Key Insights

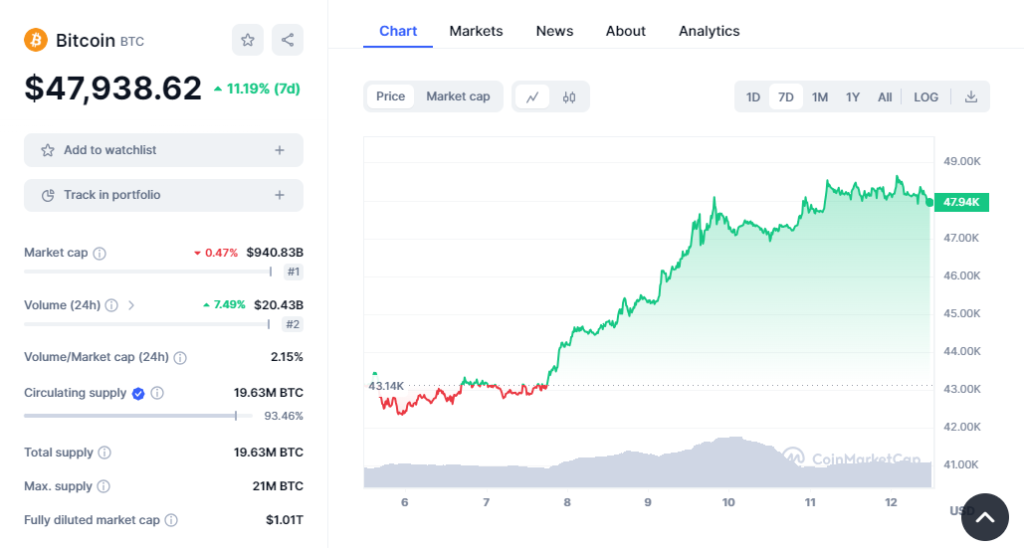

- Recent weeks have seen increased volatility, with Bitcoin nearing $50,000 but also facing uncertainty and potential sell-offs.

- According to Glassnode, the MVRV ratio indicates a “high risk” outlook, where long-term holders are profitable and might take profits at any time.

- Despite the “high risk” status, other data shows long-term investors might be uninterested in selling

- Grayscale on the other hand, believes Bitcoin ETFs can attract new buyers and balance miner selling pressure after the halving.

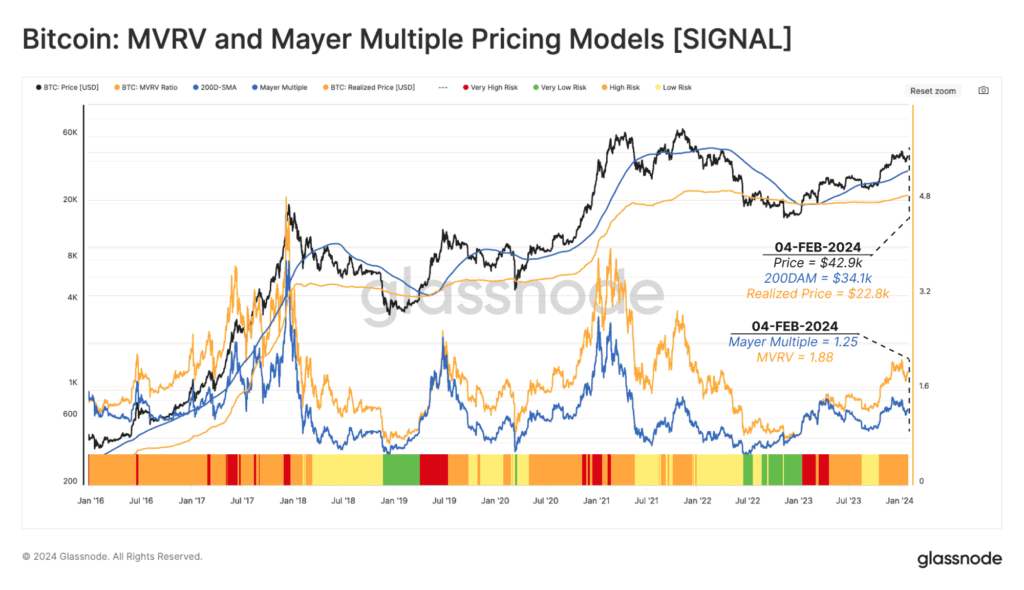

In the charts, Bitcoin faces resistance near $49,000 but could soon reach $50,000

Bitcoin has become a lot more volatile than it used to be in recent weeks, according to several indicators.

The cryptocurrency has come incredibly close to hitting or even breaking the $50,000 zone, and according to Glassnode, several on-chain indicators may be indicating that the cryptocurrency is in the early stages of the next bull market.

Not only that, the cryptocurrency is also facing massive uncertainty and a looming sell-off.

