Key Insights

- The SEC has just pushed back its decision on the Invesco-Galaxy Ethereum ETF by 35 days for public comments, raising fears of denial.

- Meanwhile, a Standard Chartered analyst sees similarities to the Bitcoin ETF timeline, and targets May 23rd as the day.

- Ethereum’s price is up by 2%. If it breaks above a key resistance level, it could be eyeing the $3,000 target.

- The Standard Chartered analyst says that an ETF approval could drive ETH to $4,000 by May 23rd.

You know what they say: “Delay is not denial”—but what if it is in this case?

The U.S. Securities and Exchange Commission has just slammed another Ethereum ETF applicant with a deadline extension this week.

The securities watchdog has once again bashed the hopes of investors hoping for a spot Ethereum ETF, and here is everything you need to know.

The SEC Versus Invesco-Galaxy

This week on 6 February 2024, the SEC announced that it was postponing the approval of the Invesco Galaxy Ethereum ETF application.

In detail, the SEC says that it is initiating proceedings to determine whether or not to approve the proposed rule change that will allow the Cboe BZX Exchange to list shares of the Invesco Galaxy Ethereum ETF for trading.

The SEC announced that it had received 19 comments on the proposal and that before reaching a final judgment, it would like more feedback from the public.

In addition, the SEC said that it would extend the deadline for the decision by another thirty-five days.

Keep in mind that the SEC had also previously postponed the Invesco Galaxy Ethereum ETF by forty-five days in December 2023, because it “needed time” to determine whether Ethereum’s proof-of-stake algorithm and “concentration of control by a few individuals” could make an ETF it approves open to fraud and manipulation.

As of right now, the SEC has the power to extend the review period by up to 240 days from the date of the first filing, meaning that June 28, 2024, is the final deadline for the Invesco Galaxy Ethereum ETF.

Standard Chartered Says We Might See An Ethereum ETF By May

According to Bloomberg, Standard Chartered predicted in a letter last week, that the SEC will approve spot Ethereum ETFs in May this year.

Geoff Kendrick, the bank’s head of the firm’s crypto research, said that the SEC’s approval process for the spot Ethereum ETFs will likely be similar to that of spot bitcoin ETFs.

Kendrick drew attention to the fact that the SEC has until May 23 to decide whether to approve the spot ETH ETF applications from VanEck and Ark 21shares, which were the first to be submitted in the United States.

As it did with the eleven spot bitcoin ETF applications that were accepted on January 10, Kendrick stated that he expects the SEC to make its announcement on its decision on that day.

Additionally, he expressed his belief that Ethereum is similar to Bitcoin in terms of financial and legal, which may also improve its prospects of being approved.

However, Kendrick acknowledged that there there are still certain issues to iron out.

He pointed out, for instance, that SEC Chairman, Gary Gensler has not yet clarified whether ETH qualifies as a security.

Additionally, he noted that the SEC has postponed the applications from Blackrock and Grayscale Investments, suggesting that the agency intends to take its time reviewing these applications.

Overall, Kendrick predicts that if the ETH ETFs are approved, the price of ETH may hit $4,000 by the May 23 approval deadline.

Meanwhile, Ethereum Shows Bullish Signs

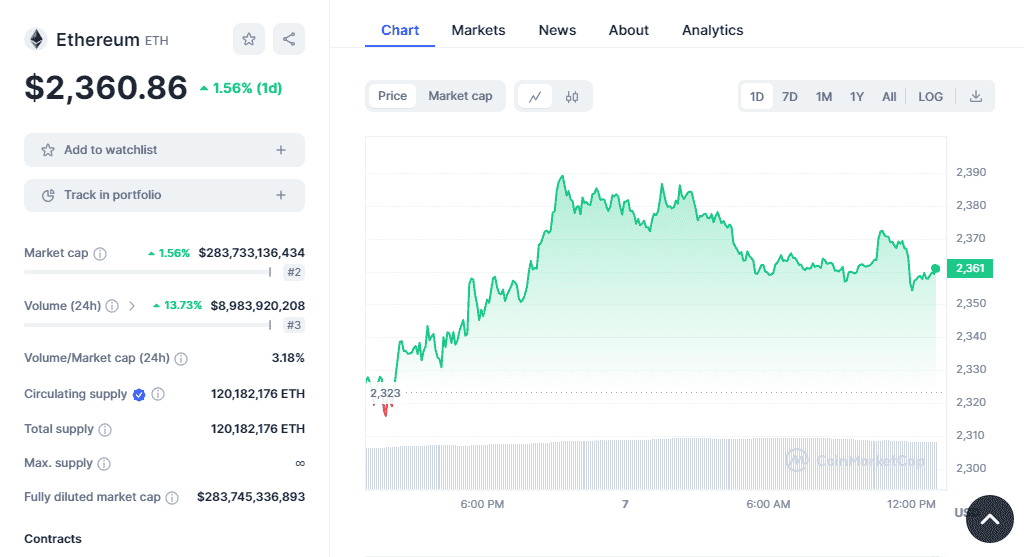

According to data from CoinMarketCap, ETH is showing signs of bullishness over the last day.

The cryptocurrency is up by nearly 2% over the last day, which is a major step up, considering its sluggishness over the last few weeks.

In the charts, ETH appears to have successfully hit the $2,400 resistance, after breaking above both its 20 and 50-day moving averages.

It is hard to tell whether ETH has any plans of going further up, but the price level to watch out for is the $2,400 zone because if a break above occurs from this point, Ethereum will have enough incentive to hit and maybe break $2,500 as well.

Once all of these resistances have been successfully broken, Ethereum will become fully poised to hit $3,000 as predicted severally by analysts.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.