Key Insights:

- The memecoin supercycle is over as top memecoins fail to recover after a major crash.

- The next race in the crypto markets seems to be between RWAs and AI cryptos.

- Real World Assets are seeing increased global adoption backed by institutional support from top finance giants.

- AI cryptocurrencies are seeing a greater growth rate led by AI Agents.

The Memecoin Supercycle is Over

As the memecoin markets saturate with Solana, Base, and other miscellaneous memecoins, we now see the overall rally in the memecoin markets fading away. Last month memecoins saw a large crash of up to 40%. Most of them are still on the same lower levels as they were after the crash.

Dogecoin has been trading at $0.25 while Shiba Inu has crashed to pre-US election levels of $0.000015. The largest Solana memecoin Official Trump has further crashed to $16 levels, 80% down from its ATH of $75.96k.

Dogecoin Crashes From $0.43 to $0.25 Within a Month

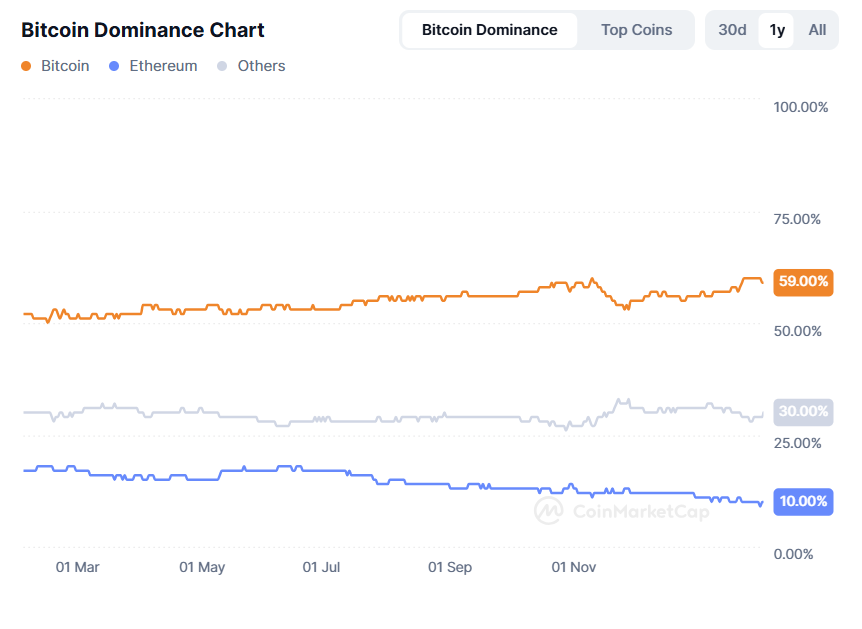

However, Bitcoin is exactly the opposite of that. Despite the market wipeout, Bitcoin has been stable near $100k and at press time was trading around $96k. Bitcoin’s market cap dominance has increased to 60%. Just 3 months back, Bitcoin had a market cap dominance of around 50%.

Bitcoin’s Market Dominance History

RWAs See Funds Flowing in From BlackRock, Goldman Sachs, and Major Finance Giants

Real World Assets are a class of tokenized assets on the blockchain. These assets range from tokenized real estate to investment funds.

Blockchain technology not only makes these assets more easily tradeable, highly secure, and transparent but also helps them tap into the easily available liquidity in the crypto markets. As a result, several top financial giants have launched several tokenized RWA funds like BlackRock’s BUIDL and UBS Bank’s uMint.

Another reason why funds are seeking to tokenize their assets is because this allows them to sell them globally which was earlier limited due to Web 2.0’s technology limitations. We saw this with Abrdn which used Ripple’s XRPL to tokenize a part of its 3.8 billion GBP fund. With new RWA funds, projects can easily change hands from different countries, like from USA to Japan within a few seconds.

Tokenization also helps RWA distribute the proceeds of the investment in a quicker way (seconds) as opposed to the earlier used SWIFT system that took days to do the same task.

AI Cryptos Take The Mattle to Reshape Future

Two main events have shaped our understanding of the “Future of AI Markets”, one is the launch of the Virtuals Protocol and the next is the launch of the Chinese LLM model Deepseek.

The Virtuals Protocol brought one of the very first AI Agents in the market that was capable of doing tasks equivalent to an entire team of professionals. As a result, the token shot up 7000% between October 2024 and December 2024.

Virtuals Protocol Token

The next major shakeup came from Deepseek which reportedly used only $6 million to build an LLM that rivaled its large competitors in the USA. As a result, most crypto projects saw massive corrections and even the Virtuals Token fell from $5.07 to $1.2 within 2 months. Though it was already in correction mode, the Deepseek scare just accelerated the crash.

Now that more AI agents have entered the markets like ChatGPT’s Operator, IBM Watson, and many others, we see the competition getting intense in them. Newer projects could seek the ICO or any DEX offering to raise funds and as a result, we see a greater bull rally in the AI crypto sector.

Recently, we saw a $6.5 million investment in the AI token ai16z (an AI token by Andreessen Horowitz) which was made by a single whale. Further, as Donald Trump puts together a $500 billion AI Fund with the help of Masayoshi Son, Elon Musk, Sam Altman, and other investors, we could see these funds trickling into crypto markets.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.