Key Insights

- Large Bitcoin transfers from Mt. Gox spooked some investors this week, but analysts believe the problem is short-term and won’t impact long-term holders.

- Based on technical indicators and buying pressure, Bitcoin is recovering strongly and may break $70,000 or higher.

- A shift in sentiment suggests long-term holders are repurchasing Bitcoin, making it easier for the crypto to break resistance levels.

- Increased investment in the Bitcoin ETFs fuels the current bull run and could push prices even higher.

- According to technical analysis, Bitcoin’s bull market might not be over.

Bitcoin’s current price is a major step up from last week’s disappointing crash below the $55,000 mark.

According to data from CoinMarketCap, Bitcoin is now showing a solid bullish trend above the $65,000 zone and is pulling the rest of the market upwards.

Will the bullishness continue? Is Bitcoin gearing up for a price reversal from here, or will we see another long and boring consolidation?

Here are some of the biggest Bitcoin narratives to better get a sense of what’s been going on with the market.

Mt. Gox Repayments and Short-term Sell Pressure

Mt Gox has begun moving billions worth of Bitcoin this week.

Particularly, on 16 July, a cold wallet associated with the defunct exchange transferred a staggering 140,000 Bitcoin into another anonymous wallet.

At the time of the transfer, this 140,000 Bitcoin was worth over $9 billion—all in a transfer that took under three hours.

Naturally, moving crypto this big is bound to create a wave of FUD and speculation. Commentators and investors have expressed fears about where Bitcoin might be headed, especially considering the minor intra-day dip of 3% from the $66,200 high on Tuesday, when the transfers happened.

However, according to analysts and industry leaders like Runner XBT, the only takeoffs in Bitcoin’s price will be from short-term investors (or paper hands), who hold the lowest conviction.

I expect CT (read as the softest of the men, soyest of soy) to react to first few 5k BTC+ transfer to CEX

Transfers onchain (shuffle of coins within wallets) does fuck all

Just like w/ Germany transfers, eventually they will have no price impact, thats when I hope to long https://t.co/EODRm1PzoI

— RunnerXBT (@RunnerXBT) July 16, 2024

According to RunnerXBT, the transfers aren’t a sell-off and have zero effect on Bitcoin’s long-term price.

Instead, they do “f*ck all” (nothing) but cause a temporary volatility wave driven by the weakest Bitcoin holders.

In essence, the market’s reactions to Mt Gox’s actions (whether sell-off or otherwise) shouldn’t have any long-term effects on Bitcoin, considering that long-term holders are unlikely to be swayed.

Bitcoin will remain stable, regardless.

2. The Bitcoin Bears are Trapped: Can BTC’s Price Beat $70K?

Bitcoin, without a doubt, is recovering—strongly, even.

This is the first wave of consistent greens the cryptocurrency has seen since the start of the major downtrend in June.

So far, the last five candlesticks on Bitcoin’s chart have been green, in an event last seen between 6 and 11 March.

However, while Bitcoin has been impressive so far, the major question is:

How likely are we to break above the $70,000 mark before or during August?

According to recent insights from Moustache, Bitcoin’s price has bounced back above one of its “most important bull market lines”.

#Bitcoin $BTC is back above one of the most important bull market lines (blue line).

In the previous cycles it NEVER fell below it until the cycle top (monthly close).

This is a strong sign that the bull market is far from over. pic.twitter.com/UxbJJI5fj5

— ⓗ (@el_crypto_prof) July 16, 2024

The analyst also notes that Bitcoin never fell above the trendline illustrated in previous cycles until it hit its cycle top.

To this end, this is a strong sign that the bull market is not over yet.

This outlook was supported by analyst Axel Adler in a later tweet, in which he pointed out that the seven-month-long selling pressure from long-term holders around $61.6k has stopped.

