Key Insights

- The crypto market crashed strongly last week, with over $1 billion liquidated across the board.

- U.S. presidential candidate Kamala Harris chose Minnesota Governor Tim Walz as her running mate, with the Trump “crypto presidency” now at risk.

- Ripple was ordered to pay a $125 million fine in its civil case with the SEC, ending the three-year legal battle.

- Montenegro delayed Do Kwon’s extradition for the seventh time since March 2023, as the Terra founder remains in custody.

- Ripple Labs is testing a new stablecoin to compete with Circle and Tether.

The crypto market experienced its fair share of ups and downs last week, especially the brutal crash that marked its beginning.

More updates surfaced, with U.S. presidential candidate Kamala Harris picking a new running mate:

Ripple appears to now be free from the SEC’s clutches, and a Montenegrin court delayed Do Kwon’s extradition—again—for the seventh time in a row amid accusations of foul play.

Here are all of the major crypto updates from the previous week:

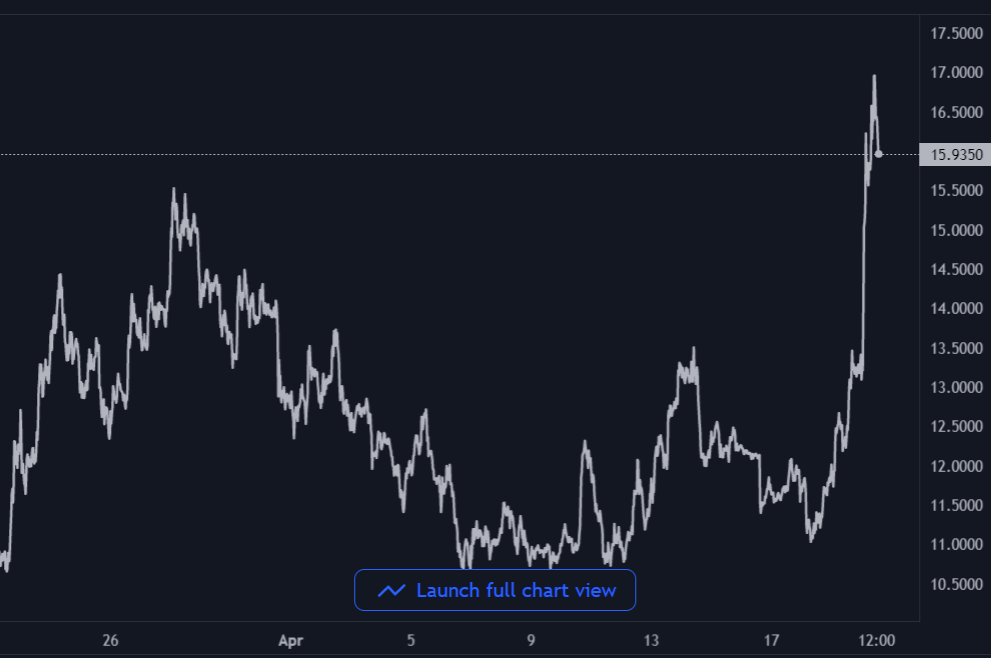

The Week Started With The “Mother Of All Crashes”

On Monday, 5 August, at the beginning of the week, the crypto fear and greed index plummeted to a low of 17/100, into the “extreme fear” territory.

This level of investor fear was even more extreme than what we saw amid the FTX catastrophe in November 2022, with upwards of $1 billion liquidated across the board between Monday and Tuesday.

Monday’s brutal crash

Between Monday and Tuesday, nearly 300,000 traders were kicked off their trades, with the bulls losing $700 million and the bears losing $266 million.

This market-wide crash was triggered by the Bank of Japan’s 25-basis-point rate hike and the weak U.S. jobs report, which ignited fears of a recession.

These factors combined sent shockwaves through the industry and sent Bitcoin straight down to $49,000.

