Key Insights:

- Solana’s $1000 Dream Might Be Closer Than You Think

- Top 5 Factors Pushing Solana Ahead of Ethereum

- 1. Network Activity Among Layer-1s

- 2. Diverse Memecoin Ecosystem

- 3. Month on-Month DeFi Growth of 73%

- 4. Highest Network Speed Among Major L1s

- 5. Solana Dapps Pose Stiff Competition to Ethereum

- Long-Term Price Estimates

- Solana has seen the formation of a cup and handle pattern on weekly charts.

- Estimates suggest a target of $1120 could arrive within 2025.

- Solana is supported by high DeFi growth, a well-developed on-chain ecosystem, strong Dapp growth, and a very scalable blockchain.

- Experts agree on Solana’s stellar future, with some estimates suggesting $4000 price targets in the long term.

Solana’s $1000 Dream Might Be Closer Than You Think

Crypto analyst shows that Solana’s charts have already seen the completion of a cup and handle pattern on its weekly charts. This cup and handle pattern has a target of $1120.

$SOL at $1,000? Long Base Needed#Solana's chart structure remains bullish with a clear cup-and-handle formation.

-Consolidation below ATH may come first

-Sub-$200 could be accumulation zones

-The longer the base, the stronger the breakoutBig moves need strong foundations. pic.twitter.com/XYbbqJijf5

— InvestingHaven (@InvestingHaven) December 17, 2024

The expert also argues that any dip below $200 would be the best accumulation level for Solana. At press time, Solana was trading at $190, shedding its recent losses. The crypto is up by almost 3% intraday with a trading volume of $4.27 billion.

Trends on the weekly charts often have a higher success rate because of a very long base. Further, long-timeframe trends(on weekly or daily charts) rarely cancel out compared to shorter ones (hourly or 4-hour charts).

This is perhaps one of the reasons why top ETF issuers like VanEck have already been bullish on their Solana ETFs. VanEck had pushed for the approval of its ETF much earlier in June 2024.

BREAKING VAN ECK FILES FOR SOLANA ETF TRUST pic.twitter.com/Swr2xWxjOj

— That Martini Guy ₿ (@MartiniGuyYT) June 27, 2024

Top 5 Factors Pushing Solana Ahead of Ethereum

There are several small and large factors that have been pushing Solana higher.

Smaller factors like user-friendliness, ease of availability and the huge peer to peer network in SOL have played a significant role in pushing it higher.

However, our current discussion will be limited to larger factors like network activity, ecosystem diversity and other on-chain factors due to them being measurable via different metrics.

1. Network Activity Among Layer-1s

According to the data available on Token Terminal, Solana had average monthly user figures of 116.45 million for the past 30 days preceding today and is much higher than Ethereum’s 7.36 million.

This trend was also seen last month when in October Solana accounted for 120 million users beating all other blockchains.

2. Diverse Memecoin Ecosystem

Solana has the presence of the most diverse memecoins on its blockchain. At present, despite severe corrections, Solana memecoins have a market cap of $15.2 billion. This might seem lower than Ethereum, which has Shiba Inu and Pepe (combined cap of $21 billion), but Solana has a much more diverse ecosystem that is not threatened by the fall in single projects.

3. Month on-Month DeFi Growth of 73%

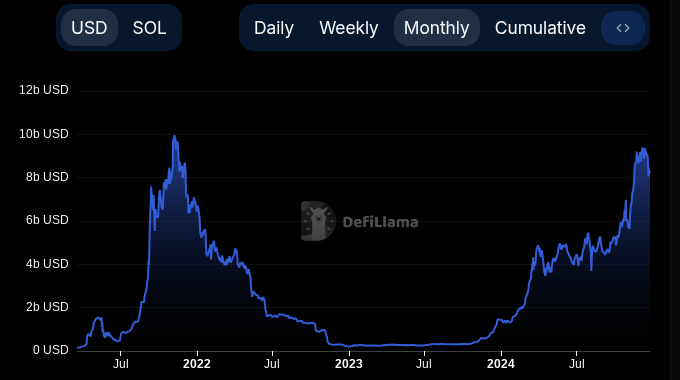

Solana recorded a 73% growth in November in its DeFi activity. The graph below from DeFi Llama clearly captures this trend.

Solana’s TVL Growth in Recent Times

According to DeFi Llama, the most popular blockchain among all DeFi-enabled chains is currently Solana with 4.16 million addresses. Other chains like Tron(2.35 million addresses), Base(1.59 million addresses), and BSC (1 million addresses), are far behind it.

Solana also has the second-highest TVL at $8.3 billion, after Ethereum’s $67.6 billion. Comparing other chains, Solana’s TVL is much higher than Tron ($7.3 billion), and even Bitcoin ($6.5 billion), despite each of them being much ahead in terms of on-chain liquidity.

4. Highest Network Speed Among Major L1s

Solana’s theoretical network speed of 65,000 TPS is much ahead of all major L1 chains like Bitcoin, Ethereum, XRP, and BNB. This helps Solana keep it’s network costs down and in turn promotes projects that focus on scalability.

Even in terms of real-time TPS, Solana easily maintains a speed of around 4000 transactions per second without stressing its chain.

5. Solana Dapps Pose Stiff Competition to Ethereum

The most active DEX on Solana, Raydium, has a 22% share in the DEX market space, very close to the top Ethereum DEX Uniswap’s 25%. Further, with the rate at which Raydium has been rising, we assume it will eventually prevail over Uniswap by the end of 2024.

Solana DEX Volumes Nov 2024

Long-Term Price Estimates

In the long-term, Solana’s price could easily touch $4000 levels based on expert predictions. Top chart analyst Ali Martinez thinks Solana would easily cross these levels because of the formation of a 2-year wide super bullish cup and handle pattern (different than that mentioned earlier).

#Solana $SOL will hit $4,000, based on this cup and handle pattern! pic.twitter.com/dXZLI9urOh

— Ali (@ali_charts) December 10, 2024

If this estimate proves to be true, SOL could be looking at a growth potential of more than 2000%.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.