The last week has seen a major sell-off in Bitcoin (BTC) and the broader crypto market. With the global macro conditions continuing to remain jittery, there’s an expectation that next month will see a rate hike from The Fed.

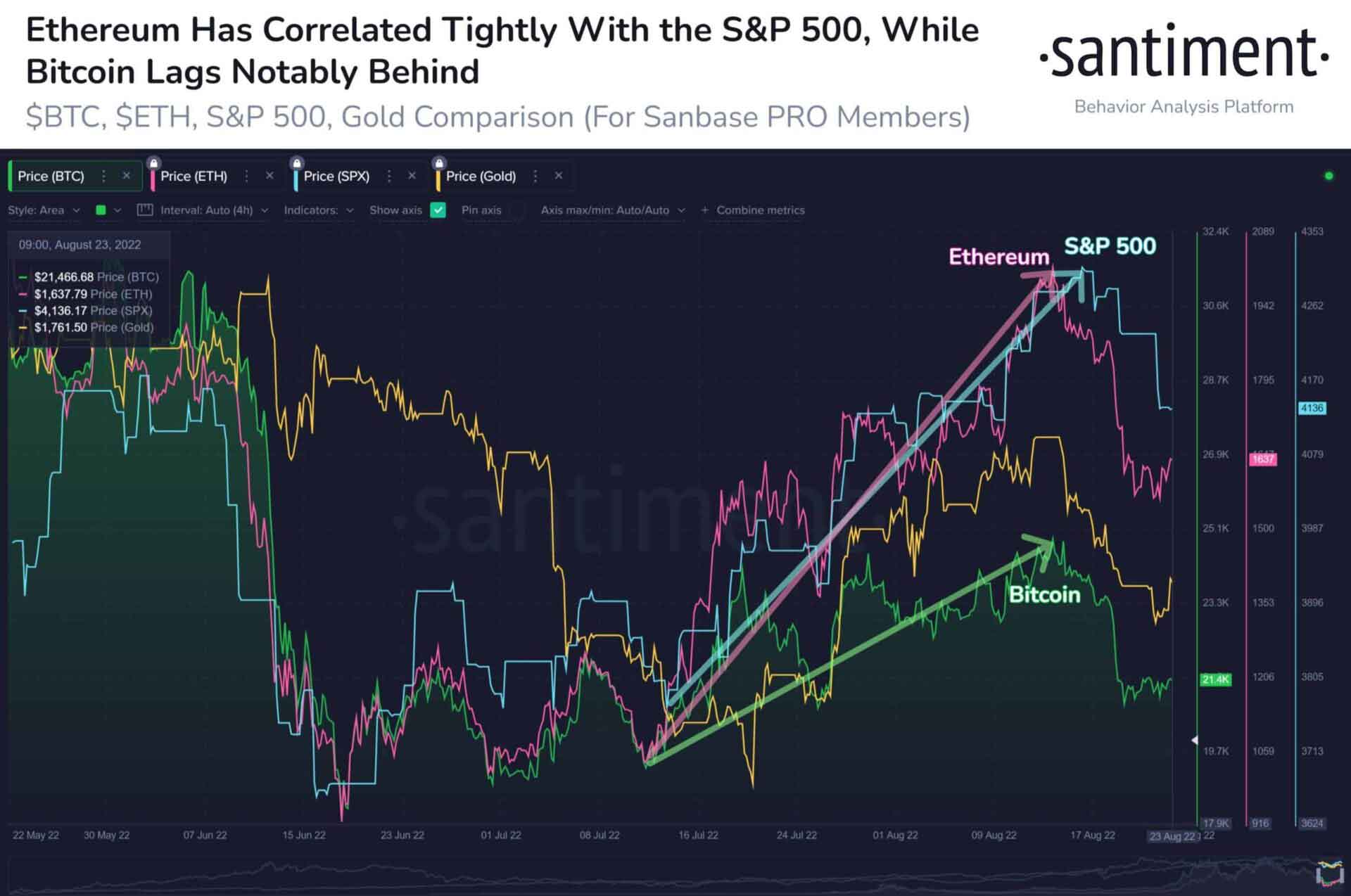

Bitcoin has lost its grip on the S&P500 and is currently in second place, behind Ethereum (ETH), which showed a remarkable correlation with this market index. The ETH price has shown a greater correlation to the blue-chip U.S equity index following its rally ahead of the much-anticipated merge upgrade, according to data provider Santiment.