Bitcoin is back up to around $62,000 at the time of writing, with the market showing signs of health once again.

Trump’s “Crypto Presidency” Is Now Under Fire

According to Yahoo Finance, last week, the current vice President of the United States and prospective president Kamala Harris chose Minnesota Governor Tim Walz as her running mate.

While Vance (and even Harris) have remained mostly silent over their positions on crypto, Vance has aligned with harsh crypto policies and consumer protections, much like other figures like Senator Elizabeth Warren.

For example, Yahoo Finance reports that Alan Orwick, co-founder of Quai Network, believes Walz’s appointment as the V.P. candidate “could signal a [harsher] regulatory environment for [crypto] under a Harris-Walz administration.”

An even more disturbing fact for crypto fans about the issue is that the odds of Harris winning the presidency have begun to rise against Trump’s.

Trump in a tie against Harris

As shown, Trump is now down from a high of 72% to a 49% tie against Harris.

Harris to beat Trump.

A poll from Marist also shows Harris’ odds of beating Trump at a high of 51% versus Trump’s 48%.

With all of this being said, a “crypto presidency” in the U.S. isn’t as assured as many think.

Ripple Walks Away With a $125 Million Fine

The ongoing civil case between Ripple and the SEC since December 2020 seemed to have ended last week when a federal judge ordered the defendant to pay a fine of $125 million.

$125 million fine

The judge also “permanently restrained and enjoined” the company from further violations of U.S. securities laws, which Ripple executives have now hailed as a “win”.

Overall, HUGE win for @Ripple. Although I’m surprised at the $125M hit, Ripple more than made that just on the price move in $XRP in the last 5 minutes. Here are the major takeaways from the ruling:

— Fred Rispoli (@freddyriz) August 7, 2024

The price of XRP surged by 26% on 8 August to a high of $0.63; Ripple Labs CEO Brad Garlinghouse stated, “The SEC asked for $2B, and the Court reduced their demand by ~94% recognizing that they had overplayed their hand”.

“This is a victory for Ripple, the industry and the rule of law”, he concluded.

So far, analysts now expect a cycle high for XRP between $3 and $5.

Do Kwon’s Extradition Delayed for the 7th Time

In early August, Montenegro announced that it had rejected the U.S.’ request for Do Kwon’s extradition after being held in custody since March 2023.

The Appellate Court of Montenegro, at the time, reaffirmed an earlier decision from the High Court of Podgorica to send Kwon to South Korea instead of the U.S. for his role in the $40 billion Terra Crash of 2022.

According to local reports, Montenegro’s Supreme Court postponed things again last week at the request of the country’s Minister of Justice, Andrej Milović.

As it turns out, Kwon wants to be tried in his home country of South Korea, which has lighter sentences for financial crimes.

However, Montenegro’s courts and legal system have now been split over which country’s request to honour.

Goran Radić reportedly told Vijesti, a Montenegrin newspaper, that the courts’ behaviour lately is a “judicial disgrace.”

Radic even alleged that Radic also told Vijesti that Minister of Justice Andrej Milović overturned the extradition because he had made an “illegal private promise” to extradite Kwon to the U.S. instead of South Korea.

Ripple Is Now Testing Its $RLUSD Stablecoin on Ethereum and XRPL

Ripple had never let the SEC’s court case get in the way of its innovation.

This time around, the company announced plans to launch a new dollar-pegged stablecoin sometime soon, and is even already testing it on the Ethereum Network and the XRP Ledger.

Ripple aims to compete with the industry’s juggernauts like Circle and Tether, even as Bernstein predicts that the stablecoin market is set to break above the $2 trillion market cap line by 2028.

Ripple USD ($RLUSD), the new stablecoin, will be backed by short-term U.S. Treasuries, cash equivalents, and dollar deposits.

It will also be audited by a third-party accounting firm, with monthly attestations for an extra layer of security.

As soon as Ripple gets regulatory approval, it will also offer both stablecoin and XRP for global payments.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.