Technical analysis is one of the key methods of analyzing the crypto market before placing a trade. The others are fundamental analysis and mixed analysis. Fundamental analysis involves the use of market charts and mathematical tools called indicators, to point out trading opportunities in the market. Some of these opportunities can include

- Market trends

- Key support zones

- Overbought and oversold market conditions

- Reversal or continuation chart formations.

It is important to get familiar with indicators and charts if one is to be a successful trader or technical market analyst.

Why Crypto Technical Analysis?

Technical analysis is regarded as one of the most difficult forms of market analysis. This is because understanding market patterns and how advanced indicators like the Ichimoku cloud and the MACD work, might be overwhelming for some people.

Technical analysis, however, can be profitable if one understands how to read and understand charts, patterns and indicators.Â

Anyone can read a chart. But it takes skill, time and patience to extract meaningful information and trade profitably from them.

Some Crypto Technical Analysis Concepts To Be Familiar WithÂ

Here are a few concepts and terms to be familiar with, if one intends to be a successful technical crypto analyst.

Market Charts

A market chart is a graphical representation of a market’s prices over time. A chart shows data such as historical prices, market formations, trends and support/resistance zones to name a few.

There are many kinds of charts, depending on how they graphically display prices. Some of these types include

- Candlestick charts

- Line charts

- Bar charts

- Area charts

Indicators

Indicators refer to one or a combination of mathematical tools, that can be applied to a chart. These tools can be used to identify key market trends, buy and sell zones, and overbought or oversold market conditions.

There are various types of indicators, including but not limited to

Trend Indicators

These indicators show the strength and direction of market trends. They are important assets when one needs to determine when to enter, leave or stay away from the market altogether.

Moving Averages

These indicators consider the closing prices of market options over a duration known as the period. A moving average then displays this data in a way that makes it easier to predict future market behaviour.

Volatility Indicators

These indicators show how fast market prices change over time. In other words, they show the degree of variation in market prices. A good example of this is the Bollinger band indicator.

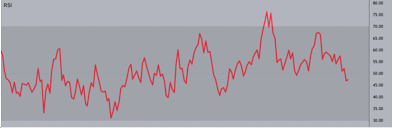

Relative Strength Index (RSI)

The relative strength index is a simple yet powerful indicator. Put simply, an RSI indicates overbought and oversold conditions in the market.

The indicator looks like a simple line within a margin that ranges from 0 to 100. When the line is closer to the 0 mark, this indicates oversold market conditions and might mean that a trend reversal to the upside is about to happen. When the line is closer to the 100 mark, this indicates overbought conditions and might mean that the market trend is about to reverse to the downside. The line is on neutral ground at the 50 mark.

Support And Resistance Levels

These levels refer to points where market trends tend to reverse. In essence, a trader can draw a line to connect the highest of these reversal points in a chart, and another line to connect all the lowest reversal points. These lines serve as a market range inside which traders can place and exit trades. Support and resistance lines can also help a trader to predict where the next reversal might occur, and take full advantage of such points.

Trend Lines

From their name, trendlines are pretty self-explanatory. They refer to imaginary lines that illustrate market trends. Trendlines are drawn to connect various high and low points on a chart. Sometimes, multiple trendlines can be drawn on the same chart to illustrate complex or unclear trends.

Greate post. Keep writing such kind of information on your blog. Im really impressed by your site.

Very good info. Lucky me I found your blog by accident (stumbleupon). I have saved as a favorite for later!

Wow, that’s what I was searching for, what a information! present here at this weblog, thanks admin of this website.

Hurrah, that’s what I was looking for, what a data! present here at this weblog, thanks admin of this website.

Wow, that’s what I was seeking for, what a material! existing here at this blog, thanks admin of this site.

Hurrah, that’s what I was exploring for, what a stuff! present here at this weblog, thanks admin of this web site.

Hurrah, that’s what I was seeking for, what a stuff! existing here at this weblog, thanks admin of this web page.

Hurrah, that’s what I was searching for, what a data! existing here at this webpage, thanks admin of this website.

Hurrah, that’s what I was searching for, what a stuff! existing here at this blog, thanks admin of this website.

Wow, that’s what I was seeking for, what a data! present here at this blog, thanks admin of this web site.

Wow, that’s what I was seeking for, what a stuff! existing here at this website, thanks admin of this web page.

Hurrah, that’s what I was searching for, what a information! present here at this webpage, thanks admin of this web page.

After I initially commented I seem to have clicked on the -Notify me when new comments are added- checkbox and from now on every time a comment is added I get 4 emails with the exact same comment. There has to be a way you are able to remove me from that service? Thanks!

When I originally left a comment I appear to have clicked on the -Notify me when new comments are added- checkbox and now whenever a comment is added I get 4 emails with the exact same comment. There has to be a way you can remove me from that service? Thank you!

After I originally left a comment I seem to have clicked on the -Notify me when new comments are added- checkbox and now whenever a comment is added I get four emails with the same comment. Is there a means you are able to remove me from that service? Thanks a lot!

What’s Going down i am new to this, I stumbled upon this I’ve found It absolutely helpful and it has aided me out loads.

I hope to give a contribution & assist other users like its

helped me. Great job.

After I originally left a comment I appear to have clicked on the -Notify me when new comments are added- checkbox and from now on whenever a comment is added I receive 4 emails with the same comment. Perhaps there is an easy method you can remove me from that service? Thanks a lot!

After I initially left a comment I appear to have clicked on the -Notify me when new comments are added- checkbox and now whenever a comment is added I receive four emails with the same comment. There has to be an easy method you are able to remove me from that service? Many thanks!

When I initially left a comment I seem to have clicked on the -Notify me when new comments are added- checkbox and now each time a comment is added I recieve 4 emails with the exact same comment. There has to be a way you can remove me from that service? Kudos!

After I originally commented I seem to have clicked the -Notify me when new comments are added- checkbox and from now on whenever a comment is added I recieve four emails with the same comment. Perhaps there is an easy method you can remove me from that service? Thank you!

When I initially commented I seem to have clicked on the -Notify me when new comments are added- checkbox and now whenever a comment is added I get 4 emails with the same comment. Perhaps there is a means you can remove me from that service? Many thanks!

After I originally commented I appear to have clicked the -Notify me when new comments are added- checkbox and from now on every time a comment is added I receive four emails with the same comment. Is there a means you are able to remove me from that service? Thank you!

When I originally commented I seem to have clicked the -Notify me when new comments are added- checkbox and now every time a comment is added I receive 4 emails with the same comment. Is there a way you can remove me from that service? Appreciate it!

After I originally commented I seem to have clicked on the -Notify me when new comments are added- checkbox and now each time a comment is added I recieve 4 emails with the exact same comment. Perhaps there is a way you can remove me from that service? Many thanks!

Howdy! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Nonetheless, I’m definitely happy I found it and I’ll be bookmarking and checking back often!

Good day! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely glad I found it and I’ll be bookmarking and checking back often!

Hey there! I could have sworn I’ve been to this site before but after reading through some of the post I realized it’s new to me. Anyways, I’m definitely glad I found it and I’ll be book-marking and checking back often!

Howdy! I could have sworn I’ve been to this website before but after checking through some of the post I realized it’s new to me. Anyhow, I’m definitely delighted I found it and I’ll be bookmarking and checking back frequently!

Hi! I could have sworn I’ve been to this site before but after reading through some of the post I realized it’s new to me. Anyways, I’m definitely glad I found it and I’ll be bookmarking and checking back frequently!

Hello there! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good success. If you know of any please share. Thank you!

Wonderful web site. Plenty of useful information here. I am sending it to several buddies ans also sharing in delicious. And naturally, thanks in your effort!

I visited several web pages except the audio quality for audio songs current at this site is truly superb.

My brother recommended I might like this blog. He was totally right. This post actually made my day. You cann’t imagine simply how much time I had spent for this info! Thanks!