The price of BTC has still not enjoyed the same recovery as Ethereum and the S&P500. Both Ethereum and the S&P500 rebounded to their May prices in mid-August.

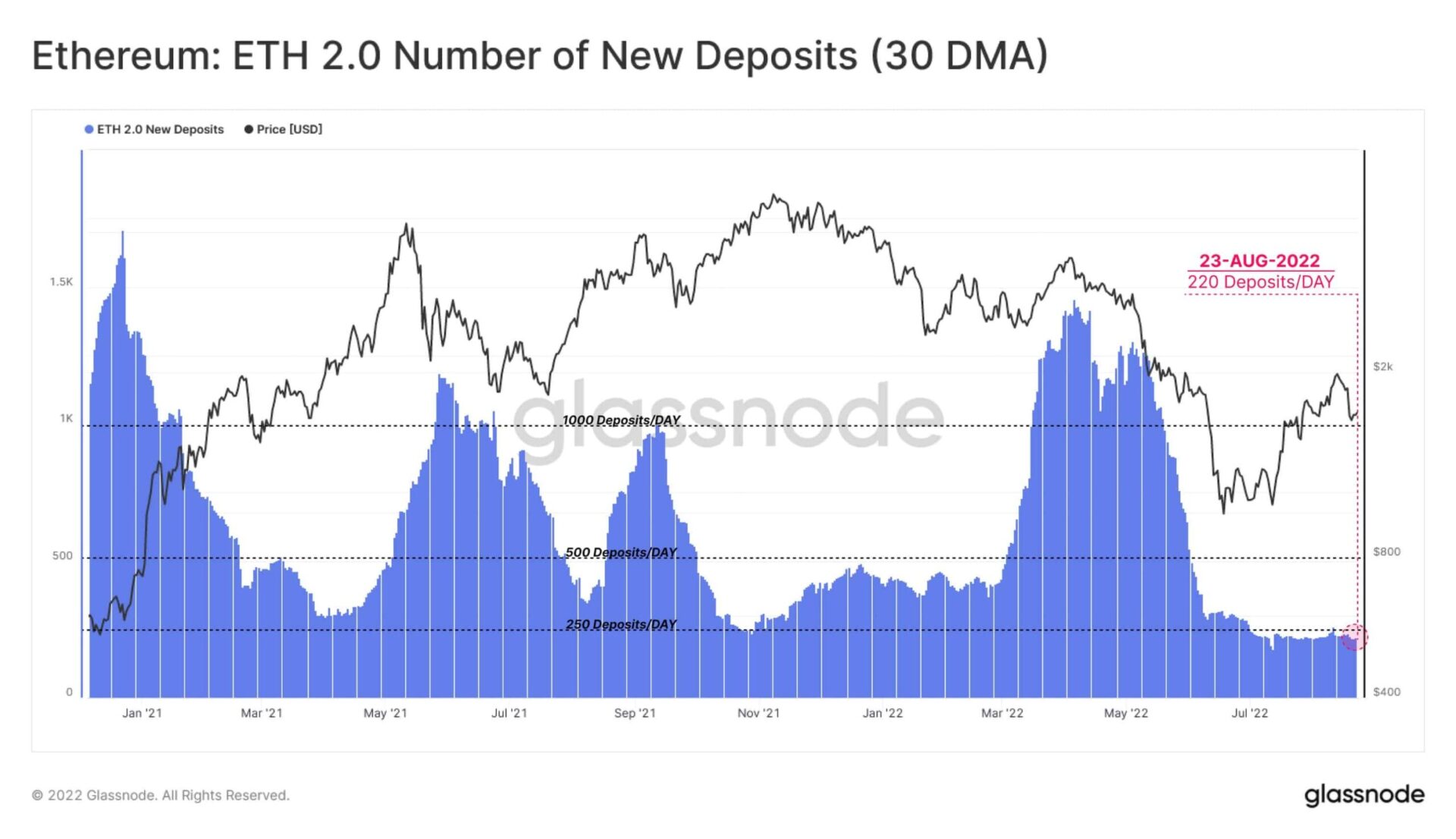

With the recent surge in ETH prices, more people are staking their tokens with Ethereum 2.0 beacon chain.

According to Glassnode, the number of $ETH deposits into the Beacon chain contract has stabilized at a low macro level, with 220 new contributions per day. This shows that investors are holding on to their coins as they expect a successful merge in mid-September.

