Key Insights:

- Real World Asset markets supported by top corporates could be a top gainer in 2025.

- Layer-1 coins will rule these markets long-term because every crypto project uses them.

- AI-based cryptocurrencies like Near Protocol and Worldcoin could see their re-emergence after the recent AI-agent craze.

- The US National Digital Assets Stockpile could be the next reason for the dominance of US-based cryptos like Ethereum, XRP, and others.

1. Real World Assets

Real World Assets already had a good run in 2024 and are now expected to take this trend sharply higher. Top RWA projects like BUIDL by BlackRock, uMint by UBS, and Abrdn by Ripple have dominated the markets with their multi-billion dollar funds.

Several new banks and global financial institutions, including the Bank of Italy, JP Morgan Chase, Goldman Sachs, BBVA Bank, and several other big names, have adopted blockchain technology to enter this space.

Breaking: BBVA, one of the largest banks in Spain, will launch its own RWA token.

You are not bullish enough on #RWA tokens! pic.twitter.com/bp8zzARwk8

— Real World Asset Watchlist (@RWAwatchlist_) November 5, 2024

Some RWA-friendly projects that are expected to ride this super-bullish trends are:

- Ethereum (ETH), due to its central role in DeFi.

- Polygon (POL) is based on its top partnerships.

- Base, because of its fast, efficient and user-friendly network.

- Algorand (ALGO), as it reoriented itself into a RWA-focused blockchain.

2. Layer-1 Coins

No matter what happens, Layer-1 cryptocurrencies will dominate the crypto landscape as long as blockchain technology exists. All dapps, DeFi protocols, AI-based crypto projects, RWA projects, and everything that functions on blockchain runs on some Layer-1 chain. Most memecoins run on Solana, RWAs like XRPL ledger, AI coins use Near Protocol, and DeFi projects like Ethereum.

Top Layer-1 blockchains that will rule the crypto markets till the end of time are:

- Bitcoin, due to its sheer dominance in crypto, the status of a reserve asset, and the most secure blockchain.

- Ethereum, due to its role as the backbone of DeFi.

- Near Protocol due to its utility in the AI markets.

- Solana, as it supports easy and cheap transactions.

- High-speed chains like Base, though it does not have its own token.

3. AI Crypto

AI agents have taken the market by storm. Initially, the Virtuals Protocol saw a 7000% market growth and benefitted from a competition-free environment. This growth could get even higher as YCombinator expects AI agents to have a 1000% bigger market size than SaaS.

However, it was soon joined by other projects like Near Protocol, which re-aligned itself to serve this market. The rising trend also gave breathing support to Worldcoin and many other similar cryptocurrencies which were almost dead.

Soon, the Deepseek scare took over the markets, as the Chinese AI Model performed much better than larger US-based AI models like OpenAI’s ChatGPT and Google’s Gemini.

The AI agent trend is expected to increase competition in the markets, driving further innovation, which would make these AI tools even better. Further, with the Trump administration’s growing focus on AI, we could see more relaxed regulations, better funding support, and stronger policies in favor of AI markets.

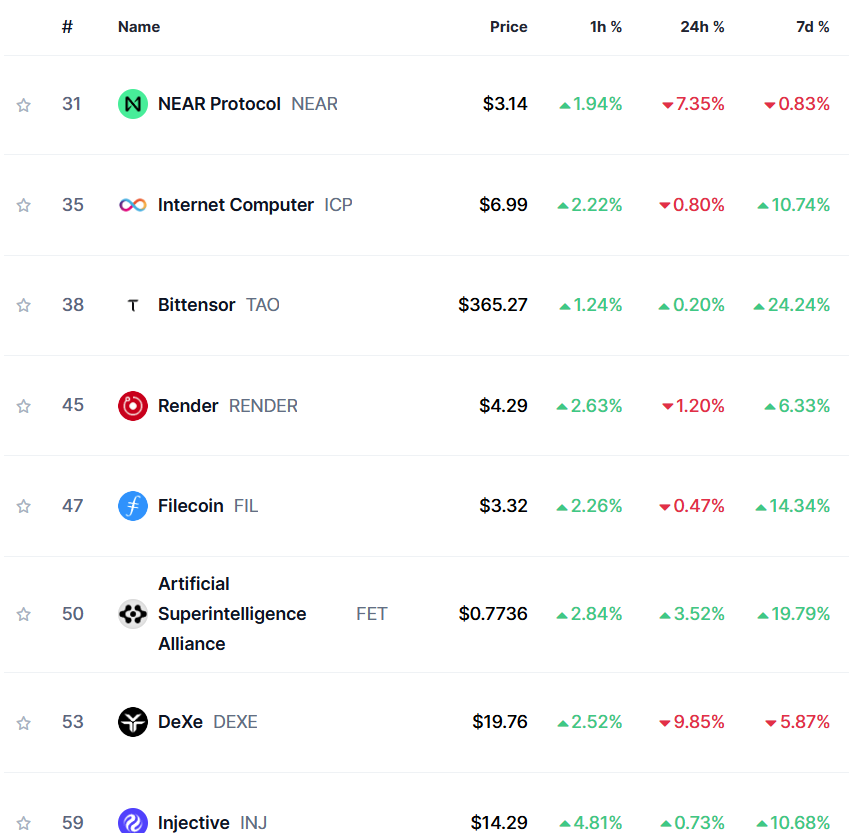

As the markets recover from the Deepseek scare, we expect a highly competitive market in which most crypto-based AI projects innovate further, creating unique applications and driving their prices higher. This week, we have seen a decent recovery, as high as 25% in these coins.

AI-Crypto Tokens Recover From Deepseek Scare

4. Made in USA

US-based cryptocurrencies have attracted attention since Trump indicated some support for them. The markets later received this as a signal that they might be included in the US National Digital Assets Stockpile.

This “Stockpile” is expected to take shape with Bitcoin as the largest asset but could also hold a significant number of assets like XRP, Dogecoin, Algorand, XLM, and even newly launched coins like $TRUMP.

There has been a heated debate in the crypto markets on whether to fill this stockpile with purely Bitcoin or include other cryptocurrencies. Top crypto voices like Brag Garlinghouse (Ripple CEO) have strongly favored a multi-crypto stockpile, whereas Bitcoin maximalists want it to be filled with Bitcoin only.

BOOM

RIPPLE CEO HINTS AT #XRP INCLUSION IN U.S. STRATEGIC RESERVE! pic.twitter.com/7xXVjk7FnB

— XRP Chancellor (@xrpchancellor) January 25, 2025

We soon expect a decision on this topic. White House AI and Crypto Czar David Sacks is expected to submit the Working Group report on this by mid-2025.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.