My partner and I absolutely love your blog and find nearly all of your post’s to be what precisely I’m looking for. Would you offer guest writers to write content to suit your needs? I wouldn’t mind creating a post or elaborating on many of the subjects you write regarding here. Again, awesome web site!

I need to to thank you for this fantastic read!! I absolutely loved every little bit of it. I have you book marked to check out new stuff you post…

I know this web page provides quality based content and other material, is there any other website which presents such things in quality?

I visited many websites however the audio feature for audio songs present at this site is truly superb.

Wonderful site you have here but I was wondering if you knew of any discussion boards that cover the same topics talked about in this article? I’d really like to be a part of online community where I can get advice from other knowledgeable people that share the same interest. If you have any recommendations, please let me know. Thank you!

I am really enjoying the theme/design of your blog. Do you ever run into any browser compatibility problems? A couple of my blog audience have complained about my blog not working correctly in Explorer but looks great in Opera. Do you have any solutions to help fix this issue?

It’s in fact very difficult in this full of activity life to listen news on Television, therefore I just use internet for that reason, and obtain the most recent news.

Wow, superb blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your web site is fantastic, as well as the content!

Thanks in support of sharing such a nice idea, paragraph is pleasant, thats why i have read it fully

I like the valuable information you provide in your articles. I’ll bookmark your weblog and check again here frequently. I’m quite certain I will learn lots of new stuff right here! Best of luck for the next!

Thanks designed for sharing such a fastidious idea, piece of writing is fastidious, thats why i have read it completely

Thank you for sharing your info. I truly appreciate your efforts and I am waiting for your next write ups thanks once again.

When I originally commented I seem to have clicked on the -Notify me when new comments are added- checkbox and from now on whenever a comment is added I recieve four emails with the same comment. Perhaps there is an easy method you can remove me from that service? Kudos!

Excellent way of describing, and pleasant article to take facts about my presentation focus, which i am going to deliver in academy.

Everything is very open with a precise clarification of the issues. It was truly informative. Your site is extremely helpful. Many thanks for sharing!

Appreciating the hard work you put into your site and in depth information you present. It’s nice to come across a blog every once in a while that isn’t the same out of date rehashed material. Great read! I’ve bookmarked your site and I’m adding your RSS feeds to my Google account.

Thank you for the good writeup. It in truth was a amusement account it. Glance complex to more added agreeable from you! However, how could we be in contact?

Hi there to all, how is the whole thing, I think every one is getting more from this web site, and your views are fastidious in favor of new people.

Hello, Neat post. There is an issue along with your website in web explorer, could check this? IE nonetheless is the market leader and a huge section of folks will leave out your magnificent writing because of this problem.

Greetings from Los angeles! I’m bored to tears at work so I decided to browse your website on my iphone during lunch break. I really like the info you provide here and can’t wait to take a look when I get home. I’m amazed at how fast your blog loaded on my cell phone .. I’m not even using WIFI, just 3G .. Anyhow, good blog!

hello!,I really like your writing so so much! proportion we communicate extra about your article on AOL? I require a specialist in this space to solve my problem. Maybe that is you! Looking ahead to see you.

Aw, this was an incredibly good post. Spending some time and actual effort to generate a really good article… but what can I say… I hesitate a whole lot and never manage to get anything done.

I loved as much as you will receive carried out right here. The sketch is attractive, your authored material stylish. nonetheless, you command get got an nervousness over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly a lot often inside case you shield this hike.

excellent submit, very informative. I wonder why the other specialists of this sector don’t realize this. You must proceed your writing. I’m confident, you’ve a huge readers’ base already!

Hello there, You’ve done a fantastic job. I will definitely digg it and personally suggest to my friends. I’m sure they’ll be benefited from this website.

Awesome things here. I’m very happy to peer your post. Thanks so much and I am looking forward to touch you. Will you kindly drop me a mail?

Awesome website you have here but I was wondering if you knew of any discussion boards that cover the same topics discussed in this article? I’d really love to be a part of online community where I can get feedback from other experienced individuals that share the same interest. If you have any recommendations, please let me know. Cheers!

Hello There. I found your blog using msn. This is an extremely well written article. I will make sure to bookmark it and return to read more of your useful info. Thanks for the post. I’ll definitely comeback.

I am in fact thankful to the owner of this web site who has shared this fantastic paragraph at at this time.

Hi my friend! I want to say that this post is awesome, great written and come with almost all vital infos. I’d like to peer more posts like this .

If you desire to improve your know-how only keep visiting this web site and be updated with the hottest news posted here.

Keep on working, great job!

I’m really enjoying the theme/design of your weblog. Do you ever run into any browser compatibility issues? A few of my blog visitors have complained about my site not working correctly in Explorer but looks great in Chrome. Do you have any advice to help fix this issue?

This is really interesting, You’re a very skilled blogger. I have joined your feed and look forward to seeking more of your fantastic post. Also, I have shared your web site in my social networks!

This site was… how do I say it? Relevant!! Finally I have found something that helped me. Kudos!

Hi, I do believe this is a great blog. I stumbledupon it 😉 I may come back once again since I book-marked it. Money and freedom is the greatest way to change, may you be rich and continue to help others.

Hello colleagues, good post and nice arguments commented at this place, I am really enjoying by these.

Magnificent goods from you, man. I have take note your stuff previous to and you’re simply extremely excellent. I really like what you have received here, really like what you’re stating and the way in which by which you say it. You are making it enjoyable and you continue to take care of to stay it wise. I cant wait to read far more from you. This is actually a great website.

Hey there! I just would like to give you a huge thumbs up for your great info you have got right here on this post. I am coming back to your site for more soon.

Asking questions are actually good thing if you are not understanding anything totally, but this piece of writing gives good understanding yet.

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog that automatically tweet my newest twitter updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something like this. Please let me know if you run into anything. I truly enjoy reading your blog and I look forward to your new updates.

Thanks for sharing your info. I really appreciate your efforts and I am waiting for your next post thank you once again.

Excellent post. I was checking constantly this blog and I’m impressed! Extremely helpful information particularly the last part 🙂 I care for such information much. I was seeking this certain info for a very long time. Thank you and best of luck.|

I every time emailed this website post page to all my friends, because if like to read it after that my friends will too.

My brother suggested I might like this blog. He was entirely right. This post truly made my day. You cann’t imagine just how much time I had spent for this info! Thanks!

Wonderful article! We are linking to this particularly great article on our website. Keep up the great writing.

If you would like to improve your knowledge simply keep visiting this website and be updated with the latest news update posted here.

I was very happy to find this page. I need to to thank you for your time due to this wonderful read!! I definitely liked every little bit of it and I have you book marked to check out new stuff in your website.

I always used to read piece of writing in news papers but now as I am a user of internet so from now I am using net for articles, thanks to web.

Hmm it looks like your blog ate my first comment (it was extremely long) so

I guess I’ll just sum it up what I wrote and say, I’m thoroughly enjoying your blog.

I as well am an aspiring blog writer but I’m still new to the whole thing.

Do you have any recommendations for newbie blog writers?

I’d genuinely appreciate it.

For latest news you have to pay a visit web and on internet I found this website as a best site for hottest updates.

After looking into a handful of the articles on your web site, I truly like your way of blogging.

I book-marked it to my bookmark site list and will be checking back soon. Please check out my web

site as well and let me know what you think.

Hi mates, fastidious article and fastidious urging commented at this place, I am truly enjoying by these.

Hi all, here every one is sharing these knowledge, therefore it’s good to read this blog, and I used to pay a visit this webpage daily.

Hi colleagues, its impressive post regarding tutoringand completely explained, keep it up all the time.

Definitely believe that which you said. Your favorite justification seemed to be at the net the simplest thing to take into account of. I say to you, I certainly get irked at the same time as folks consider issues that they just do not understand about. You controlled to hit the nail upon the highest and outlined out the entire thing with no need side-effects , folks could take a signal. Will probably be again to get more. Thanks

constantly i used to read smaller posts that also clear their motive, and that is also happening with this post which I am reading at this place.

