Key Insights

- Binance sells huge amounts of Ethereum and Solana via Wintermute.

- Solana will see a $2 billion token unlock while Ethereum sees increasing FUD around its price.

- The sales happen even when many altcoins are expecting an ETF soon.

- Both Ethereum and Solana are fundamentally strong in the current markets with huge future potential, despite current market FUD.

Binance Dumps Solana Due to Unlocks and Ethereum Due to Crash Fears

Crypto research firm HodlFM Team has spotted Binance selling Solana and Ethereum via Wintermute, a market maker. Solana and Ethereum have seen some turbulence in recent times.

Binance & Wintermute dumping Solana?

Over the past 4 hours, multiple large $SOL transfers have been spotted from @binance wallets to @wintermute_t, one of the biggest market makers in crypto.

Meanwhile, Solana is under $160 following the $2b token unlock on March 1. pic.twitter.com/PGH15Xku7c

— HodlFM Team (@Hodl_fm) February 24, 2025

Solana has seen a crash in its price from $294 to $138 at press time as the memecoin markets extend losses. On the part of Ethereum, the top L1 coin has been seeing significant selling pressure in the last few months. At press time, Ethereum trades around $2500.

The reason why Binance has been dumping these cryptocurrencies in the markets seems to come from its customers. Solana and ETH have spooked several customers, many of whom are questioning their ability to get back to pre-crash levels.

@binance violently selling $ETH, $TRUMP and other crypto.

The entire market is dumping because of this.

What are they up to? pic.twitter.com/pLKfg1IBrV— VorteXz⚡️ (@VorteXz171) February 24, 2025

Specific reasons for dumping in Solana could be its $2 billion worth of unlocks, while for Ethereum, it seems a possible crash following a $1.4 billion ETH hack from Bybit could happen soon.

Lately, the crypto markets have seen very high liquidation, with ETH seeing one of the highest such levels in recent times.

