Key Insights

- The overall crypto market cap is down by about 1% compared to yesterday.

- Bitcoin’s price is back in the $58,000 zone after failing to reclaim $60,000.

- The amount of money lost by leveraged traders due to liquidations has also decreased compared to yesterday.

- Bitcoin’s consolidation around $58,000 might be too soon, and if the bulls can’t force a break above $60,000 soon, the price could drop.

- Ethereum is consolidating around $3,100, while Stacks and Jasmy are showing promise for upward trends if they break certain resistance levels.

Yesterday, Bitcoin attempted to reclaim the $60,000 zone and ended up at an average price of around $59,000 in the intra-day timeframe.

Today, the crypto market has slid downwards again by a little bit and is now down by around 1% in terms of market cap.

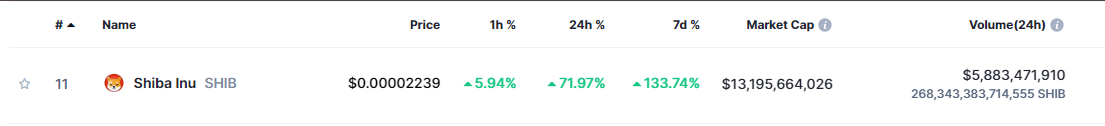

Bitcoin is back at the $58,000 zone, and the crypto heatmap looks like this:

The crypto heatmap

As shown above, most cryptocurrencies on the market have turned red again, with only BNB and a few other L1s managing to stay green.

The crypto liquidations have become milder still today. Compared to yesterday’s $100 million in liquidations, the market’s leveraged traders have only lost around $87 million over the last 24 hours.

The crypto liquidation heatmap

In contrast to yesterday, the bulls are back on the receiving end of the liquidation wave and have lost around $62 million, compared to the bearish $25 million.

Today, we can see that the bears have retaken control of the market, and the tides appear to be shifting in their favour.

Is Bitcoin Consolidating Too Soon?

The chart below shows Bitcoin‘s successful rebound off the base of the descending trendline.

However, amid this rebound, the cryptocurrency is facing resistance around the $58,000 price level and is consolidating underneath.

Bitcoin’s consolidation

While consolidations are normal in crypto and most other financial markets, Bitcoin’s consolidation has come slightly too soon.

The cryptocurrency needs this break and close above the $58,000 – $60,000 zone soon. Otherwise, the bears will seize this opportunity to cause a price rejection, taking the cryptocurrency down again for a retest and possibly breaking below $53,500.

Ethereum Is Doing Much Better

According to the charts, Ethereum is moving much slower than expected but is taking its rebound from the $2,800 zone seriously.

Ethereum’s price action

However, amid the slow price movement to the upside, Ethereum is entering a consolidation of its own, considering the reasonably strong resistance of around $3,100.

The $3,100 zone remains one of Ethereum’s most difficult price levels to break, and investors should consider monitoring its price action around this level.

If we see a break above, the cryptocurrency will continue further upwards and retest the $3,300 – $3,500 resistance.

A Little More Upward Pressure on Stacks (STX)

According to the charts, Stacks has rebounded strongly off the $1.19 price level and is progressing from here.

However, the Stacks chart also has a small, minor descending trendline, indicating a resistance zone at around $1.6.

And there is.

Stacks In The Charts

What happens with Stacks next depends almost entirely on what happens around this $1.6 price level.

If we see a break and a daily candle close above, the cryptocurrency will be poised for an explosive rally that takes it up by as much as 96% to the $3 price level.

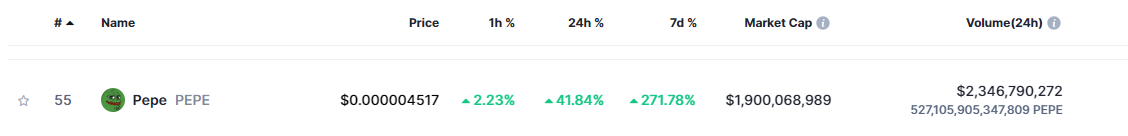

Watch Out for JASMY

According to the charts, Jasmy is trending within an ascending triangle after rebounding successfully off the $0.0222 price level.

Jasmy’s price action

The chart above shows that Jasmy is now trying to break above the $0.025 – $0.027 range and, therefore, out of the ascending triangle formation.

Investors should watch for what happens in this $0.025 – $0.027 range because a break above would make JASMY poised to double in price up to the $0.044 resistance.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.