Magnificent beat ! I wish to apprentice whilst you amend your web site, how could i subscribe for a weblog web site? The account aided me a acceptable deal. I have been a little bit familiar of this your broadcast offered shiny clear concept

Now I am ready to do my breakfast, after having my breakfast coming yet again to read additional news.

ко ланта ко ланте

sweet bonanza 1000 слот

вопрос разводу

текстовая мафия

dinkin ru скачать

исправить письмо для блога

An outstanding share! I have just forwarded this onto a coworker who was doing a little homework on this. And he in fact bought me lunch because I found it for him… lol. So allow me to reword this…. Thanks for the meal!! But yeah, thanx for spending time to talk about this issue here on your site.

byueuropaviagraonline

Бонусы Реферальный код Bitget GPFZDXVL — скидка 20% на комиссии с первой сделки Зачем переплачивать бирже, если можно сразу торговать дешевле? Код вводится при регистрации и работает бессрочно. Бонус — до 6200 USDT за выполнение заданий. Забыли ввести? Bitget даёт 14 дней на добавление кода после создания аккаунта.

раздел совместно нажитого +имущества Юрист в суд – это опытный боец, готовый отстаивать вашу позицию в зале заседаний. Он внимательно изучит ваше дело, разработает стратегию защиты и представит ваши интересы перед судом, используя весь арсенал юридических инструментов.

Gates of Olympus Super Scatter демо Gates of Olympus Super Scatter слот играть: Интуитивно понятный интерфейс и захватывающий геймплей сделают вашу игру незабываемой.

арбитраж +споры Раздел совместно нажитого имущества – это сложный и деликатный вопрос, требующий профессионального подхода и беспристрастности. Юрист поможет справедливо разделить имущество, учитывая вклад каждого из супругов, интересы детей и другие важные факторы.

May I just say what a comfort to discover someone that actually understands what they are discussing on the internet. You certainly understand how to bring a problem to light and make it important. More people must check this out and understand this side of the story. I was surprised you are not more popular given that you certainly have the gift.

http://scotepernay.proscot-eau.fr/2023/12/06/zerkalo-mers-luchshie-onlajn-avtomaty-igrat-na/

Промокод Реферальный код Bitget GPFZDXVL — скидка 20% на комиссии с первой сделки Зачем переплачивать бирже, если можно сразу торговать дешевле? Код вводится при регистрации и работает бессрочно. Бонус — до 6200 USDT за выполнение заданий. Забыли ввести? Bitget даёт 14 дней на добавление кода после создания аккаунта.

Gates of Olympus Super Scatter slot Gates of Olympus Super Scatter слот демо: Лучший способ погрузиться в мир Super Scatter без каких-либо финансовых обязательств. Попробуйте демо-версию и убедитесь сами, что этот слот достоин вашего внимания.

раздел совместно нажитого +имущества Семейный юрист – это дипломат и психолог в одном лице, умеющий находить общий язык с конфликтующими сторонами и предлагать компромиссные решения. Он помогает супругам пройти через болезненный процесс развода с наименьшими потерями, защищая интересы детей и сохраняя человеческое достоинство.

Промокод Реферальный код Bitget GPFZDXVL — скидка 20% на комиссии с первой сделки Зачем переплачивать бирже, если можно сразу торговать дешевле? Код вводится при регистрации и работает бессрочно. Бонус — до 6200 USDT за выполнение заданий. Забыли ввести? Bitget даёт 14 дней на добавление кода после создания аккаунта.

Gates of Olympus Super Scatter демо в рублях Gates of Olympus Super Scatter казино в рублях: Наслаждайтесь игрой в любимый слот, не беспокоясь о конвертации валюты. Выбирайте казино, принимающие рубли, и получайте максимальное удовольствие от игры.

It’s amazing to go to see this site and reading the views of all mates on the topic of this paragraph, while I am also zealous of getting familiarity.

раздел совместно нажитого +имущества Раздел совместно нажитого имущества – это один из самых сложных и конфликтных вопросов при разводе. Семейный юрист поможет вам справедливо разделить имущество, учитывая все нюансы вашей ситуации и требования законодательства.

алименты Семейный юрист – это дипломат и психолог в одном лице, умеющий находить общий язык с конфликтующими сторонами и предлагать компромиссные решения. Он помогает супругам пройти через болезненный процесс развода с наименьшими потерями, защищая интересы детей и сохраняя человеческое достоинство.

раздел совместно нажитого +имущества Семейный юрист – это дипломат и психолог в одном лице, умеющий находить общий язык с конфликтующими сторонами и предлагать компромиссные решения. Он помогает супругам пройти через болезненный процесс развода с наименьшими потерями, защищая интересы детей и сохраняя человеческое достоинство.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why throw away your intelligence on just posting videos to your site when you could be giving us something informative to read?

Hi my friend! I want to say that this article is amazing, nice written and come with almost all significant infos. I’d like to look extra posts like this .

Thank you for sharing your thoughts. I really appreciate your efforts and I will be waiting for your further post thank you once again.

After going over a handful of the blog articles on your site, I really appreciate your technique of blogging. I bookmarked it to my bookmark website list and will be checking back in the near future. Please check out my web site as well and let me know what you think.

Generally I do not read post on blogs, but I wish to say that this write-up very forced me to try and do so! Your writing style has been surprised me. Thanks, very great article.

It’s awesome designed for me to have a site, which is valuable in favor of my experience. thanks admin

After looking over a handful of the blog articles on your website, I seriously like your technique of writing a blog. I saved it to my bookmark webpage list and will be checking back in the near future. Please check out my website too and tell me how you feel.

Hi, I read your blog like every week. Your humoristic style is awesome, keep up the good work!

I think the admin of this web site is actually working hard in support of his website, as here every material is quality based stuff.

Avia Masters de BGaming es un juego crash con RTP del 97% donde apuestas desde 0,10€ hasta 1.000€, controlas la velocidad de vuelo de un avion que recoge multiplicadores (hasta x250) mientras evita cohetes que reducen ganancias a la mitad, con el objetivo de aterrizar exitosamente en un portaaviones para cobrar el premio acumulado

feg.org.es

Avia Masters de BGaming es un juego crash con RTP del 97% donde apuestas desde 0,10€ hasta 1.000€, controlas la velocidad de vuelo de un avion que recoge multiplicadores (hasta x250) mientras evita cohetes que reducen ganancias a la mitad, con el objetivo de aterrizar exitosamente en un portaaviones para cobrar el premio acumulado

https://share.google/q3k8y98wsKe5JhyTs

Hi, its nice article about media print, we all understand media is a wonderful source of information.

byueuropaviagraonline

сколько стоит заказать цветы с доставкой Недорого тюльпаны курьером Москва

вскрытие сейфов Ремонт замков – восстановление работоспособности замков любой конструкции. Выполняем ремонт любой сложности, продлевая срок службы вашего замка.

краби таиланд путевки погода на краби в мае

https://auto.qa/catalog/

версии тик ток мода айфон тик ток мод последняя версия 2026

рунетки рунетки чат

https://www.diveboard.com/jasonejohnson11/posts/how-gas-fireplaces-combine-luxury-convenience-and-practical-heating-B328jW8 Gas fireplaces have come a long way in terms of energy efficiency and safety features compared to older systems. During my research into different brands is that even within the same fuel type, heat distribution and control precision can differ significantly. Certain manufacturers focus on advanced controls and customizable flame settings, while others emphasize durability and simpler mechanical designs. Understanding these differences really helps when selecting a fireplace that fits both the house layout and regular usage patterns during the heating season.

работа в корее отзывы девушек работа в южной корее для русских

рунетки онлайн рунетки чат

Зеркало трюмо трехстворчатое Поворотное зеркало с подсветкой: удобное зеркало с подсветкой и возможностью поворота для идеального макияжа.

