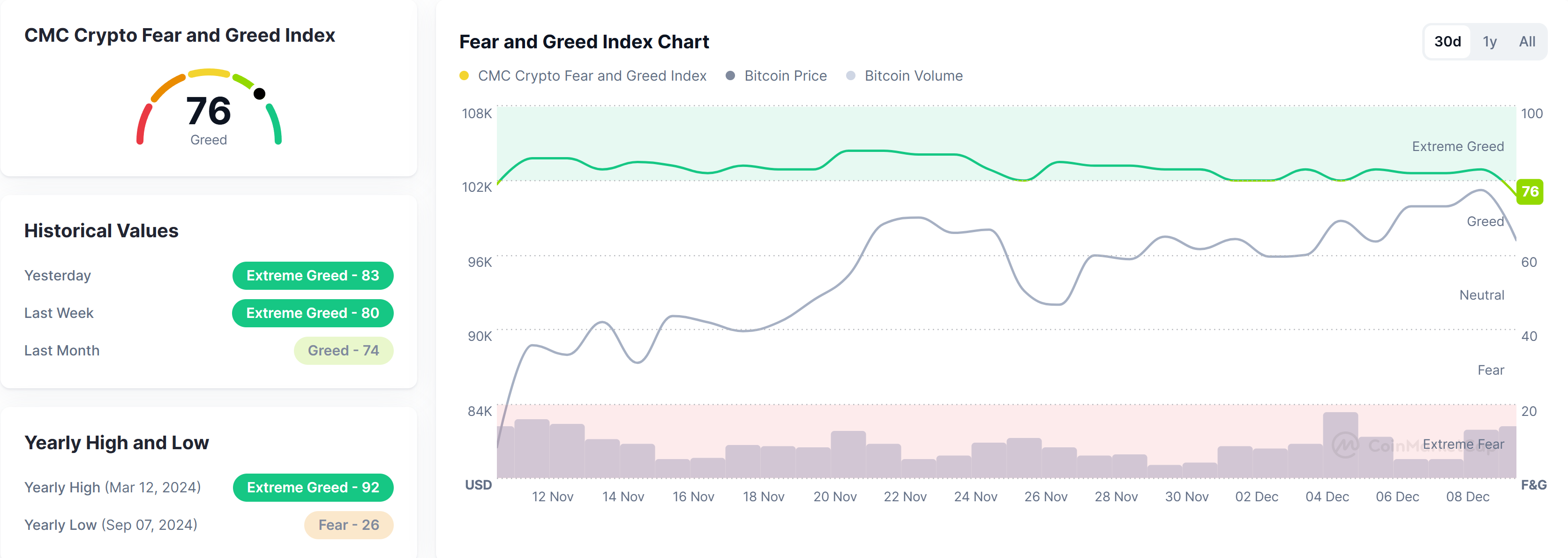

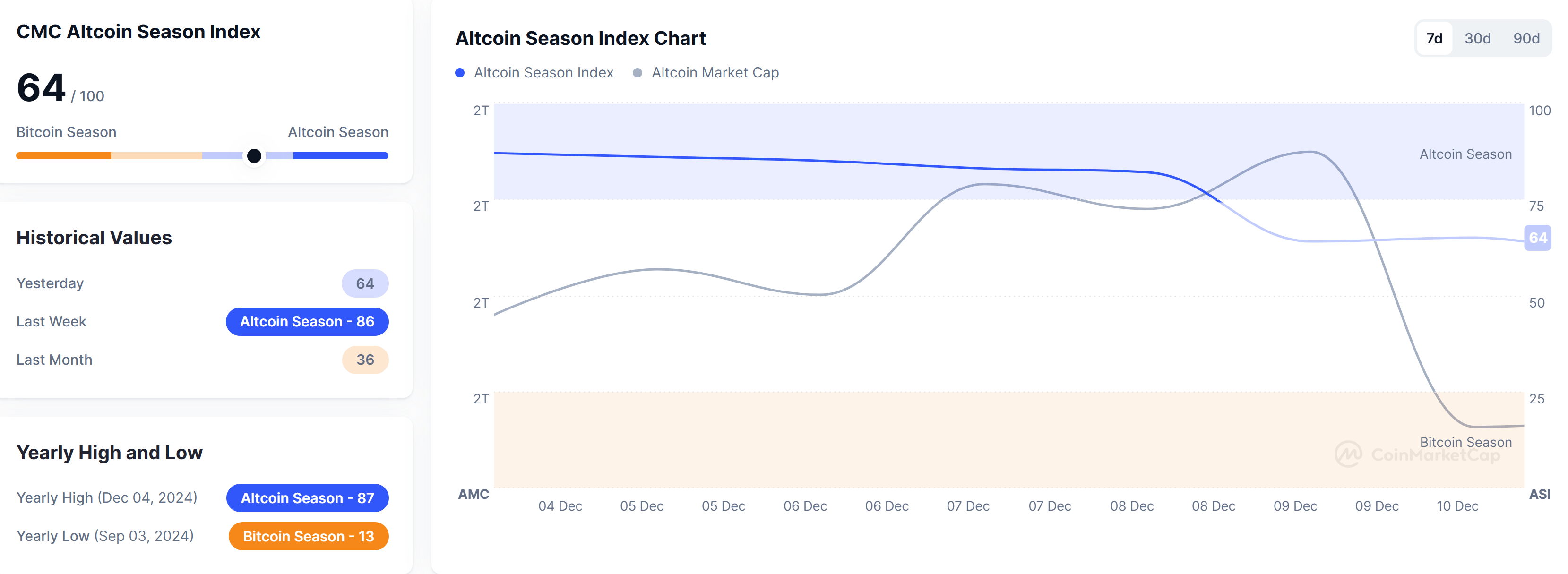

Altcoin Index and Crypto Fear and Greed Index Cool Down

After a phenomenal rally last month, the crypto markets reeled under profit booking today, causing bullish sentiments to drop.

At press time, the crypto fear and greed index had reached a level of 76, which is still highly bullish considering major market corrections.

Crypto Fear and Greed Index

However, the altcoin season index has dropped drastically from 83 yesterday to 61 today. This is because, with each market correction, altcoins tend to correct more than Bitcoin due to their high volatility. Further, since Bitcoin enjoys institutional investment that is less turbulent and focused on the long term, it tends to correct less. This is the reason why Bitcoin’s market dominance has increased from 53.9 yesterday to 55.5% today.

CMC Altcoin Index Trend in the Last 7 Days

Bitcoin and Ethereum’s Market Dominance on 10 Dec 2024

Memecoins Extend Their Losses

Most of the top memecoins today have shown losses running between 5% and 20%, with most correcting after major rallies and all-time highs. This profit booking was expected and might stop soon.

Top 10 Memecoins by MarketCap

Among the top two memecoins, both DOGE and SHIB have been consolidating at higher levels and have not extended their losses like smaller memecoins did. At press time, DOGE was around $0.4 after a fall of 7.6% since yesterday and SHIB at $0.000026 with a 12% loss. However, both of them show strong signs of a further rally, with DOGE seeing $1 and SHIB seeing $0.000067 in the next few weeks.

Top Emerging Altcoins

Two emerging altcoins have caught our attention. Algorand and Worldcoin are the top candidates showing revival potential.

Algorand has gained nearly 200% in the last one month and at press time quotes a price of $0.42. It is now at its highest point in the last 2.5 years. The project features a low-cost, quantum-resistant blockchain with backing from the Massachusetts Institute of Technology.

Algorand Price History in the Last 1 Month

Worldcoin has been another top candidate showing high revival potential in the current markets. After a fall from $11 in March 2024 to $1.9 in June this year, most of us assumed that the project would die. However, consistent development and engagement with regulators have uplifted its future potential. The project now sees an increasing demand in digital ID markets.

Worldcoin Price Trends in the Last 1 Month

This does not mean both projects have emerged victorious. Both still face fundamental challenges that could derail their future. However, at present, the odds seem to be in their favor.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.