The crypto world is waiting for the long-awaited Merge upgrade to be released next month. Two Ethereum clients, Go Ethereum and Nethermind, have found bugs in their Mainnet merge updates. However, the Ethereum developers seem to be within control of these bugs and are unlikely to create any further delay with their merge upgrade.

Traders Turn Attention to Altcoins

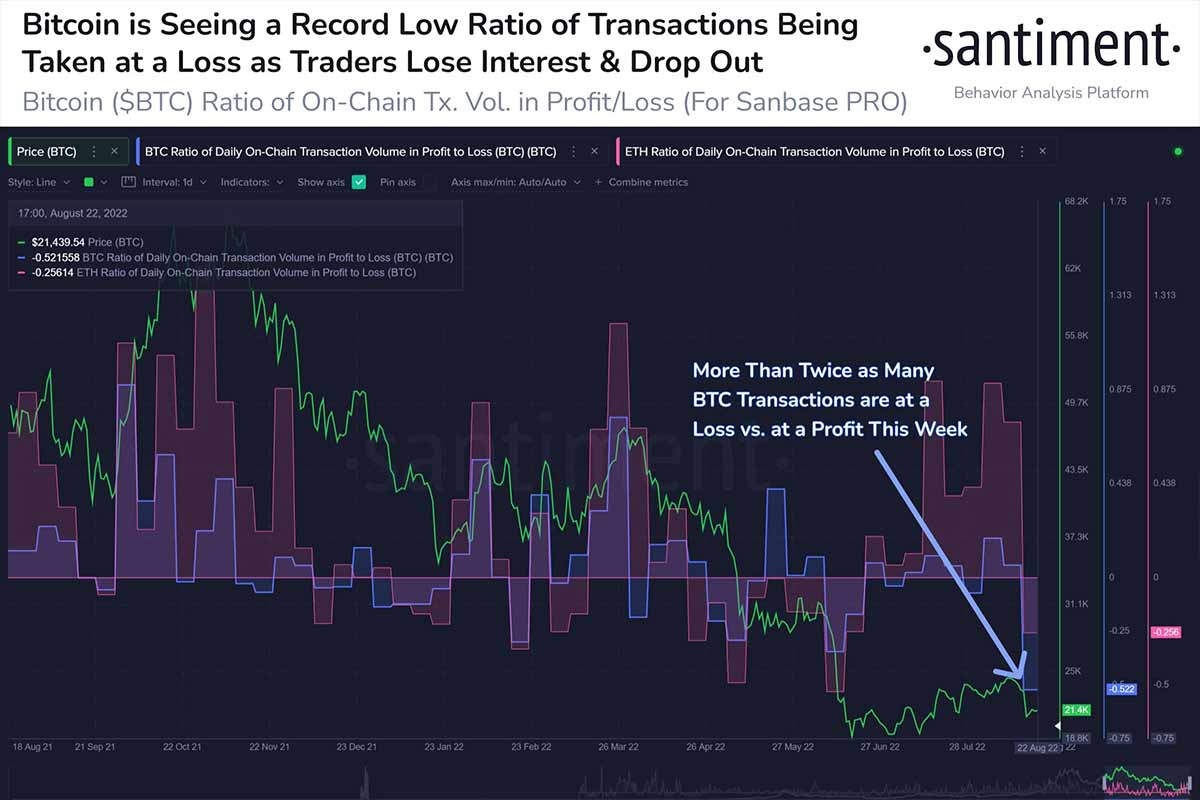

As per on-chain data provider Santiment, traders have been losing their interest in Bitcoin and thus shifting their focus on altcoins. According to the data, BTC dived briefly before reaching $25,000 on August 14. Traders have turned to Ethereum and altcoins, as most transactions are at a loss for BTC. The current ratio of profit taking is at an all-time low.

Bitcoin Price Analysis

Bitcoin has been consolidating for some time now, but we may soon see a lid on prices. The price is trading in green and attempting to increase to $21,750.

As the price of Bitcoin continues its slow decline toward an expected bottom, it has been supported by a strong support zone established on August 19.

This seems like a great opportunity to buy, but buyers should be cautious as the price is still below $22,000.

The bear market may have just gotten worse for Bitcoin owners. Santiment notes that the flagship cryptocurrency has fallen below $15.8k for the first time in two years. BTC currently trades at a $15,684 level, down by over 3%. In addition, Bitcoin’s dominance stands at 38.70%, a decrease of 0.09% as of 22 November.

Disclaimer: Voice of crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.