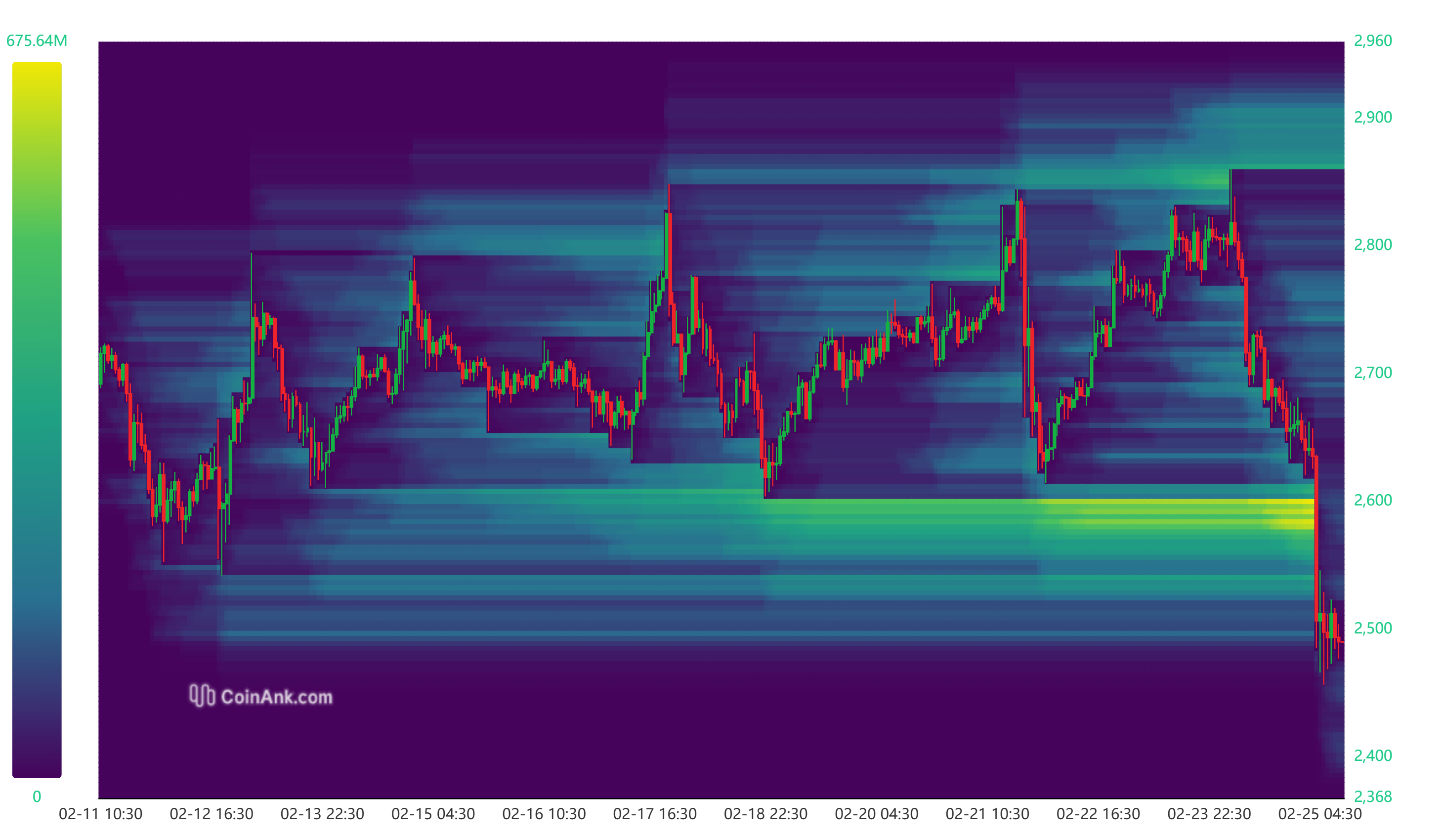

ETH Liquidation Heat Map

Solana too has seen increased rates of liquidations in the last 14 days.

SOL Liquidation Heat Map

Liquidations are those forced closures of trades where users cease their trading positions, whether bullish or bearish, because the market moves strongly in the opposite direction. In the current case, the markets have moved strongly against both Ethereum (20%) and Solana (25%) within the last two weeks.

Why is Ethereum Down?

ETH has been seeing increasing FUD around its price since June 2024 because of the memecoin supercycle.

Reason for ETH’s Fall

The sole major reason of Ethereum’s fall emerges from the memecoin supercycle, which attracted the entire market’s attention, making several millionaires. As a result, by the end of the memecoin supercycle, crypto markets were seeing roughly 50,000 memecoin launches per day.

Will ETH Go Back Up?

