Key Insights

- The Bitcoin Power Law predicts a price of $210,000 by 2026, $1 million by 2033, and $10 million by 2046 for Bitcoin.

- The model creator claims that his predictions have historical accuracy and are backed by science.

- The creator also sees the S2F as inaccurate, and ignoring supply/demand.

- The power Law predicts a drop to $60,000 after a high of $210,000 in 2026

What if there was a way to predict Bitcoin’s price movements based on a simple mathematical formula?

Several kinds of Bitcoin prediction models have emerged over the years. Some of them are accurate to some measure, while others are a little off most of the time.

Some, on the other hand, predict plain ridiculous Bitcoin prices in extremely short timeframes.

Not the “Bitcoin Power Law†though. At least according to its creator and supporters.

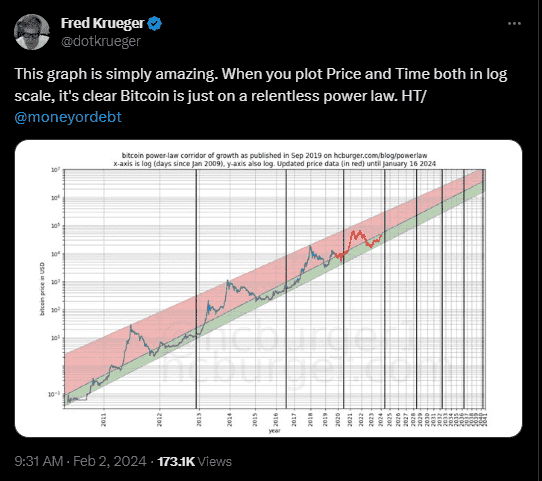

This model aims to capture the long-term price movements of Bitcoin on a logarithmic scale, and present semi-accurate predictions of where prices might be headed.

What is the Bitcoin Power Law?

Astrophysicist Claudio Santostasi, who observed that the price of Bitcoin appeared to follow a straight line on a log-log plot in 2019, came up with the Bitcoin Power Law. The x- and y-axes of a log-log plot are both scaled logarithmically, which means that each unit corresponds to a factor of 10.

Santostasi discovered that the following formula can be used to estimate the price of Bitcoin:

Estimated Price = A * (days from GB)^n

Where A is a constant equal to 10^-17, GB is the date of Bitcoin’s Genesis Block (January 3, 2009), and n is a constant equal to 5.8.

To the non-math-savvy, this formula simply predicts that Bitcoin’s price increases at a set rate as time passes (which we all know).

Judging by this formula though, its proponents believe that Bitcoin’s price will hit the $1 million mark by 2033.

Even crazier, it also predicts that Bitcoin will take another 13 years after that to hit $10 million (sometime around 2046).

Santostasi (the model’s creator) swears that this formula is supported by historical facts and grounded in science.

This Math PhD also seems to think Santostasi’s hypothesis holds water.

Santostasi also claims that since 2010, his model has correctly predicted Bitcoin’s highs and lows, and it will continue to do so.

Some more details can be found in this YouTube video.

.

Bitcoin: A Shining City In Cyberspace

In 2022, Michael Saylor sent out a tweet, calling Bitcoin a “shining city in cyberspaceâ€

Santostasi referenced this tweet in a lengthy tweet of his own, stating that because Bitcoin functions like a city, its price follows a power law.

In essence, Santostasi means that every city follows a mathematical connection in which one variable depends on another, raised to a constant power.

Much like the same way a city’s population can be determined by raising its area to a power of around 0.85.

Why The Stock To Flow (S2F) Model Might Be BS

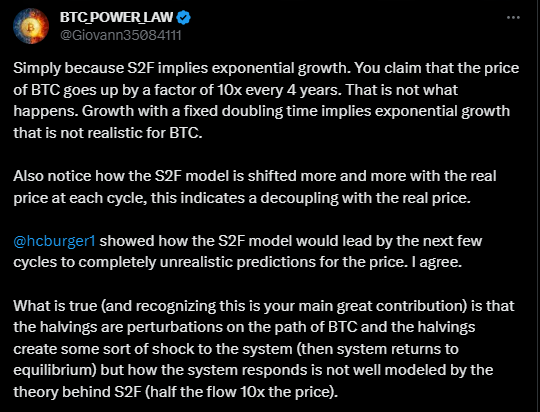

The stock-to-flow (S2F) model is one of the most controversial Bitcoin prediction models out there.

It was created by an anonymous Twitter user named PlanB, who claims to be a Dutch institutional investor.

The model attempts to predict a future price of Bitcoin, based on comparisons between the current quantity of Bitcoin (stock) to the fresh supply that is coming into circulation (flow).

This model has been largely criticized for being inaccurate, misguided or just plain wrong.

The S2F model’s creator also recently predicted a $500k price on Bitcoin for the next cycle, garnering criticism and mockery from the crypto community

Santostasi recently came after the S2F model, stating that it is wrong because it assumes that Bitcoin’s price will grow indefinitely and exponentially.

Santostasi says that that these models are unrealistic, and that they ignore the laws of supply and demand.

The Implications Of The Bitcoin Power Law

Here are some of the power law’s assumptions, summarized into bullet points

- It assumes that Bitcoin will continue to rise, and will eventually reach $1 million by 2033, and $10 million by 2046.

- Based on the current date, the model predicts that the price of Bitcoin should be $64,564.

- It also implies that Bitcoin’s price will crash at intervals and that it won’t grow as fast as many expect.

- External variables including technology advancements, regulatory modifications, societal trends, and geopolitical events can impact the price of Bitcoin.

- According to Santostasi’s model, Bitcoin is expected to reach $210,000 in January 2026, and then fall to $60,000 later that year.

- The price of Bitcoin should reach $1 million by 2033 and not go below $35,000 in the near future.

Investors should be aware that the Bitcoin Power Law is not a magic wand that can accurately predict the price of Bitcoin at any given moment.

It is only meant to assist investors in understanding the overall trend of Bitcoin.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.