Key Insights

- A new Bitcoin ETF and the next halving event may launch Bitcoin above $80,000 in 2024.

- Bitwise predicts stablecoins will beat Visa’s payment volume in 2024.

- Ethereum revenue is projected to double thanks to the upcoming EIP-4844 upgrade.

- AI assistants will begin using crypto for online payments, solidifying its role as the “native currency of the internet.”

- Coinbase revenue will double and JP Morgan is also expected to tokenize a fund.

A week after VanEck released its list of 15 predictions for the world of crypto in 2024, Bitwise, another asset manager has come out with 10 of its own predictions.

While VanEck’s predictions were centred mostly on predictions of the general market’s performance including stablecoins, exchanges, Bitcoin, Ethereum and the rest of its rivals, Bitwise’s is a lot more concise.

Bitwise’s is a lot more concise, focusing on Bitcoin, Ethereum, ETFs, stablecoins and an out-of-the-blue topic… Taylor Swift.

Let’s see what the asset manager had to say

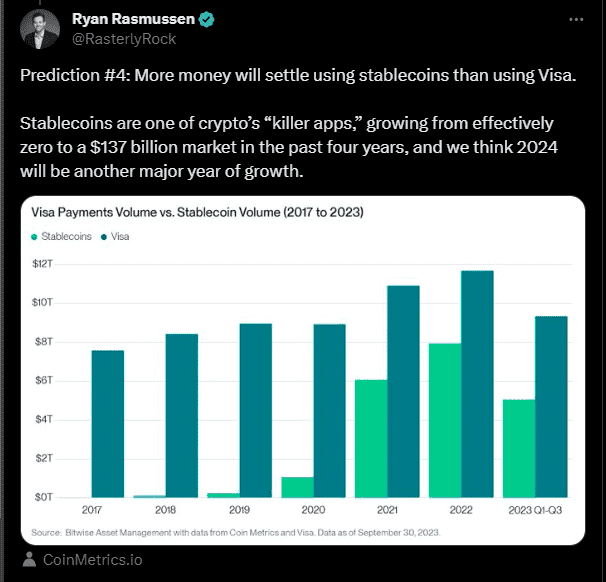

Stablecoins Will beat Visa

According to a 13 December thread on Twitter (now X) from Bitwise’s senior research analyst, Ryan Rasmussen, stablecoins will be used to settle more volume than Visa payments volume in 2024.

Rasmussen refers to stablecoins as the “killer app” of crypto and suggests that this amount of money that stablecoins will be used to process will beat the $9 trillion mark that Visa processed in the third quarter of 2023.

Rasmussen also notes that during the same period of Visa’s $9 trillion, stablecoins weren’t far behind at all. In fact, they processed about $5 trillion during the same period, indicating that industry players are creating a huge demand for these “digital fiats”.

Rasmussen says that stablecoins will be used to handle various use cases like remittances, cross-border payments, DeFi, gaming, e-commerce, and more. He also pointed out that stablecoins grew from a market cap of near-zero to a whopping $137 billion in just four years, and predicted that they will continue to expand in 2024.

This is similar to VanEck’s prediction, in which the asset manager predicted that the total stablecoin market cap would grow to reach a whopping $200 billion by the end of 2024.

Bitcoin Is Set To Shine

According to Bitwise, Bitcoin is also expected to have a spectacular 2024.

According to Rasmussen’s thread, Bitcoin will hit and break past $80,000 in 2024.

Bitwise’s predictions were similar to VanEck’s in this regard.

According to Rasmussen the launch of the first spot Bitcoin ETF, as well as the upcoming halving event will be the major catalysts for this Bitcoin price explosion.

Rasmussen also says that this ETF approval next year will be the most successful ETF launch of all time.

The prediction goes on to say that Bitcoin ETFs will capture about $72 billion in assets under management (or AUM) within the next five years.

