Key Insights

- Ethereum recently broke above the $2,500 mark, since its rejection from $2,700 on 12 January

- Jeffrey Wilcke, one of Ethereum’s co-founders, also recently dumped 4,300 ETH via Kraken, valued at $10.7 million

- Wilcke’s previous transfer of 22,000 ETH in June 2023 happened before a significant -53% market dump.

- Ethereum’s charts show that investors are currently experiencing a consolidation phase after a rejection from $2,539.

- Analysts predict a possible rally towards $3,000 if we do not break below the $2340 support.

Ethereum recently broke above the $2,500 mark for the first time since its rejection from $2,700 on 12 January last month.

The cryptocurrency is currently struggling to hold its ground above this price level, and there are now reports of an ETH co-founder, selling a massive tranche of ETH on Kraken.

Does this affect ETH’s price trajectory? Who is this Ethereum co-founder, and how did the ETH dump happen?

Jeffrey Wilcke Dumps 4,300 ETH

According to recent developments reported by LookOnChain, Jeffrey Wilcke, one of the co-founders of Ethereum, sent 4,300 ETH to Kraken over the weekend.

This amount of ETH at the time, was worth around $10.7 million at around $2,482 per coin, and has become the talk of the town in the crypto community ever since.

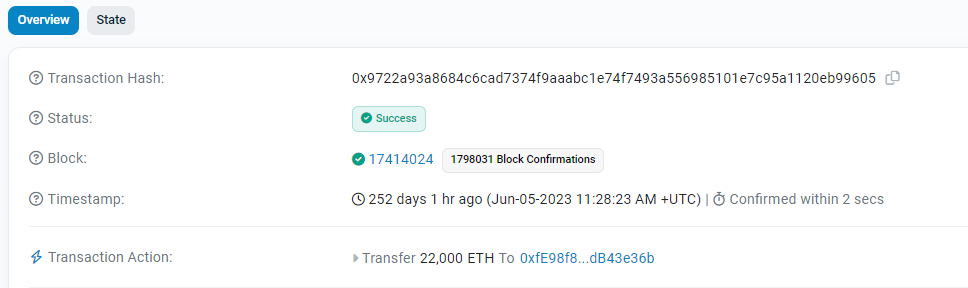

This move echoes other similar moves from the ETH co-founder as far back as 6 June 2023, when he deposited a massive 22,000 ETH into the same crypto exchange, at a “then†value of $41.1 million according to Etherscan data.

At the time of the transfer, ETH was worth around $1,870.

Interesting Developments in the Charts

Recall that the previous transfer from Wilcke happened around 6 June 2023.

The chart below provides us with some insights as to what happened after.

According to the chart shown above, right after this $41 million selloff, ETH entered a massive dump, from around $1,870 to $881.

These two events might be partially or completely correlated, but the facts remain that a price decline occurred soon after.

The chart above shows ETH currently, consolidating after what appears to be a rejection from $2,539.

ETH seems poised to continue upwards from here, and could even hit $3,000.

However, if we see a rejection from the $2,539 price level, the cryptocurrency could slide downwards and hit its 50-day EMA around $2,343.

Analysts Believe Ethereum Can Hit $3,000

Moreover, analysts believe that ETH is incredibly poised to hit $3,000 very soon.

One of these analysts is Crypto X, who in a recent tweet, told his 41.6k followers that Ethereum is repeating a historical pattern from 2019 – 2020.

According to the chart attached to the analyst’s tweet, Ethereum broke out from 305 back in 2020, and skyrocketed upwards, before eventually breaking above $4,000 in 2021.

Crypto X believes this pattern may be repeating itself, and we might be about to see $3,000 as the “next moveâ€.

Another analyst is CryptoPatel, who believes that Ethereum is “ready for $3,000â€.

The analyst cited the ETH/USD chart and stated after Ethereum broke the $2380 Resistance, it is trading successfully above, and we “might” see $3000 in “a few days”. However, on the flip side, Ethereum has to hold the $2340 support for us to see this happen.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.