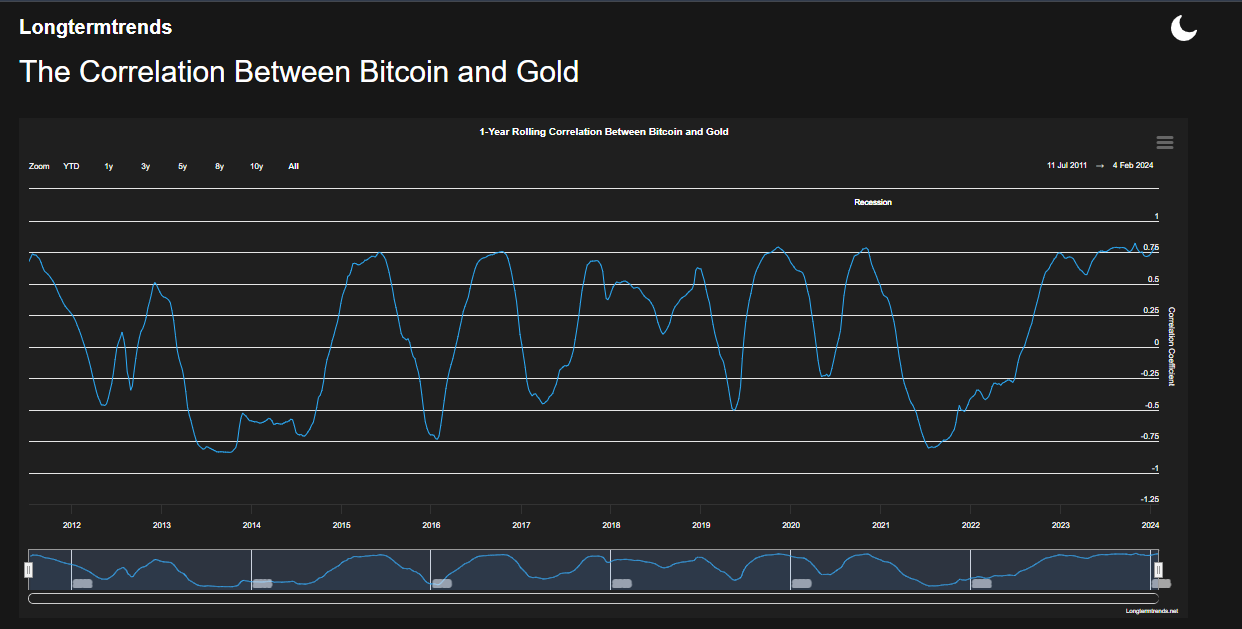

Bitcoin’s change in LTH sentiment

This massive shift in Bitcoin’s LTH sentiment shows that Bitcoin might have an easier time approaching and even breaking the $70,000 mark compared to other attempts in the past.

3. Investors are Pouring Cash into Bitcoin Investment Products

Another interesting factor supporting Bitcoin’s bull run is the rising inflow of capital into investment products, including the ETF market.

Juan Leon, a senior investment strategist from Bitwise, pointed out that since the SEC approved them for trading in January this year, the Bitcoin ETF market has seen more sovereign capital flows into any country during the second half of 2023.

For context, the $16B inflows into BTC ETFs in the six month period since launch is more than the sovereign capital flows into any country during H2 2023. https://t.co/0KTJwKYXXU pic.twitter.com/Wsw8tSspED

— Juan Leon (@singularity7x) July 16, 2024

Moreover, data from Soso Value also shows that the Bitcoin ETF market has recorded inflows of a staggering $16.53 billion, a new all-time high.

The spot ETF metrics

On the other hand, Farside data shows that the ETF market has seen consistent inflows since 5 July, marking eight trading days of greens.

Moreover, capital inflows on 16 July were the highest since mid-June, with a single-day inflow of $422 million.

Coinshares data also shows that Bitcoin investment products, in general, have seen the fifth-largest weekly inflows ever, raking in $1.347 billion during the week ending 12 July.

So far, Year-to-date inflows for Bitcoin investment products have now reached a record $17.221 billion.

Overall, this growing demand for the Bitcoin ETFs and other investment products might play a crucial role in pushing the cryptocurrency’s price to $71,000 or even further.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.