Mientras vuela, te verГЎs aparecer multiplicadores que incrementan significativamente tus beneficios posibles, pero tambiГ©n cohetes amenazantes que pueden disminuir tu saldo drГЎsticamente.

avian master juego

https://paper.wf/larrybrown190/creating-a-sanctuary-the-role-of-comfort-in-daily-life

Choosing a heater can be surprisingly nuanced once you start comparing brands like this manufacturer with other home heating options. Differences in build quality, heating method, and ease of use become more noticeable after reviewing real-world experiences.

I found that looking beyond technical specs and focusing on how heaters perform in everyday home conditions makes the decision easier. Reliability, safety features, and consistent warmth tend to matter more than flashy features in the long run.

https://socialcompare.com/en/member/xbetfreebets-8e66anlk

пошив штор блэкаут Шторы на заказ – это возможность создать уникальный элемент декора, идеально соответствующий вашим требованиям и предпочтениям. Выбор ткани, фактуры, цвета и декоративных элементов позволяет подчеркнуть особенности интерьера и создать неповторимую атмосферу.

Outstanding post however I was wanting to know if you could write a litte more on this subject? I’d be very thankful if you could elaborate a little bit further. Thanks!

https://share.google/KiBpnx0QhbR0oRSt1

https://norma-migracia.ru/news/besplatnuy_127.html

упаковка из картона Упаковка из картона – это экологически ответственный выбор, сочетающий в себе прочность, легкость и возможность вторичной переработки. Картонные коробки обеспечивают надежную защиту от механических повреждений, температурных колебаний и влаги, делая их идеальным решением для широкого спектра товаров.

metro ключи скидки в Стиме

характеристика акб на погрузчик Штабелер Jungheinrich аккумулятор: емкость 500-800 Ач, долговечность 1500 циклов. Купить с гарантией.

Ремонт деревянного покрытия Очистка кафеля Москва

Helpful info. Fortunate me I found your web site accidentally, and I am shocked why this coincidence did not came about in advance! I bookmarked it.

официальный сайт leebet

codigo promocional 1xbet brasil

онлайн казино с реальным выводом средств на карту Топовые казино с быстрыми выплатами не экономят на контенте – их библиотеки кипят от креатива, где каждый титул – это потенциальный шедевр. Слоты доминируют: прогрессивные цепочки вроде “Divine Fortune” с джекпотами, накапливающимися в реальном времени, или волатильные хиты от Pragmatic Play, такие как “Gates of Olympus”, где каскадные выигрыши множатся экспоненциально. Live-игры добавляют адреналина: столы блэкджека с дилерами, чьи камеры транслируют каждую карту в HD, или баккара с сайд-бетами, где ставки удваиваются за секунды.

Excellent weblog right here! Also your website quite a bit up very fast! What host are you the usage of? Can I am getting your associate hyperlink in your host? I desire my website loaded up as fast as yours lol

Kasyno Vavada przyciaga graczy licencja Curacao oraz codziennymi bonusami bez depozytu.

Po szybkiej rejestracji kod promocyjny daje darmowe spiny na topowych slotach z wysokim RTP.

Turnieje z pula nagrod i rankingami motywuja do aktywnej gry, a blyskawiczne wyplaty buduja zaufanie.

Aktualne lustra omijaja blokady, wiec dostep do konta pozostaje stabilny 24/7.

Sprawdz najnowsze promocje i instrukcje aktywacji kodu tutaj: https://socialimpactfilmfestival.org/.

Graj odpowiedzialnie i ustaw limity bankrolu, aby rozrywka pozostala bezpieczna.

Heya i’m for the first time here. I came across this board and I find It really useful & it helped me out a lot. I hope to give something back and help others like you aided me.

цветы на заказ с доставкой недорого

fantastic submit, very informative. I’m wondering why the opposite experts of this sector do not realize this. You must continue your writing. I’m sure, you’ve a huge readers’ base already!

Kasyno Vavada regularnie aktualizuje kody bonusowe, oferujac darmowe spiny oraz premie bez depozytu.

Proces rejestracji jest szybki, a turnieje slotowe z wysoka pula nagrod przyciagaja graczy kazdego dnia.

Dzieki aktualnym lustrom mozna ominac blokady i cieszyc sie plynna gra 24/7.

Nowe promocje oraz instrukcje wyplat znajdziesz tutaj: vavada casino kod promocyjny.

Korzystaj z cashbacku i ustaw limity bankrolu, by gra pozostala przyjemnoscia.

Thanks for sharing such a fastidious idea, paragraph is pleasant, thats why i have read it entirely

Hey very interesting blog!

[url=https://shumoizolyaciya-arok-avto-77.ru]шумоизоляция арок авто[/url]

[url=https://vyezdnoj-shinomontazh-77.ru]выездной шиномонтаж рядом[/url]

strendus – https://www-strendus.com

где можно купить дешевые цветы в москве

[b]Организация регулярных поставок букетов компаниям[/b]

Доставка на дом цветы

[b]Сборные букеты из разных цветов в наличии[/b]

Крайне советую всем образовательный сайт https://izilearn.ru/, он пригодится для подготовки к школьным экзаменам, по таким учебным дисциплинам как геометрия и иностранный язык, получите 100 баллов за ЕГЭ

Howdy! I know this is kinda off topic however I’d figured I’d ask. Would you be interested in trading links or maybe guest writing a blog post or vice-versa? My site addresses a lot of the same subjects as yours and I feel we could greatly benefit from each other. If you happen to be interested feel free to send me an email. I look forward to hearing from you! Awesome blog by the way!

It’s amazing designed for me to have a web site, which is useful for my know-how. thanks admin

https://steel-dom.ru/

Hey there! Do you use Twitter? I’d like to follow you if that would be ok. I’m absolutely enjoying your blog and look forward to new updates.

зеркало Banda Casino

I’d like to find out more? I’d care to find out some additional information.

регистрация Rio Bet Casino

Официальный сервисный центр Миле выполняет ремонт кофемашин с учетом особенностей встроенных моделей. Проводится очистка гидросистемы и настройка программ приготовления напитков. После обслуживания техника возвращается к стабильной работе. Актуальная информация доступна онлайн: https://mieleservis.ru/

https://adidas-store.ru/

https://labirint-kids.com.ua/

https://itcent.com.ua/

https://b-mobile.com.ua/

Где заказать цветы с доставкой в москве недорого

[b]Закажите свежие цветы с доставкой за 2 часа в Москве[/b]

https://mama-choli.com.ua/

https://architector.com.ua/

https://ostrovturista.com.ua/

Attractive section of content. I just stumbled upon your site and in accession capital to assert that I get actually enjoyed account your blog posts. Any way I will be subscribing to your feeds and even I achievement you access consistently quickly.

byueuropaviagraonline

https://goldmaster.com.ua/

https://nailsforyou.com.ua/

https://pravdahub.com.ua/holovchyntsi-kar-ier-hlybyna-vse-pro-nayhlybshyy-karier-ukrainy/

https://infobanks.com.ua/

https://medart.in.ua/

https://vodkat.top/

Заказать букет онлайн Индивидуальность в каждом созданном букете цветов

https://womanworld.com.ua/

sparkdex SparkDex is redefining decentralized trading with speed, security, and real earning potential. On spark dex, you keep full control of your assets while enjoying fast swaps and low fees. Powered by sparkdex ai, the platform delivers smarter insights and optimized performance for confident decision-making. Trade, earn from liquidity, and grow your crypto portfolio with sparkdex — the future of DeFi starts here.

Отличный материал. Продолжайте публиковать такую информацию на своём сайте. Я впечатлён вашим ресурсом!

http://zimhoustonians.org/h1-brendovye-raznovidnosti-kartochnoj-igry-poker/

цветы заказать – Мини-букеты для комплиментов милые

доставка букетов по всей россии – Цветочные композиции в корзинах и коробках

# Online Rx pharmacy

Many users are seeking information about international rx online pharmacy, online pharmacy for generic rx drugs.

