Key Insights

- Uniswap v4, a major new version of Uniswap, is set to launch after the Ethereum Dencun upgrade in March 2024.

- UNI v4 will introduce several improvements, including scalability, performance, security, and lower gas fees.

- UNI v4 will leverage Ethereum’s proto-danksharding to improve scalability and transaction processing.

- Uniswap v4 will introduce new features like flash swaps and improved oracles for better price resistance.

- Uniswap’s price is currently bullish, and a break above $13.3 could potentially lead to another rally.

UNI is gearing up for a major change.

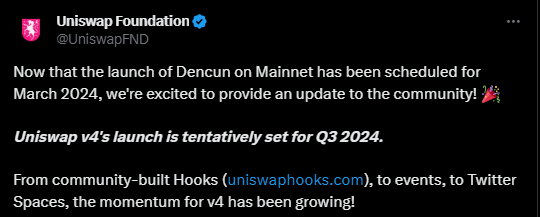

According to a recent announcement from the UNI Foundation, the official deployment of the Uniswap v4 protocol now has an official date and is set to be deployed after the upcoming Ethereum Dencun upgrade.

Uniswap v4: What’s New

To state things simply, UNI is one of the most widely used Defi protocols out there.

According to OKX, UNI is currently the largest decentralized exchange in the world, with an average daily transaction size of about $1.4 billion, and about 144 million all-time trades

According to Defillama, UNI also has about $4.7 billion in total value locked as of February 2024.

From all of the above, we have established how big Uniswap is, and how important it is in the Defi space.

Very recently, via a tweet, the UNI foundation just announced the upcoming launch of Uniswap v4, which is set for Q3 of 2024, after the Ethereum Dencun upgrade.

According to the announcement, this 4th Uniswap version will introduce several improvements to the protocol, in terms of scalability, performance and even security.

Moreover, the UNI v4 is set to leverage Ethereum’s proto-danksharding from the Dencun upgrade, to split transactions into small bits and process them in parallel, and on different shards.

Users will also enjoy much lower gas fees and improved security, as the upcoming Uniswap version is set to undergo rigorous audits by multiple firms and a community contest.

This would make the upcoming version the most extensively audited protocol ever deployed on Ethereum.

If this isn’t impressive enough, there will also be flash swap features that allow users to borrow any amount they wish, as long as they return them within the same transaction.

This will turn out to be useful for arbitrage hunters, and collateral swaps, but without upfront capital.

Additionally, UNI v4 is set to improve the quality of its oracles and will use time-weighted average prices (TWAPs) instead of spot prices, to become more resistant to manipulation.

Uniswap v4: When And How It Will Launch

The Uniswap Foundation has shared a roadmap for the launch of UNI v4, which will feature three phases:

- Code Freeze

This phase is currently underway and involves finishing, testing, and optimizing the core code and everything around the protocol.

2. Audit and Testnet

This phase is expected to start very soon and will have the code sent to several audit firms, as well as a community audit contest. After this, the code will also be deployed to the testnet for finalization.

3. Mainnet

This is the final phase and is expected to happen in the third quarter of 2024. When this phase arrives, Uniswap v4 will be deployed onto the Ethereum mainnet, allowing users to benefit from it.

At the time of writing, however, the launch date has not been fixed yet and might depend on Ethereum’s Dencun upgrade (which is expected to hit on 13 March this year).

Why Uniswap Might Follow Ethereum Right Up

The upcoming Dencun upgrade that UNI’s v4 relies on is set to bring in several improvements to the Ethereum network, in terms of scalability, security and even gas fees.

This upcoming EIP 4844 is set to bring in fresh inflows of users and liquidity to Ethereum, boosting its price by a wide margin.

But what about Uniswap?

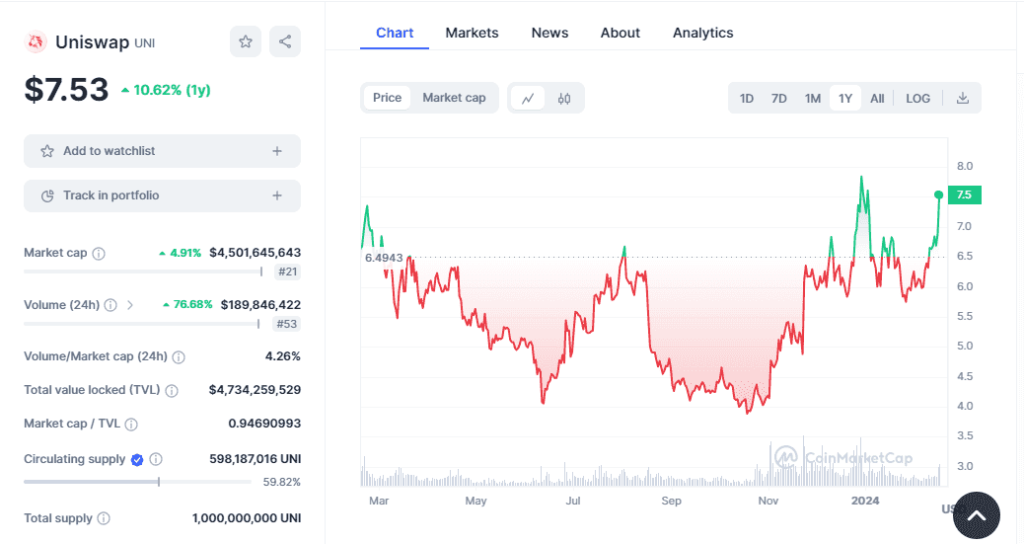

UNI is currently bullish on all timeframes and is up by 5%, 16% and 10% on the daily, weekly and monthly timeframes.

However, the yearly timeframe shows some sluggishness, with a measly 10.57% increase over the last 12 months.

Uniswap has an all-time high of around $45 but currently trades at around $7.53.

In the charts, we can see how far behind the cryptocurrency is.

We can see according to the weekly chart below, that Uniswap’s bearish woes began right after its break below $13.3.

Because of this, we can conclude that if this upcoming v4 upgrade pushes $UNI upwards into a break above $13.3, we just might have a chance at another massive Uniswap rally, like the old days.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.