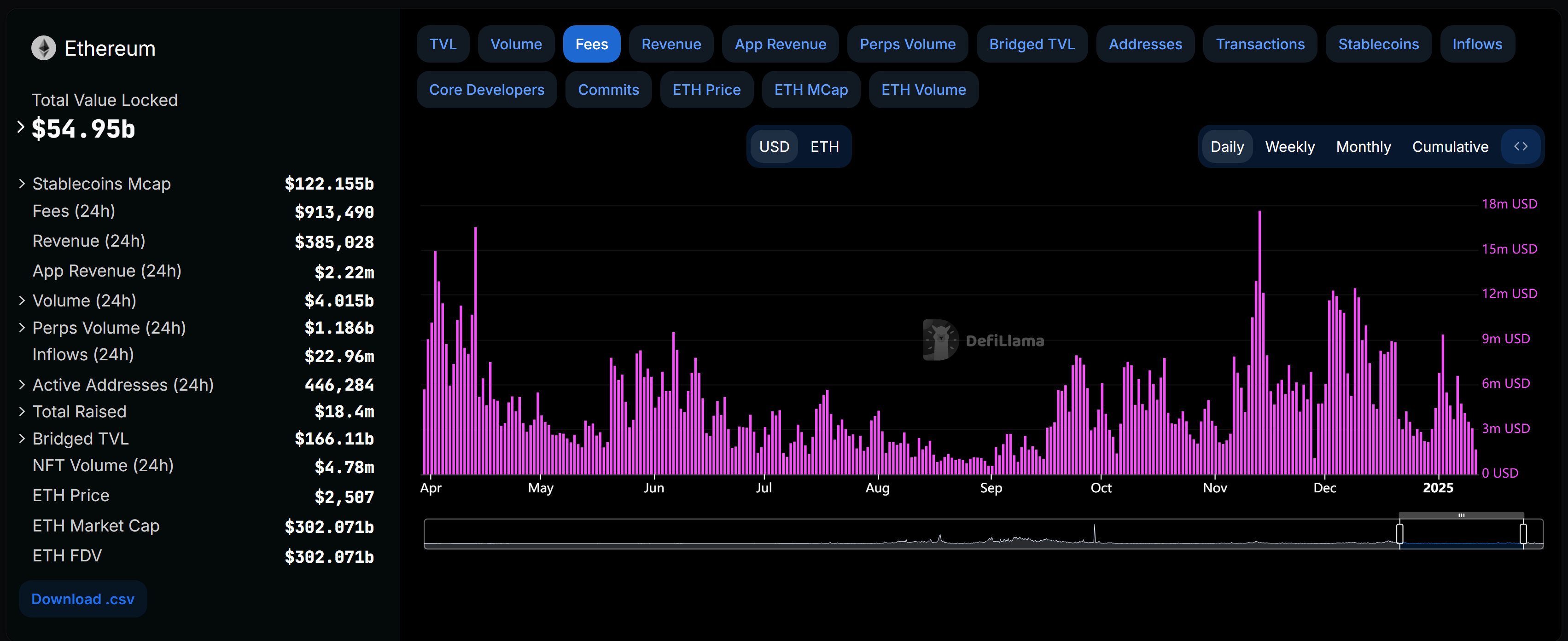

Yes, ETH could go back up in the near future. Fee trends, expert predictions, and many other signals indicate a positive momentum in the future.

Its fee revenue saw a net growth in 2024 despite a 99%+ crash in average fee collection. This indicates that there has been a strong network growth last year.

Ethereum Fee Trends in 2024 and 2025

Price Analysis for 2025

If we see expert predictions, VanEck expects a $6,000 price tag by the end of the year. Crypto chart analyst Ali Martinez sees a similar level of growth, while Bankless co-founder sees a $10,000 price tag. Our own estimates suggest a $15,000 price tag by the end of 2025 to early 2026.

#Altcoins 2016/2017 vs. #Altcoins 2024/2025

Even the timing is almost identical (1 month difference).

Sounds strange at first, but this crash yesterday was necessary and is rly bullish. pic.twitter.com/4Eiq7UTLc5

— ⓗ (@el_crypto_prof) December 10, 2024

What Is Happening to Solana?

Solana has seen a 55% price crash from its ATH achieved just a couple of months ago. This crash in Solana’s price has forced liquidations in the markets causing many to panic sell. As a result, Solana has been pushed down to $138 levels at press time.

What is Causing Solana’s Fall?

The end of rally in the memecoin markets is seeing a fall in Solana, as it was the primary source of fees for the blockchain.

Lately, we have seen a shift in Solana that would shift its focus from memecoins to utility-based sectors. At present, we are assuming that this means more growth in RWA, Metaverses, and DeFi-based projects.

Will Solana Go Back Up?

Solana is falling at the same rate as the broader crypto markets. This will help it regain its lost prices once the markets start to climb. However, given the end of the memecoin supercycle, we might see a strong phase of developmental activity before its price picks up positive momentum again.

Solana Price Prediction 2025

VanEck, one of the leading crypto ETF issuers, thinks that Solana could reach $500 by the end of 2025.

Our own estimates which were successful in the previous time, suggest that Solana could reach a bull phase in mid-2025 as the US crypto policy begins to take shape. By the end of 2025, we expect $1000 per SOL, and in the long term, SOL could see $4000 levels.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.