Key Insights:

- Cardano’s TVL Surges beyond $400 million for the first time ever.

- TVL surged by twice since October 2023.

- High developmental activity seems to be attracting more users.

- Top Cardano projects are Djed, Charli3 and Hydra.

Cardano has recently witnessed a surge in its on-chain liquidity last week. The total value locked in Cardano’s TVL has crossed $420 million for the first time since its launch in Jan 2022.

The return of a TVL level of a blockchain to pre-crypto winter levels shows that the current markets have started to recover strongly.

TVL or the Total Value Locked is the sum of funds locked in the several liquidity pools in a blockchain. These liquidity pools are the core of DeFi and the funds in such pools are used for borrowing and lending.

The prime liquidity pools on its blockchain are Indigo, Minswap, Djed and Liquid. Djed is the decentralized stablecoin on Cardano.

These are also the major contributors to a high in Cardano’s TVL. All of these protocols have surged more than 30% in the last 7 days alone.

The Reasons why Cardano’s TVL is Surging

Cardano has been doing high developmental activity on its platform even during the worst days of the crypto winter which shows determination because most projects were shutting shop at that time.

RELATED: 5 Altcoins With Great Development Activity

The platform has also been developing Hydra, which is its own Layer-2 scaling solution. Several times IOHK co-founder Charles Hoskinson (who also co-founded Ethereum) defended Hydra saying that it should not be measured using the Transaction Per Second (TPS) metric because Hydra can produce as many as 350 outputs in a single transaction.

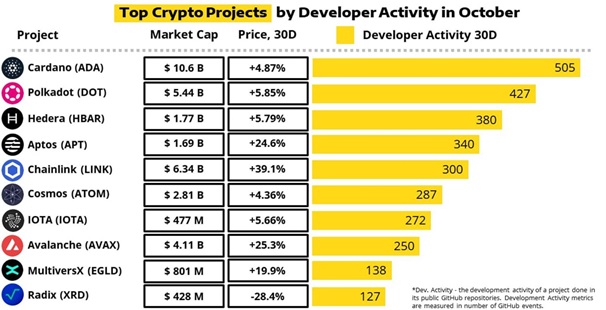

Cardano has always been a blockchain with one of the top development activities. In September, October and November, its developmental activity has been phenomenal. Below is an infographic by CryptoDep.

Another star of Cardano’s developmental ecosystem is Charli3, a blockchain oracle for Cardano. A unique aspect of Charli3 is that its data is secured on-chain which helps in avoiding even the smallest of mishappenings.

Oracles are those softwares which help blockchain smart contracts access real world data such as cryptocurrency prices or any other event data. They help smart contracts execute itself without getting compromised. Oracles also operate on the same lines as a blockchain but they are different than them.

TVL Comparision with Solana and Ethereum

It was in the same period of October 2023 when Cardano’s TVL began showing signs of recovery. It was less than 75 million in early October 2023.

Since then the TVL has never looked back and is has now crossed $400 million as of Dec 09, 2023.

Ethereum’s TVL is about 55 times larger than Cardano at $28 Billion. However, it would be misleading to say that Ethereum is ahead of it.

This is because Ethereum’s TVL at the top of the previous bull market was $108 billion. This shows that Ethereum’s TVL has not yet recovered to its pre-crypto winter levels.

However, Cardano’s TVL has already surpassed its all-time highs. Even if we take a look at its recovery, Cardano’s TVL has multiplied at least 2.7 times from $154 million on October 1 to $420 million on Dec 09, 2023.

However, for the same period, Ethereum lost $1 billion worth of TVL which shows that the current preference for defi activities like yield farming, staking and lending are switching towards other chains.

Further, the gas fees in Ethereum makes users less profitable which is not in the case of the Cardano blockchain.

Solana, one of the fastest growing cryptocurrencies in the last few weeks is another TVL gainer. The total value locked in Solana has grown three times from $323 million on October 1 to 892 million on December 11, 2023.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.