Key Insights

- The US government’s efforts to combat inflation and recession could cause the next bull run.

- Bitcoin’s relatively scarce supply makes it immune to all kinds of liquidity injections.

- The next BTC bull run could be stellar, as investors flock towards Bitcoin to protect their wealth from the declining value of the US dollar.

- Bitcoin’s price action appears bullish, and it is now trading atop most of its major EMAs.

- Bitcoin is now properly poised to hit the $30,000 zone again.

The next Bitcoin bull run is going to happen soon.

However, while we all know that the next bull run will come after the next BTC halving, nobody knows exactly what might trigger it.

Nobody except the ex-BitMEX CEO, Arthur Hayes, that is.

In a recent thread on Twitter (X), Hayes has described what (or whom) the catalyst for the next bull run will be.

And as it turns out, the BitMex former CEO believes that the US will help, rather than hinder this event.

How The US Government Will Cause The Next Bull Run

Almost everyone knows about the US’ rising inflation rates, and the continuous increase in interest rates by the FED to combat a looming recession.

According to Arthur Hayes, the more the US government is forced to make these drastic decisions to combat inflation, the weaker the outlook for the US dollar, and the more likely BTC is to flip it over.

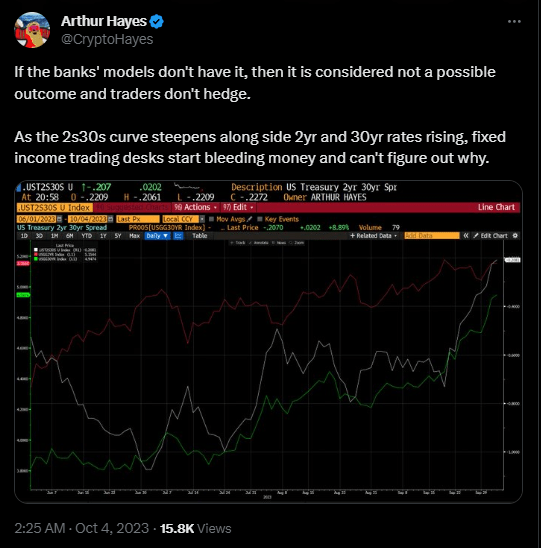

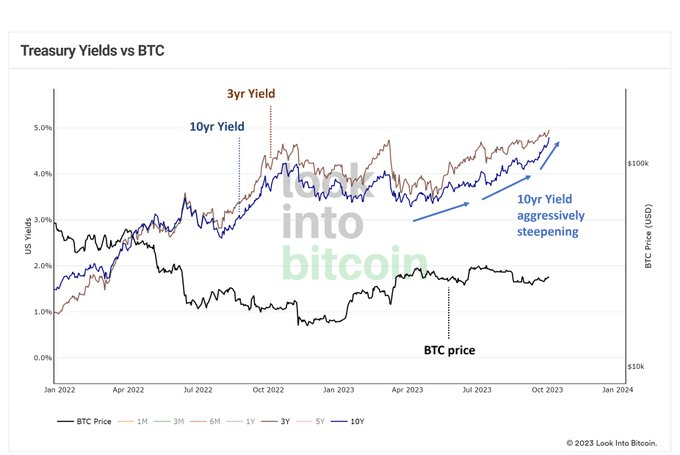

In a Twitter thread posted on 4 October, Hayes argued that the current rise in the 2s30s curve (the difference between the 30-year and 2-year yields), along with the way the FED continues to increase interest rates is putting massive pressure on the US economy.

If you didn’t know, a “bear steepener” is a situation in which long-term interest rates are raised more quickly than short-term ones.

According to Hayes, this happens when investors and banks are worried about the future of the economy and start to sell long-term bonds.

This in turn drives down their prices, pushes up yields and leads to more selling.

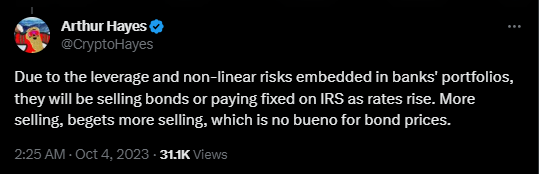

Before long, a vicious cycle of selling takes place, which can be very negative for bond prices.

Hayes believes that this situation could lead to mass liquidity injections by the U.S. government, as it tries to prevent a financial crisis.

In other words, liquidity injections occur when a government is forced to print more (dollar) bills to hold up the crashing bond prices.

Bitcoin Can Capitalize On US Economic Woes

The value of Bitcoin (and almost any other asset) lies in scarcity.

With the US government being forced to print more bills, the value of the US dollar is bound to become shaky and would be positive for BTC and other cryptocurrencies.

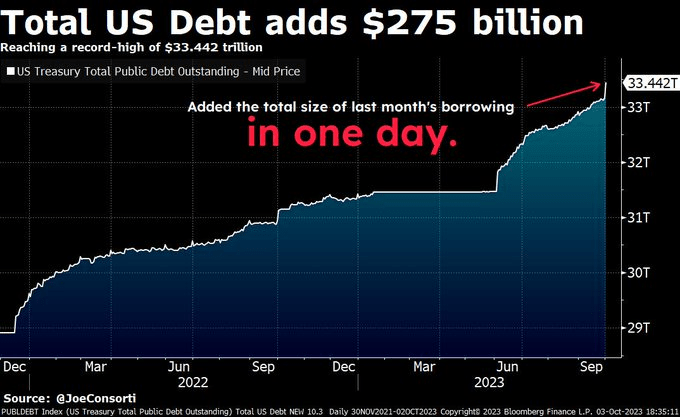

Keep in mind that Hayes’ prediction is supported by the fact that the U.S. government’s national debt is climbing at insane rates.

The US national debt is now sitting at an all-time high. According to this tweet from market analyst, Joe Consorti the U.S. government added more than half of Bitcoin’s entire market cap in debt in less than 24 hours.

This suggests that the U.S. government may now be running out of options, and may be forced to print more money out of thin air soon.

Be prepared: A massive dollar devaluation may be incoming (against BTC and the alts).

Here’s Why The Next Bull Run Will Be Stellar: Bitcoin Was Made For This

If the US government is forced to print more money as liquidity injections, the dollar’s value will decline while Bitcoin’s rises.

Aside from this being a great way to make some profit, BTC was also made specifically for this kind of situation.

Bitcoin’s relatively scarce supply of 21 million coins also makes its value immune to all kinds of liquidity injections and Philip Swift, Founder of LookIntoBitcoin seems to agree with Hayes in this tweet.

All of this points to a stellar performance from Bitcoin as investors begin to flock towards it when the next bull run approaches.

Bitcoin In The Charts

The Bitcoin bulls appear to have woken right back up over the last few days.

The cryptocurrency started to rally on 11 September and finally broke the descending trendline formed by its $32,000 high on Thursday, last week.

The cryptocurrency rallied to a high of $28,580 and has now reversed for a retest of this trendline.

In all, Bitcoin appears bullish and is now trading atop most of its major EMAs.

The cryptocurrency now seems properly poised to hit the $30,000 zone again and will do so if a break above $28,650 occurs.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.