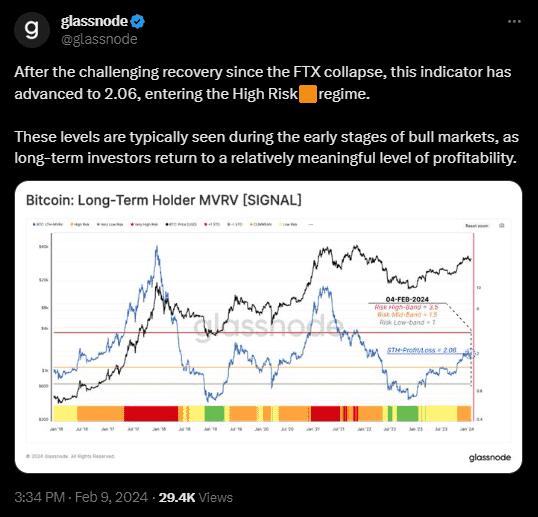

Glassnode Says Bitcoin Is In “High Risk†Zone

The MVRV ratio is one of the most important metrics for determining what is going on with Bitcoin under the hood.

In essence, it helps analysts to determine whether the cryptocurrency is overvalued or trading at a “fair valueâ€.

According to a new insight report from Glassnode, the long-term holder MVRV ratio for Bitcoin (which calculates the amount of coins that haven’t been moved in at least 155 days), shows that the cryptocurrency has entered a “high-risk†zone.

In essence, Glassnode means that Bitcoin’s long-term investors have reached a significant level of profit, and could be taking profits at any time.

Glassnode says that this usually happens in the early stages of an incoming bull market, and shows that the market is starting to heat up and raw in more attention.

Furthermore, Glassnode notes that other indicators like the supply profitability state and the net unrealized profit/loss indicate that despite this “high risk” status in the market, long-term investors aren’t all that interested in taking profits.

Not to jump to conclusions, but this might mean that investors are holding on to their coins, and might be expecting Bitcoin to rally further in the future.

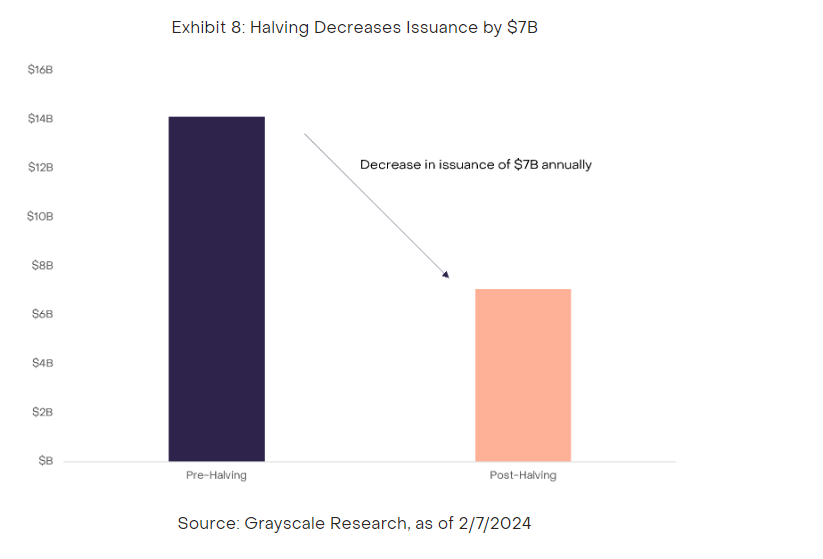

Why The ETFs Could Shape The Next Bitcoin Bull Run

According to a separate report from Grayscale, one of the leading providers of the recently-approved Bitcoin ETFs, these exchange-traded products (ETPs) might do wonders for Bitcoin’s price in the next halving.

According to the asset manager, the current Bitcoin block reward is about 6.25 Bitcoin per block, which equals roughly $14 billion, assuming a Bitcoin price of $43,000.

To put it simply, this means that in order to keep Bitcoin trading at its current price level, the market will need to absorb sell pressure from miners totalling around $14 billion annually.

However, the mining rate is expected to decrease to 3.125 Bitcoin per block after the halving, bringing the yearly supply down to $7 billion and effectively “counterbalancing†the selling of the miners.

According to Grayscale, the ETF customers who are attracted by the simplicity and lack of risks of these products will buy massively, creating a balance with the miners pulling Bitcoin down.

Bitcoin’s Price Outlook

The upcoming halving event in April 2024 is already affecting the cryptocurrency’s price, as we speak.

Bitcoin has enjoyed bullishness throughout 2023, and now through 2024, with Bitcoin currently trading at $47,938 after nearly breaking above $50,000 less than a day ago.

The cryptocurrency in the charts recently broke into the overbought zone and is showing signs of consolidation before breaking above the $48,969 high from 11 January, when the ETFs were first approved.

Bitcoin was only able to hit $48,826 before rejection somewhere around $48,826.

The bears are likely laying in wait around $48,969, meaning that the bulls will have to put in extra effort to break above this price level.

In all, Bitcoin appears poised to break above $50,000 soon, but if a rejection occurs from here, we might see a retest of the 20-day EMA (shown above), around $44,557.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.