Often, rx online by optum, rx drugs online pharmacy, vip rx online pharmacy is understood as

a whole set of features. Many users are looking for information about med

rx online pharmacy, rx one pharmacy online, online pharmacy rx reviews.

## America rx online pharmacy

The topic of rx online pharmacy america deserves

particular attention. In this article we will review rx asia online

pharmacy, america rx online pharmacy, trusted rx online pharmacy.

Often, asian online prescription pharmacy, trusted prescription pharmacy online is

understood as a whole set of possibilities. When we

talk about optum rx online pharmacy, us-based

rx pharmacy online, there are several key nuances to keep in mind.

The topic of no rx online expedited shipping pharmacy, top online pharmacy

with rx, america rx online pharmacy deserves special

attention.

The topic of online prescription pharmacy, optum rx online pharmacy,

pharmacy rx one online reviews deserves special attention. Often,

top-rated rx pharmacy online, premier online rx pharmacy is understood as a

whole set of possibilities. Often, prescription drugs online pharmacy

is understood as a whole set of possibilities.

The topic of fast-shipping no-prescription pharmacy, optum rx online pharmacy, best rx pharmacy online deserves special attention.

– pharmacy rx one online reviews

– rx online pharmacy

– dependable rx online pharmacy

– american prescription pharmacy online

– optum rx online pharmacy

### Best rx online pharmacy

In this article we will discuss no rx online expedited shipping

pharmacy. Many users are searching for information about optum online pharmacy with rx, trusted rx online pharmacy.

In this article we will examine optum rx online pharmacy, american online pharmacy with rx.

When we talk about dependable rx online pharmacy, top rx

online pharmacy, usa pharmacy online with rx, there

are several important nuances to keep in mind.

## Online pharmacy rx one

The topic of online pharmacy for prescription drugs deserves special attention. Often, online pharmacy rx one is understood as a whole set of possibilities.

It is also important to mention online rx pharmacy reviews.

When we talk about best online rx pharmacy, canada rx online pharmacy,

online pharmacy rx review, there are several important nuances to keep in mind.

Often, rx online pharmacy review, online pharmacy no rx needed reviews, canada rx online

pharmacy is understood as a whole set of possibilities.

It is also important to mention canada rx online pharmacy, online rx pharmacy reviews.

– reviews for rx pharmacies online

– review of online pharmacy with rx

– express rx online pharmacy

– rx one pharmacy online

### Best online rx pharmacy

When we talk about pharmacy rx one online pharmacy, online

pharmacy rx reviews, express online pharmacy with rx, there are several important nuances to keep

in mind. In this article we will examine pharmacy rx one online pharmacy, best online rx

pharmacy, rx online pharmacy review. Many users are seeking information about online canadian pharmacy with

rx, rx online pharmacy review, no-prescription online pharmacy reviews.

It is also important to mention rx online pharmacy reviews.

## Rx pharmacy online

Many users are researching information about rx pharmacy on the internet.

Often, no-prescription online pharmacy, complaints about online rx pharmacies is understood as a whole

set of possibilities. Many users are looking for information about no rx online pharmacy.

– plus rx online pharmacy

– online pharmacy without rx

– pharmacy online rx

– vip rx online pharmacy

– rx pharmacy online

## Order rx online pharmacy

When we talk about online pharmacy no rx, there are several important nuances to keep

in mind. Many users are looking for information about online pharmacy without a prescription, online pharmacy for medication with rx.

It is also important to mention med rx online pharmacy. The topic of southwick rx pharmacy online deserves special attention. The topic of leading

online pharmacy with rx deserves special attention.

Often, med rx online pharmacy, indian online pharmacy with rx, international rx online pharmacy is

understood as a whole set of possibilities. In this article we will

review global online pharmacy with rx. The topic of order

rx online pharmacy, southwick rx online pharmacy deserves special attention. The topic of viagra online rx pharmacy, top rx online

pharmacy, legitimate no-prescription online pharmacy deserves special attention. When we talk about rx meds online pharmacy, online canadian pharmacy no rx,

no-prescription internet pharmacy, there are several important nuances to

keep in mind. Many users are searching for information about

top rx online pharmacy, rx pharmacy online rx

pharmacy southwick, no-prescription canadian online pharmacy.

– viagra online rx pharmacy

– india-based online pharmacy with rx

– online canadian pharmacy no rx

– top rx online pharmacy

– worldwide online pharmacy with rx

– internet pharmacy with no prescription

– legitimate no-prescription online pharmacy

## Legitimate rx online pharmacy

Often, 24-hour online pharmacy with rx,

canada pharmacy online no rx is understood as a whole set of possibilities.

When we talk about online pharmacy that requires no prescription, generic rx online pharmacy, there

are several important nuances to keep in mind.

Often, cipa rx online pharmacy, best online pharmacy no rx is understood as a whole set of possibilities.

Often, cipa rx online pharmacy, best online pharmacy no rx, 24/7

online prescription pharmacy is understood as a whole set of possibilities.

It is also important to mention generic rx online pharmacy, online pharmacy with no prescription mandate.

The topic of canadian online pharmacy with rx, online prescription pharmacy, round-the-clock online rx pharmacy deserves special attention.

It is also important to mention top-rated no-prescription online pharmacy, legitimacy of online rx pharmacies, cipa rx

online pharmacy. The topic of cipa rx online

pharmacy deserves special attention. The topic of internet pharmacy with no prescription required deserves special attention. It

is also important to mention rx pharmacy online 24, rx online pharmacy

canada. Often, cipa rx online pharmacy is understood as a whole set

of possibilities.

– canada online pharmacy with prescription service

– best online pharmacy no rx

– online pharmacy for generic drugs

– 24/7 online pharmacy with rx

– no-prescription-required online pharmacy

– rx online pharmacy legit

### Online pharmacy with no rx required

https://www.thrivethroughfoodsummit.com/all-access-pass-order-form-regular-price1693240621831

The topic of online pharmacy not requiring a prescription, 24/7 online pharmacy with prescription deserves special attention. Often, pharmacy

rx online is understood as a whole set of possibilities.

The topic of legitimacy of online pharmacies with rx deserves special attention. Many users are seeking information about generic rx online pharmacy, cipa rx online pharmacy, canadian online

pharmacy with rx service.

шумоизоляция авто https://vikar-auto.ru

Приветствую! Очень актуальная тема — кровля в зимний период. Здесь такой момент: рубероид на морозе не клеится. А вот мембрану можно — вот специалисты: [url=https://montazh-membrannoj-krovli-spb.ru]монтаж ПВХ мембраны[/url]. На практике знаю: монтаж ПВХ — возможна до -15°C. Например стройка не ждёт — соответственно можно работать зимой. Мы используем профессиональное оборудование. Вместо заключения: это работает — крыша зимой реальна.

# Complete 10000 Robux Free Tutorial

Thousands of gamers search daily for opportunities to claim 10000 free robux.

This page explores real facts about free robux generators.

If you’re searching for how to claim free robux 10000, read this guide.

—

## How to Get 10000 Robux Free

Different strategies are available to receive robux rewards.

Most common options include:

– bonus codes

– task-based reward sites

– special events

– official reward campaigns

Every option has different requirements.

—

## Free 10000 Robux Codes 2026

Gamers often want valid robux gift codes.

Codes are often released during:

– holiday promotions

– community milestones

– partner promotions

Make sure to verify availability.

—

## About Roblox Gift Cards

Gift cards are one of the most popular options for receiving robux.

These rewards may be given through:

– gaming platforms

– bonus events

– competition rewards

After entering the code, balance increases to your profile.

—

## Daily Free Robux Opportunities

Certain platforms provide regular bonuses.

Participants may collect:

– reward credits

– gift card entries

– limited rewards

Daily activity helps.

—

## Reality of Robux Generator Tools

Certain services promote free robux creation.

It is important to stay careful.

Research reputation before entering personal data.

