Key Insights:

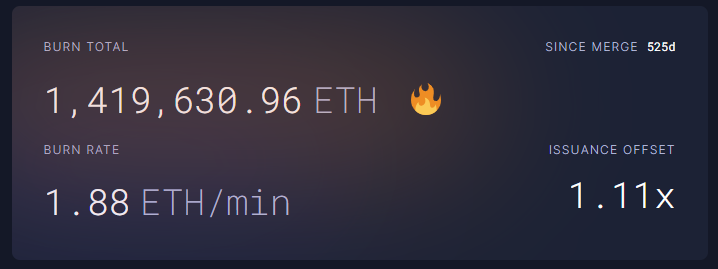

- Ethereum has burned 1.4 million ETH since The Merge (Sept, 2022).

- New minted coins were at 1.01 million in the same period.

- Deflation rate is now at 0.21%.

- Validator rewards are not impacted as of now.

- Factors affecting deflation are ETH price and the upcoming upgrade, The Surge.

Data reveals that since The Merge in September 2022, Ethereum has actually become deflationary, a model where the no. of tokens decreases every year.

However, with 900k validators, will Ethereum be able to pay them well with reduced token supply and upgrades that will reduce transaction fees even further?

Data from Ultra Sound Money Shows Deflation in Ethereum

Since Ethereum transformed into a Proof of Stake blockchain with The Merge, its token issuance has actually become deflationary. The number of new tokens that were issued every year has reduced by 90%.

The following graph by the UltraSound.money reveals that Ethereum has been reducing its token supply. You can see below that the current deflation is around 0.210% in ETH’s token supply.

The data also reveals that since the Merge (September 15, 2022), Ethereum has lost around 362,628 ETH worth $1.01 billion.

How does Deflation Benefit Token Holders?

Deflation is the phenomenon where the supply of any currency or token decreases. As a result, the value of each individual token which is still in supply, increases. The cryptocurrencies where this phenomenon happens, either by design or by fate, are known as deflationary cryptocurrencies.

Ethereum Gets Deflationary as Burn Rate Soars

It is interesting to note that these tokens were lost purposefully.

Like most blockchains, Ethereum also has a burn mechanism where a portion of the fees collected is purposefully burnt to control the price of its cryptocurrency, ETH.

Since the Merge, Ethereum has burnt nearly 1.4 million tokens. During the same phase there were 1.01 million newly minted ETH.

The current deflationary model is dependent on increased burn rates which in turn are dependent on increased blockchain usage.

If the burn rates decrease, Ethereum will have to issue more ETH to pay validators. This in turn will probably stop the deflationary path of Ethereum.

Data from UltraSound.money shows that for every 1 ETH minted, the current burn rate removes 1.11 ETH from circulation.

Impact on Validator Rewards

To make ETH more valuable, new token mints have to be less than the token burns. This is how deflation is introduced by design in any crypto tokenomics.

However, one cannot just simply cut new token issuance because validators depend on new tokens and transaction fees to get paid. Without validators, the entire blockchain will become valueless.

Hence, to make sure that validators are rewarded properly, the price of ETH must go so high that even with a reduced reward in ETH, the validators get a good payment (in fiat, USD, GBP, etc.). Alternatively, the supply of ETH should come down.

The current model used by Ethereum seems to combine both. The recent rally in ETH prices have lifted the price and the increased number of transactions have ensured a higher burn rate.

Is the Deflationary Model Sustainable? Two Questions

Yes, it will be as long as ETH trades above a certain level. UltraSound.money prejects that a stable equilibrium will be achieved around the year 2224 where the total token supply would be 82.6 million, enough to balance new issued ETH and token burns.

As of Feb 2024, the total ETH in circulation is around 120 million. Which will reduce over time to achieve the above equilibrium.

Questions on The Sustainability of Deflationary Model in Ethereum

Two factors that affect Ethereum’s capability to remain deflationary are the price of ETH and its scaling upgrade called the Surge.

If the price of ETH drop below an estimated price of $2000, this equilibrium will be disturbed. As a result, more ETH will have to be issued so that validators can keep the blockchain safe.

Another question is that of Surge, which aims to increase the transaction capacity of Ethereum to 100k transactions per second. As a result, the transaction fees will reduce, which will increase the dependency of validators

#NOTE: In Proof of Stake blockchains, the price of token is of critical importance to secure the blockchain. If the token price crashes, it would become easier to buy its token; and thus, overtake the entire blockchain (a 51% attack).

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.