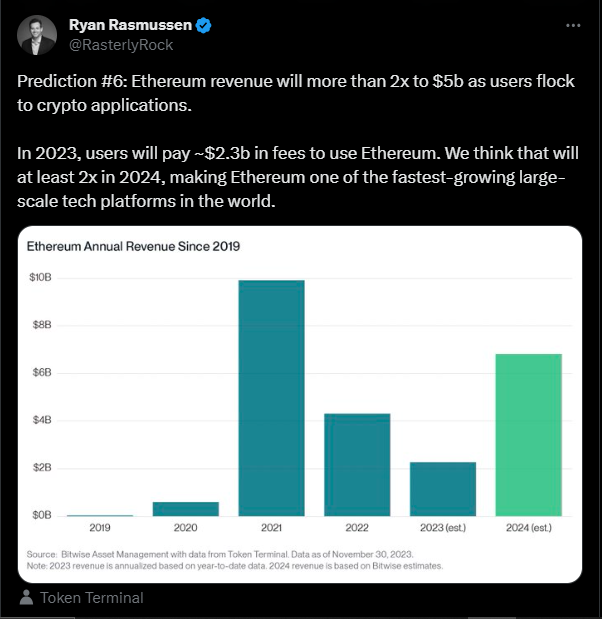

Ethereum And AI

According to Rasmussen, Ethereum is set to experience more than a 2x increase in revenue to $5b as users rush towards crypto applications.

Rasmussen goes further to say that in 2023, users will pay ~$2.3b in fees to use Ethereum.

This, he explains, will make Ethereum one of the fastest-growing tech platforms in the world.

Rasmussen says that the EIP-4844 upgrade could potentially drive the average cost of transactions below $0.01. This 90%+ reduction in transaction costs may attract a lot more investors to Ethereum, leaving an open-ended question as to where that leaves L2 Solutions like Polygon and Optimism.

As with the issue of AI, however, Rasmussen says that AI assistants will start using crypto to pay for things online.

Rasmussen explained that this will affirm crypto as “the native currency of the internet.â€

Seeing as AI is digital in nature, Rasmussen says that AI assistants will also prefer digitally native money, like bitcoin or stablecoins, and that this will start happening in 2024.

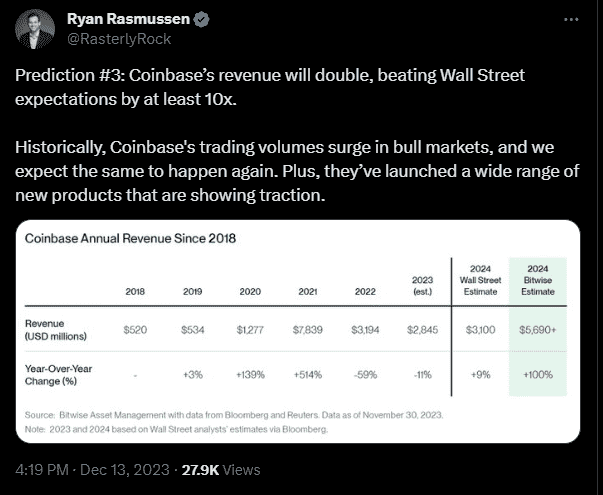

Coinbase And JP Morgan

There has been a lot of speculation as of late, about Coinbase’s chances of beating Binance to become the largest crypto exchange in the world by trading volume.

According to one of the predictions from Bitwise, Coinbase’s revenue will double in 2024 and will beat Wall Street expectations by at least 10x.

Rasmussen says that historically, Coinbase’s trading volumes surge in bull markets, and the same thing might happen again.

Rasmussen explains that asset tokenization will skyrocket in 2024. JPMorgan will tokenize a fund and launch it on-chain as Wall Street gears up to tokenize real-world assets.

This, Rasmussen explains, will allow JP Morgan to take advantage of crypto’s capabilities, especially while the market is growing.

For Some Reason… Spotify and Taylor Swift

Rasmussen’s thread took a rather unexpected turn when he mentioned that Bitwise predicts Taylor Swift will launch a new NFT collection in 2023.

Rasmussen mentions that this might happen, considering how Spotify—where Swift was the most-streamed artist in 2023, is experimenting with “token-gated†playlists.

In essence, only fans who possess a particular NFT will have access to certain songs.

Rasmussen suggests that Taylor Swift may take advantage of this, and launch a new NFT drop.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.