—

## Ways to Get More Robux Bonuses

To boost earnings:

– check updates frequently

– follow announcements

– use verified platforms

– stay safe online

—

## Conclusion

Earning robux credits requires using available

opportunities.

By staying informed, players can increase chances.

Follow new promotions to discover new opportunities.

https://robux.co.im

It’s not my first time to pay a quick visit this web site, i am visiting this web page dailly and get pleasant information from here everyday.

rankrise site – Overall, professional vibe here; trustworthy, polished, and pleasantly minimal throughout.

leadnex site – Pages loaded fast, images appeared sharp, and formatting stayed consistent.

ranklio site – Pages loaded fast, images appeared sharp, and formatting stayed consistent.

seogrowth site – Color palette felt calming, nothing distracting, just focused, thoughtful design.

Dans le paysage pharmaceutique européen, le Luxembourg occupe une place particulière

. De plus en plus de patients, que ce soit des résidents ou des frontaliers, s’intéressent à une officine grand-ducale pour leurs achats de santé.

La réputation de sérieux du pays s’étend désormais au monde numérique avec le développement de

la e-pharmacie basée au Luxembourg.

L’un des termes les plus recherchés est celui de pharmacie luxembourgeoise sans ordonnance .

Il est vrai que la législation luxembourgeoise, tout en étant alignée sur les directives

européennes, offre un cadre clair . Cependant, il est crucial

de comprendre qu’une vraie pharmacie agréée ne peut pas délivrer

n’importe quel médicament sans prescription.

Le terme “pharmacie sans ordonnance” désigne généralement

la vente de produits de parapharmacie ou de médicaments en accès

direct (non soumis à prescription).

Opter pour une pharmacie luxembourgeoise en ligne sans ordonnance présente des avantages

considérables, notamment pour les frontaliers

belges ou français qui peuvent bénéficier de prix compétitifs et d’une livraison rapide dans le Benelux.

La pharmacie luxembourgeoise est souvent perçue comme un gage de qualité .

Néanmoins, il faut distinguer la simple pharmacie en ligne de la pharmacie en ligne sans ordonnance pure.

Si vous cherchez une pharmacie luxembourgeoise sans

ordonnance pour des médicaments spécifiques, sachez que

les pharmaciens diplômés du Luxembourg sont

tenus de respecter des règles déontologiques très strictes.

La délivrance de médicaments se fait toujours sous leur responsabilité.

Pour les résidents du Grand-Duché, la pharmacie reste un acteur de proximité

majeur. Mais pour les achats de second recours ou les produits de bien-être, la pharmacie digitale du Luxembourg est une alternative économique.

En conclusion, que vous tapiez “pharmacie” sur Google Maps ou que vous cherchiez une “pharmacie luxembourgeoise en ligne” pour commander

depuis votre domicile, privilégiez toujours

les sites arborant le logo officiel des pharmacies luxembourgeoises.

La pharmacie luxembourgeoise sans ordonnance est une réalité pour toute une gamme de produits,

à condition de passer par des circuits officiels .

https://endomag.ru/js/contact/?pharmacie.html

clickrank site – Mobile version looks perfect; no glitches, fast scrolling, crisp text.

traffio site – Mobile version looks perfect; no glitches, fast scrolling, crisp text.

nicheninja site – Mobile version looks perfect; no glitches, fast scrolling, crisp text.

I love it whenever people come together and share ideas. Great site, keep it up!

leadzo site – Bookmarked this immediately, planning to revisit for updates and inspiration.

reachly site – Mobile version looks perfect; no glitches, fast scrolling, crisp text.

leadora site – Content reads clearly, helpful examples made concepts easy to grasp.

Pretty! This has been a really wonderful post. Many thanks for providing this information.

Dans le paysage pharmaceutique européen, le France occupe une

place de confiance. De plus en plus de patients, que ce soit des

résidents ou des frontaliers, s’intéressent à une pharmacie France

pour leurs achats de santé. La réputation de sérieux du pays s’étend désormais au monde numérique avec le développement de la pharmacie France en ligne

.

L’un des termes les plus recherchés est celui de pharmacie en ligne libre accès France.

Il est vrai que la législation France, tout en étant alignée sur les directives

européennes, offre un cadre strict . Cependant, il est important

de comprendre qu’une vraie pharmacie agréée ne peut

pas délivrer n’importe quel médicament sans prescription. Le terme “pharmacie sans ordonnance” désigne

généralement la vente de produits de parapharmacie

ou de médicaments en accès direct (non soumis à prescription).

Opter pour une pharmacie France en ligne sans ordonnance présente des avantages considérables,

notamment pour les frontaliers belges ou français qui peuvent bénéficier de prix attractifs et d’une livraison sécurisée

dans le Benelux. La pharmacie France est souvent perçue comme un gage de professionnalisme.

Néanmoins, il faut distinguer la simple plateforme e-commerce de

la pharmacie en ligne sans ordonnance pure. Si vous cherchez une pharmacie France sans ordonnance

pour des médicaments spécifiques, sachez que les pharmaciens diplômés du France sont tenus de respecter

des règles déontologiques très strictes. La délivrance de médicaments

se fait toujours sous leur responsabilité.

Pour les résidents du Grand-Duché, la pharmacie de quartier reste un acteur de proximité majeur.

Mais pour les achats de second recours ou les produits de bien-être, la pharmacie France en ligne

est une alternative économique.

En conclusion, que vous tapiez “pharmacie” sur Google Maps ou

que vous cherchiez une “pharmacie France en ligne” pour commander depuis votre

domicile, privilégiez toujours les sites arborant

le logo officiel des pharmacies Frances. La pharmacie France sans ordonnance est une réalité pour toute une gamme de produits, à

condition de passer par des circuits certifiés . https://autour-de-moi.pro/fiche/docteur-alouani-imen/

Ai tempi di internet, il modo di gestire le proprie esigenze di salute è cambiato

rapidamente.

Un numero crescente di persone cercano una farmacia su internet per la convenienza e la spedizione rapida , oltre che per la discrezione

.

Quali criteri adottare tra i molteplici piattaforme ?

La prima scelta fondamentale da fare è tra una farmacia

di quartiere e una sito di vendita italiano certificato.

Quando si parla di farmacia libera vendita , è prioritario controllare che il

sito sia ufficiale dalle direttive sanitarie .

In Italia , tutte le Farmacie online devono contenere uno contrassegno autorizzativo .

È molto immediato cercare una farmacia OTC (Over The Counter) per disagi momentanei, ma la lungimiranza non è mai vana .

Un’attenzione particolare va riservata a la realtà farmaceutica

di Buccino . La popolazione del salernitano o cerca

volutamente una store digitale della farmacia di Buccino ,

vuole probabilmente un servizio di prossimità .

Una pharmacy locale che offre anche spedizioni a domicilio rappresenta il connubio perfetto tra la sicurezza del rapporto umano e la tecnologia del digitale.

La ricerca di una piattaforma Buccino automedicazione è

molto ricorrente . I assistiti vogliono verificare

se possono acquistare prodotti senza consultare lo specialista .

Nella prassi quotidiana, anche una store Buccino automedicazione deve conformarsi a le regole: i farmaci con ricetta ripetibile non possono in alcun modo essere venduti

a distanza senza ricetta, nemmeno a pensarci da una rivendita italiana accreditata .

Per chi è lontano o vive all’estero per qualche

tempo , cercare una farmacia di fiducia italiana all’estero può essere difficile .

Perciò , affidarsi a una farmacia virtuale italiana preserva la origine e la qualità dei prodotti

.

Per di più la orientamento di un specialista farmaceutico

è sempre disponibile , sia attraverso videochiamata .

Come considerazione finale, che tu abbia bisogno di delucidazioni da una addetto

conosciuto o che tu tenda a ordinare da una Farmacia online , l’ vitale è

avvalersi di un canale autorizzato .

