This Bitcoin retirement planning strategy guide explains how specialized calculators differ from traditional retirement tools by using models like the Power Law to predict price cycles tied to Bitcoin’s four-year halving events and fixed 21 million coin supply. Unlike conventional calculators assuming 7-10% steady returns, Bitcoin planning focuses on accumulating Satoshis through dollar-cost averaging while factoring in irregular growth patterns, capital gains taxes, and alternative withdrawal strategies that treat scarcity as a defense against inflation.

Key Insights

- Bitcoin retirement calculators are unlike traditional tools and use models like the Power Law to predict price.

- These calculators move the focus away from dollar amounts to “stacking” a target number of Satoshis.

- This allows investors to determine when their holdings will realistically cross a set threshold at retirement.

A Bitcoin retirement calculator offers investors a new way to think about their long-term financial plans. Traditional models rely on stocks and steady returns to function. However, Bitcoin planning is focused on supply limits, market cycles, and long-term horizons.

This trend has drawn interest from people who see Bitcoin as a long-term store of value, rather than a medium-term trade.

Bitcoin Retirement Calculator Basics and Why They Exist

A Bitcoin retirement calculator is very different from standard retirement tools. Traditional retirement calculators assume predictable growth and expect returns between 7% and 10% at the end of their calculations.

However, Bitcoin does not behave this way.

For Bitcoin, its price movements happen in cycles. These cycles are often connected to the halving events every four years, where the new coin supply is cut in half.

Reduced supply has historically affected long-term price trends, and a Bitcoin retirement calculator factors all of this in.

It allows users to track irregular growth patterns and moves the focus away from steady gains and onto long-term accumulation.

Many users describe this as stacking “Sats”, where small purchases add up over time. The calculator helps to show how these small actions can support future expenses.

This approach is very appealing to people who question whether traditional assets can keep pace with inflation.

How does the Bitcoin Retirement Calculator work?

Most calculators rely on two main methods for their function, and each one offers a different way to predict Bitcoin’s performance. The first method uses a fixed annual return, where users select a growth rate. Some investors choose conservative figures, while others test aggressive scenarios.

The calculator then compounds those returns year by year. The second method relies mostly on the Bitcoin power law.

This model comes from physics research and assumes that Bitcoin’s price follows a predictable curve over time. This curve links price to network growth and allows for heavy price drops or long recoveries.

Bitcoin’s power law does not assume that Bitcoin will continue to move smoothly, and this is what makes it very different from traditional tools.

Traditional Retirement Math versus Bitcoin Planning

Retirement plans used to be relatively simpler. Investors would save regularly, buy diversified assets, and follow the 4% rule.

Bitcoin planning breaks this structure, where supply is capped at 21 million coins and no authority can change this. This fixed supply changes how people look at value over the long term.

Traditional calculators treat inflation as a constant threat, while Bitcoin models treat scarcity as a defence against this problem.

Another difference is in withdrawal logic. Traditional plans assume that investors will sell small amounts regularly, while Bitcoin plans consider selling less often.

These differences show why many people run to the Bitcoin retirement calculator rather than a stock-focused tool.

Inputs for Bitcoin Retirement Calculators

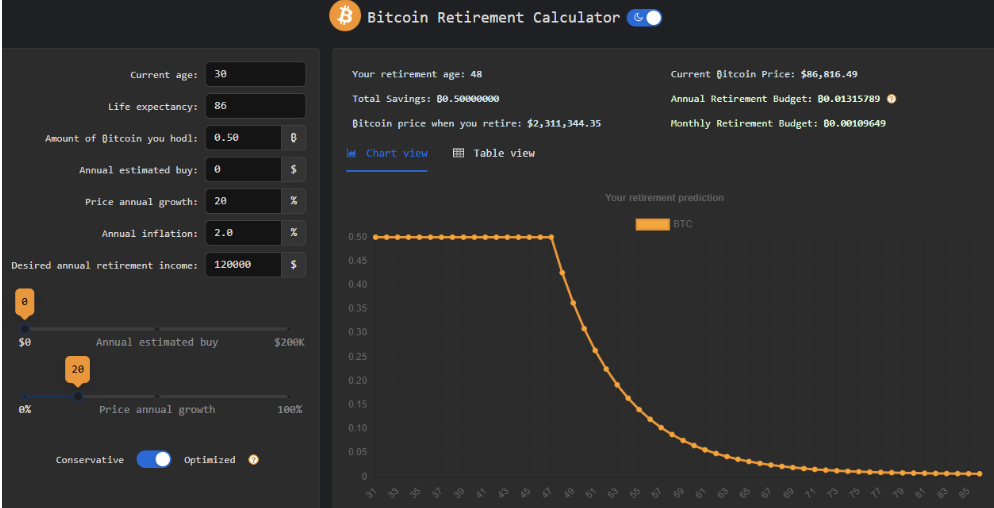

In order to plan accurately, the Bitcoin retirement calculator needs several inputs. This is because guesswork reduces its influence, and this makes it different from the traditional kinds. For starters, current Bitcoin holdings come first. This stands as the starting point, and even small amounts will matter over long periods.

Annual contributions come next, and many users plan steady purchases through dollar cost averaging, where the calculator spreads these buys across time. Expected Bitcoin growth continues to be the most uncertain input, where users often test multiple scenarios like bearish, base, and bullish cases.

Retirement expenses are also worth considering. Calculators often require yearly spending in today’s dollars, and inflation assumptions adjust those figures over time. Taxes also cannot be ignored, as selling Bitcoin tends to trigger capital gains tax in many jurisdictions.

A good calculator factors this cost into projections, and each input affects the final picture, where one variable can change results massively.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.