The Tron (TRX) blockchain project will now have its own native stablecoin pegged to the US dollar. The same can pump up TRX’s price giving it a much-needed breather from its consolidation phase.

Tron founder Justin Sun on Thursday unveiled plans to launch a stablecoin called USDD, which will be pegged to the US Dollar.

In a Twitter thread, Sun announced, “Tron DAO has teamed up with major Blockchain players to launch USDD (Decentralized Dollar), the most decentralized stablecoin in human history.”

Embedded link:

(1/5)🙌#TRON DAO joined hands with major #blockchain players to launch #USDD (Decentralized USD), the most #decentralized #stablecoin in human history.

💪 Today, we see the possibility of decentralizing the blockchain world’s most centralized territory. pic.twitter.com/S5gX3JpiVH

— H.E. Justin Sun 🅣🌞🇬🇩 (@justinsuntron) April 21, 2022

The ‘Most Decentralized Stablecoin’

The new stablecoin USDD will differentiate itself from other market competitors such as Tether (USDT) and USDCoin (USDC), which hold cash reserves of dollars and are centralized. Instead, it will resemble Terra’s algorithmic decentralized stablecoin, UST, which is backed by Terra’s native token LUNA, as well as reserves of Avalanche’s Bitcoin and AVAX.

Similar to how UST works with LUNA, USDD will burn TRX, Tron’s native token, to maintain parity with the US dollar. When the price of USDD is lower than 1 USD, users will be able to send 1 USDD to the system and receive USD$1 worth of TRX in return.

On the contrary, when the price of USDD is higher than USD $1, users will send TRX worth 1 dollar to the decentralized system and receive 1 USDD, according to the technical documentation of the project. Sun stated that the USDD algorithm will take care of ensuring that the stablecoin maintains its peg to the US dollar regardless of market conditions.

The new stablecoin will be a multi-chain project as, in addition to being based on Tron as its native network, it will also be available on Ethereum and Binance Smart Chain. Interoperability between chains will be possible thanks to the BitTorrent network cross-chain protocol (BTTC).

USDD To Have Reserves of USD $10,000M

The project promises to be completely decentralized and will be under the administration of the decentralized autonomous organization, Tron DAO. According to its founder, this organization will be in charge of managing USDD reserves with an interest rate of 30%.

Tron DAO will also provide custody reserves of up to $10 billion in ‘highly liquid assets’ to serve as collateral for USDD. The funds will be used as “early-stage reserve, keep the USDD exchange rate stable, and fully enforce convertibility,” the document reads.

The structure resembles recent plans revealed by Terra founder Do Kwon to acquire $10 billion worth of Bitcoin as reserves for UST. Terra, which has already advanced these plans and currently holds just over 1.5 billion in BTC, has also chosen to diversify these reserves. A few weeks ago, a $200 million purchase of AVAX was announced.

Sun did not detail whether it has any plans to invest in Bitcoin for USDD reserves. In this regard, the founder said that they would be “highly liquid assets obtained from the initiators of the blockchain industry,” that would serve as collateral for the stablecoin.

The roadmap toward the Tron USDD launch will consist of four stages, which are named after space explorations – 1.0 Space, 2.0 ISS, 3.0 Moon, and 4.0 Mars. USDD is expected to be officially launched on May 5, this year.

TRX’s Price Rise

The news comes amid the growing popularity of UST and its native ecosystem, Terra. The project’s stablecoin has become the third-largest stablecoin on the market, surpassing Binance’s BUSD in terms of market cap.

In general, interest in decentralized stablecoins seems to be growing among investors. The announcement also coincided with reports of the launch of another asset of its kind by NEAR Protocol, which announced the deployment of its native USN stablecoin on the testnet on Thursday.

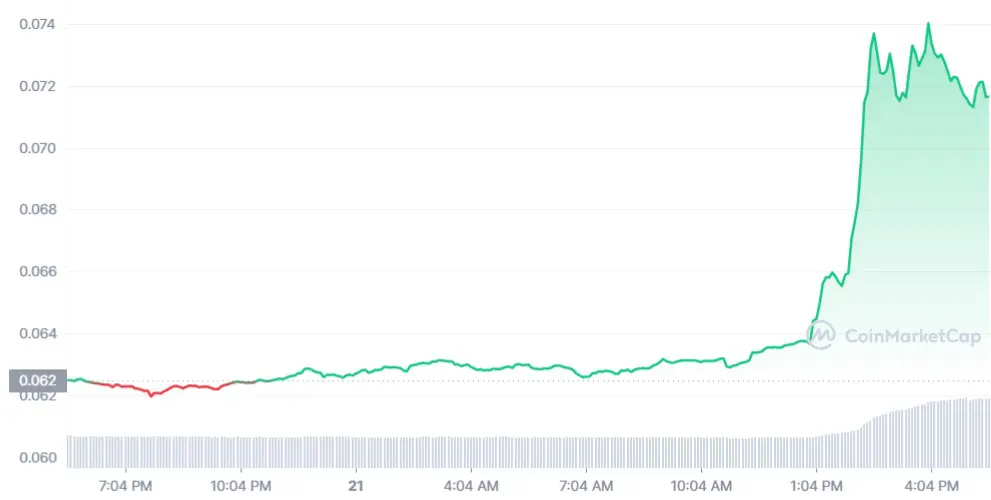

Notably, TRX’s price has gone up in tandem with the news of the launch of its stablecoin.

It seems that the USDD launch plans favored the TRX market, which is up 16% in the last 24 hours to trade at a price of USD $0.072, according to data from Coinmarketcap.