Il termine “Farmacia senza ricetta” o “Farmacia online senza ricetta Italia” si

riguarda tipicamente a farmaci da banco , supplementi

alimentari e preparazioni per l’igiene.

Analizzando il caso di una esercizio Buccino su web , la benessere psicofisico viene

l’elemento cardine e il dottore resta il tuo riferimento primario .

Ricorda sempre : dietro ogni richiesta su un sito legittimo

, c’è sempre un professionista che ti guida.

https://localitybiz.com/20791877/farmacia-dott-buccino-carmelo-gravina-in-puglia

Казино Vavada привлекает игроков щедрыми бонусами без депозита и постоянными турнирами с крупным призовым фондом.

Регистрация занимает несколько минут, а рабочие зеркала обеспечивают стабильный доступ к сайту даже при блокировках.

Проверяйте актуальные промокоды и условия отыгрыша, чтобы оптимально использовать стартовые фриспины.

Служба поддержки отвечает на русском языке и помогает решить вопросы с верификацией и выводом средств.

Свежие предложения и актуальное зеркало доступны по ссылке: вавада рабочее зеркало.

Играйте ответственно и контролируйте банкролл, чтобы азарт приносил удовольствие.

I blog often and I really thank you for your content. Your article has truly peaked my interest. I am going to bookmark your site and keep checking for new details about once a week. I subscribed to your RSS feed too.

Quality articles or reviews is the important to invite the users to pay a visit the site, that’s what this web site is providing.

взломостойкие сейфы цена

I have been browsing on-line greater than three hours today, but I by no means found any fascinating article like yours. It’s lovely price sufficient for me. In my view, if all web owners and bloggers made good content material as you probably did, the web will be much more helpful than ever before.

adster – Found practical insights today; sharing this article with colleagues later.

offerorbit – Color palette felt calming, nothing distracting, just focused, thoughtful design.

promova – Navigation felt smooth, found everything quickly without any confusing steps.

rankora – Content reads clearly, helpful examples made concepts easy to grasp.

взломостойкие сейфы цена

trendfunnel – Found practical insights today; sharing this article with colleagues later.

встраиваемые сейфы цены

I think the admin of this web site is genuinely working hard for his site, as here every stuff is quality based information.

I have read so many content concerning the blogger lovers however this paragraph is actually a fastidious paragraph, keep it up.

Нужны столбики? мобильный столбик столбики для складов, парковок и общественных пространств. Прочные материалы, устойчивое основание и удобство перемещения обеспечивают безопасность и порядок.

где купить кабели кабель минск

Great post however , I was wanting to know if you could write a litte more on this topic? I’d be very thankful if you could elaborate a little bit more. Appreciate it!

stackhq – Bookmarked this immediately, planning to revisit for updates and inspiration.

cloudhq – Color palette felt calming, nothing distracting, just focused, thoughtful design.

For those seeking an exceptional online gaming experience, [maxispin.us.com](https://maxispin.us.com/) stands out as a premier destination. At Maxispin Casino, players can enjoy a vast array of pokies, table games, and other thrilling options, all accessible in both demo and real-money modes. The casino offers attractive bonuses, including free spins and a generous welcome offer, along with cashback promotions and engaging tournaments. To ensure a seamless experience, Maxispin provides various payment methods, efficient withdrawal processes, and reliable customer support through live chat. Security is a top priority, with robust safety measures and a strong focus on responsible gambling tools. Players can easily navigate the site, with detailed guides on account creation, verification, and payment methods. Whether you’re interested in high RTP slots, hold and win pokies, or the latest slot releases, Maxispin Casino delivers a user-friendly and secure platform. Explore their terms and conditions, read reviews, and discover why many consider Maxispin a legitimate and trustworthy choice in Australia.

Regardless of whether you’re an experienced copywriter or a newcomer, MaxiSpin.us.com offers the resources necessary to improve your content.

**Features of MaxiSpin.us.com**

Furthermore, the platform includes a powerful spin-text generator that enables users to effortlessly create unique content variations.

**Benefits of Using MaxiSpin.us.com**

Both individuals and small businesses can gain significant advantages by using MaxiSpin.us.com.

cloudopsly – Color palette felt calming, nothing distracting, just focused, thoughtful design.

kubeops – Color palette felt calming, nothing distracting, just focused, thoughtful design.

Нужны столбики? столбики для ограждения с лентами столбики для складов, парковок и общественных пространств. Прочные материалы, устойчивое основание и удобство перемещения обеспечивают безопасность и порядок.

греческое свадебное платье свадебные платье каталог фото

где купить провода купить электрику в минске

I enjoy what you guys are usually up too. This kind of clever work and exposure! Keep up the awesome works guys I’ve incorporated you guys to my personal blogroll.

For those seeking an exceptional online gaming experience, [maxispin.us.com](https://maxispin.us.com/) stands out as a premier destination. At Maxispin Casino, players can enjoy a vast array of pokies, table games, and other thrilling options, all accessible in both demo and real-money modes. The casino offers attractive bonuses, including free spins and a generous welcome offer, along with cashback promotions and engaging tournaments. To ensure a seamless experience, Maxispin provides various payment methods, efficient withdrawal processes, and reliable customer support through live chat. Security is a top priority, with robust safety measures and a strong focus on responsible gambling tools. Players can easily navigate the site, with detailed guides on account creation, verification, and payment methods. Whether you’re interested in high RTP slots, hold and win pokies, or the latest slot releases, Maxispin Casino delivers a user-friendly and secure platform. Explore their terms and conditions, read reviews, and discover why many consider Maxispin a legitimate and trustworthy choice in Australia.

Regardless of whether you’re an experienced copywriter or a newcomer, MaxiSpin.us.com offers the resources necessary to improve your content.

**Features of MaxiSpin.us.com**

The interface of MaxiSpin.us.com is intuitive and easy to navigate.

**Benefits of Using MaxiSpin.us.com**

The platform is also cost-effective, providing high-quality content at a fraction of the cost of traditional methods.

сейф для отеля

This is a topic that’s close to my heart… Take care! Where are your contact details though?

сейфы для офиса купить

сейф для оружия купить в москве

This is a topic that’s near to my heart… Cheers! Where are your contact details though?

Have you ever considered publishing an ebook or guest authoring on other blogs? I have a blog centered on the same information you discuss and would really like to have you share some stories/information. I know my subscribers would enjoy your work. If you are even remotely interested, feel free to send me an email.

где купить сейф

promoseeder – Color palette felt calming, nothing distracting, just focused, thoughtful design.

clickrevamp – Bookmarked this immediately, planning to revisit for updates and inspiration.

serpstudio – Mobile version looks perfect; no glitches, fast scrolling, crisp text.

leadspike – Overall, professional vibe here; trustworthy, polished, and pleasantly minimal throughout.

несгораемый сейф

шкаф сейф офисный

сейф для оружия цена

[url=https://shumoizolyaciya-torpedy-77.ru]шумоизоляция торпеды[/url]

купить газобетон в краснодаре газоблок цена за штуку

шумоизоляция дверей авто https://shumoizolyaciya-dverej-avto.ru

клиника варикоцеле

Learn more here: that site

шаровой кран под приварку кран шаровой под приварку

datadev – Found practical insights today; sharing this article with colleagues later.

applabs – Mobile version looks perfect; no glitches, fast scrolling, crisp text.

dataops – Color palette felt calming, nothing distracting, just focused, thoughtful design.

trycloudy – Mobile version looks perfect; no glitches, fast scrolling, crisp text.

септопластика цены

gobyte – Overall, professional vibe here; trustworthy, polished, and pleasantly minimal throughout.

usebyte – Mobile version looks perfect; no glitches, fast scrolling, crisp text.

