Key Insights:

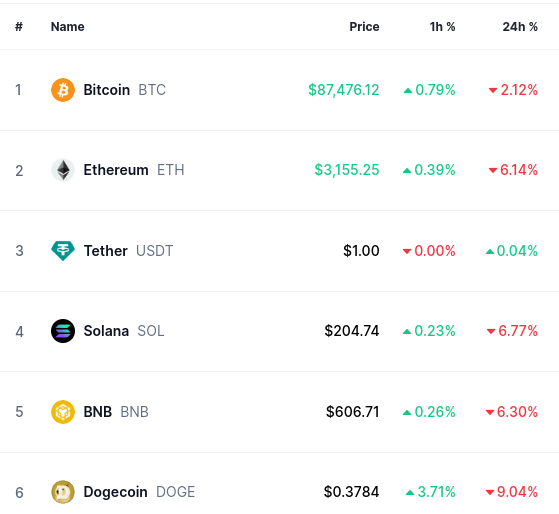

- Crypto markets have seen flash rallies and major price corrections this week.

- Bitcoin rose to new ATH of $89.9k, Ethereum crossed $3000 while Dogecoin flipped XRP and USDC.

- Lately, Altcoins have corrected with no such corrections in Bitcoin, causing its market dominance to rise to 60%.

Bitcoin’s Market Dominance At 60%

Bitcoin has reached new ATH levels of $89.9k and has stabilized near the $86k price zone at press time. The top cryptocurrency has been one of the largest gainers this week, taking the crypto market cap to almost $3 trillion because of its high market dominance.

At press time, Bitcoin’s market dominance is at 59.8% and is expected to reach 60% within this week due to weaker Altcoin markets and much stronger investor support for Bitcoin.

Bitcoin saw four distinct phases in its market dominance history.

Bitcoin Market Dominance 2013 to 2024

Earlier, it was presumed that Bitcoin would continue to lose dominance as the crypto markets matured. This proved true until 2018 when its market dominance fell to 34%.

This is when Bitcoin saw a few highly volatile years. Its market cap rose from 34% to 70% within a year, i.e., by 2019. In this phase, Bitcoin saw one of the best rallies in its history, with prices going from $3.6k to around $12.1k. However, it soon began to fall, starting in 2021.

Between early 2021 to late 2022, i.e., till the end of the crypto winter, Bitcoin market dominance again started falling from 69.2% to 38.3% ending with the launch of Bitcoin ETF.

The last phase i.e., the current phase is the phase of Bitcoin’s growth when it rose from $16k levels in early 2023 to $90k levels in late 2024. This growth saw its dominance rise again from 38% to 60%. However, the current market dominance might have reached a peak as Bitcoin seems to stabilize at these levels.

In the last phase, Bitcoin’s growth was influenced by factors that were not seen earlier. The current growth phase, which has lasted for the last 22 months, was heavily influenced by institutions when Bitcoin ETFs and investment companies accumulated BTC.

Why Are the Altcoins Bleeding?

The Altcoin markets gained decently in the last few days. Ethereum crossed $3,000, XRP crossed $0.65, Dogecoin flipped XRP and USDC, and Solana managed to cross its 2024 high of $210. Yet all these started correcting heavily after a couple of days of reaching their highs.

Corrections in the Altcoin Markets

The cause of these corrections will become more clear by the end of this week. At present, it seems like the corrections were a result of heavy profit booking because the markets gauge that unlike Bitcoin, which sees a consistent long-term commitment from institutional investors, other altcoins rarely see such commitment.

However, two unique Altcoins do not fit into the above assumption. Ethereum, the first one, saw a consistent decline because of whales dumping its token, failure of ETFs to pick momentum and the declining rate of is market utility.

The second is XRP, which sees heavy investment from multinational finance giants like JP Morgan. Still, XRP lost heavily in the current correction because, unlike Bitcoin, institutions do not use it as a reserve asset. XRP is mostly used for transactional purposes and hence sees bouts of volatility when its usage is low.

Further, the crypto also suffers from severe regulatory and legal issues created by the SEC and despite winning two cases against the regulator, has yielded zero clarity from it.

Will Markets Sustain at Current Levels?

Markets are likely to regain the high price levels achieved earlier this week because the inflow of capital has been consistent over the last few weeks.

The central reason for this consistent inflows is the 0.75% rate cut, which the US Fed made in the second half of this year. A considerable portion of the additional liquidity created by the Fed made its way into the crypto markets, taking the market cap to $3 trillion.

Further, on several occasions, we have seen that markets eventually recover after such profit-booking-led corrections. Also, during the flash rallies that we saw across the markets, the derivatives data gets highly volatile, causing frequent ups and downs in the market, like we saw this week.

Such volatility eventually cools down within a fortnight, and we expect the markets to stabilize at higher levels by the end of November 2024.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.