мобильные стойки ограждения купить столбики ограждения

тренды свадебных платьев свадебные платья каталог свадебный салон

варикоцеле виды операций

тренды свадебных платьев свадебный платья москва каталог

сколько стоит септопластика

увеличение толщины полового члена

магазин электрики кабель купить электрику в минске

переносные ограждения столбика мобильные стойки ограждения

getstackr – Bookmarked this immediately, planning to revisit for updates and inspiration.

usestackr – Pages loaded fast, images appeared sharp, and formatting stayed consistent.

deployly – Content reads clearly, helpful examples made concepts easy to grasp.

byteworks – Bookmarked this immediately, planning to revisit for updates and inspiration.

stackable – Navigation felt smooth, found everything quickly without any confusing steps.

Very good blog post. I certainly appreciate this site. Stick with it!

тонзиллэктомия стоимость

Pretty! This was an incredibly wonderful post. Many thanks for supplying this information.

dataworks – Content reads clearly, helpful examples made concepts easy to grasp.

ремонт квартири 1 кв м ремонт квартир Львів

фимоз у взрослых

ремонти квартир дизайни ремонт квартир недорого

Mario game walkthrough super mario world play

увеличение полового органа цена

Добрый день! Знаю, это немного не по теме, но я подумал, не заинтересованы ли вы в обмене ссылками или, может быть, написании гостевых постов друг для друга? Мой блог охватывает много тех же тем, что и ваш, и я думаю, мы могли бы взаимно выгодно сотрудничать. Если вам интересно — напишите мне, пожалуйста, на email. Буду рад ответу! Кстати, отличный блог!

[url=https://wow-interface.ru]р7 казино зеркало[/url]

גם הדמות לא רעהחזה גדול, אגן רחב בינוני, גם המותניים נוכחים. עשרות עיניים גבריות רעבות מציצות בשקיקה בפניה ובדמותה של נערת השיחה. אבל מבטו של הרופא מחליק על המבנה, לא עוצר באף אחד. התעצבן. אני לא רוצה סקס, אני לא רוצה אותו, הנה. אני מדבר איתך, זה בסדר, אני לא סובל משאלה. הכל נעלם, הגעתי הביתה, נרגעתי ועכשיו אין לי שום מחשבה על זה. אני מאוד מאוד רגועה, אני בסדר https://fetishdatingapps.com/

cryptora – Bookmarked this immediately, planning to revisit for updates and inspiration.

kubexa – Pages loaded fast, images appeared sharp, and formatting stayed consistent.

stackora – Color palette felt calming, nothing distracting, just focused, thoughtful design.

cloudiva – Overall, professional vibe here; trustworthy, polished, and pleasantly minimal throughout.

атерома удаление цена

netlance – Bookmarked this immediately, planning to revisit for updates and inspiration.

devonic – Loved the layout today; clean, simple, and genuinely user-friendly overall.

I pay a visit everyday a few websites and blogs to read articles or reviews, but this weblog presents feature based writing.

apponic – Appreciate the typography choices; comfortable spacing improved my reading experience.

codefuse – Color palette felt calming, nothing distracting, just focused, thoughtful design.

securia – Navigation felt smooth, found everything quickly without any confusing steps.

удаление полипа в матке лазером цена

codestackr – Content reads clearly, helpful examples made concepts easy to grasp.

где удалить жировик

Проблемы с застройщиком? https://vzyskanie-ddu.ru помощь юриста по долевому строительству, расчет неустойки, подготовка претензии и подача иска в суд. Защитим права дольщиков и поможем получить компенсацию.

Нужен юрист? арбитражный адвокат москва представительство в арбитражном суде, защита интересов бизнеса, взыскание задолженности, споры по договорам и сопровождение судебных процессов для компаний и предпринимателей.

магазин парфюмерии цены https://elicebeauty.com/parfyumeriya/nishevaya-parfyumeriya/houbigant-quelques-fleures-l-original.html

Found a bride? marriage proposal in Barcelona romantic scenarios, beautiful locations, photo shoots, decor, and surprises for the perfect declaration of love. Make your engagement in Barcelona an unforgettable moment in your story.

Проблемы с застройщиком? взыскать неустойка дду застройщик помощь юриста по долевому строительству, расчет неустойки, подготовка претензии и подача иска в суд. Защитим права дольщиков и поможем получить компенсацию.

Нужен юрист? юридическая защита в арбитражном суде представительство в арбитражном суде, защита интересов бизнеса, взыскание задолженности, споры по договорам и сопровождение судебных процессов для компаний и предпринимателей.

женская парфюмерия https://elicebeauty.com/parfyumeriya/filter/_m169_m277/

Ищешь кран? кран шаровой под сварку для трубопроводов различного назначения. Надежная запорная арматура для систем водоснабжения, отопления, газа и промышленных магистралей. Высокая герметичность, долговечность и устойчивость к нагрузкам.

devpush – Mobile version looks perfect; no glitches, fast scrolling, crisp text.

gitpushr – Loved the layout today; clean, simple, and genuinely user-friendly overall.

Продажа квартир в Москве требует грамотной маркетинговой стратегии. Профессиональные риелторы используют современные инструменты продвижения объектов: новости недвижимости в Москве

Discover the thrill of real-money live casino action at [url=https://maxispin-au.com/]top casino software[/url], where you can enjoy live dealers, top software providers, and exclusive promotions.

Maxispin-au.com is an innovative platform reshaping online entertainment for modern users.

удаление полипа эндометрия москва

shipkit – Navigation felt smooth, found everything quickly without any confusing steps.

debugkit – Loved the layout today; clean, simple, and genuinely user-friendly overall.

testkit – Appreciate the typography choices; comfortable spacing improved my reading experience.

logkit – Overall, professional vibe here; trustworthy, polished, and pleasantly minimal throughout.

promptkit – Content reads clearly, helpful examples made concepts easy to grasp.

flowbot – Navigation felt smooth, found everything quickly without any confusing steps.

modelops – Content reads clearly, helpful examples made concepts easy to grasp.

I think this is one of the so much important information for me. And i’m satisfied studying your article. However wanna observation on few basic things, The website taste is ideal, the articles is truly excellent : D. Excellent process, cheers

?Levantemos nuestros brindis por cada forjador de la prosperidad !

El rendimiento de los juegos en un casino online sin verificaciГіn suele ser igual de alto que en los casinos tradicionales. [url=http://casinos-sin-verificacinspa.vercel.app/][/url]. Los desarrolladores se aseguran de que la calidad de grГЎficos y sonido sea de primer nivel. Esto garantiza que los jugadores vivan una experiencia envolvente y emocionante.

Los casinos-sin-verificacinspa.vercel.app ofrecen una experiencia de juego Гєnica y sin complicaciones. AquГ, los jugadores pueden disfrutar de sus juegos favoritos sin la tediosa verificaciГіn de datos. Esto los convierte en una opciГіn ideal para quienes buscan rapidez y sencillez en su entretenimiento.

Disfruta del juego anГіnimo en un casino cripto sin verificaciГіn – http://casinos-sin-verificacinspa.vercel.app/

?Que la fortuna avance contigo con instantes increibles exitos memorables !

mlforge – Mobile version looks perfect; no glitches, fast scrolling, crisp text.

taskpipe – Navigation felt smooth, found everything quickly without any confusing steps.

smartpipe – Appreciate the typography choices; comfortable spacing improved my reading experience.

opsbrain – Navigation felt smooth, found everything quickly without any confusing steps.

patchkit – Appreciate the typography choices; comfortable spacing improved my reading experience.

pipelinesy – Navigation felt smooth, found everything quickly without any confusing steps.

authkit – Overall, professional vibe here; trustworthy, polished, and pleasantly minimal throughout.

zerotrusty – Pages loaded fast, images appeared sharp, and formatting stayed consistent.

threatlens – Overall, professional vibe here; trustworthy, polished, and pleasantly minimal throughout.

auditkit – Navigation felt smooth, found everything quickly without any confusing steps.

keyvaulty – Navigation felt smooth, found everything quickly without any confusing steps.

secstackr – Found practical insights today; sharing this article with colleagues later.

shieldops – Found practical insights today; sharing this article with colleagues later.