Key Insights

- Bitcoin is not out of the woods yet; after the FTX crash.

- According to an analyst, Bitcoin may be headed for another price dip to the $15,000 zone or lower.

- This dip may last until the first quarter of 2023 and may go as low as $14,500.

Bitcoin is not out of the woods yet. These are perilous times indeed for the crypto market. The aftereffects of the FTX crash seem to have faded away for the better part of the market. However, while some cryptocurrencies across the market have trended up again and have regained their previous highs, most are still not out of the woods yet.

BTC, for example, managed to break through the $17,000 zone in late November and the first few days of December. However, the cryptocurrency’s break above this level was short-lived, as the bears have managed to sink the cryptocurrency below this support level again.

This rise of Bitcoin from its post-FTX $15,500 low to about $17,300 marked an impressive 9% bullish correction. However, this correction was insufficient to push the flagship cryptocurrency back over the $19,000 zone again.

According to an interesting piece of analysis shared via a tweet by Bluntz, the analyst and self-described “bubblechaserâ€, Bitcoin may be on the verge of taking an even bigger beating.

im still of the belief for now that this move up on #btc is part of a corrective abc w4 before making a new low sub $15k into Q1 2023 where we find a longer term bottom. pic.twitter.com/rG7ksh7zqh

— Bluntz (@Bluntz_Capital) December 5, 2022

Bitcoin Primed for Fresh New Lows?

Traders and investors who have spent considerable time in the crypto market know by now that the FTX bubble is far from over.

One of these traders is Bluntz.

In a tweet, the analyst shared insights about what Bitcoin might be doing and where it might be headed over the next few weeks.

im still of the belief for now that this move up on #btc is part of a corrective abc w4 before making a new low sub $15k into Q1 2023 where we find a longer term bottom. pic.twitter.com/rG7ksh7zqh

— Bluntz (@Bluntz_Capital) December 5, 2022

In the tweet, Bluntz opined that the upside Bitcoin experienced after crashing alongside FTX may be part of a corrective ABC wave before making a new low below the $15,000 zone that stretches into the first quarter of 2023 where “we find a longer-term bottom.â€

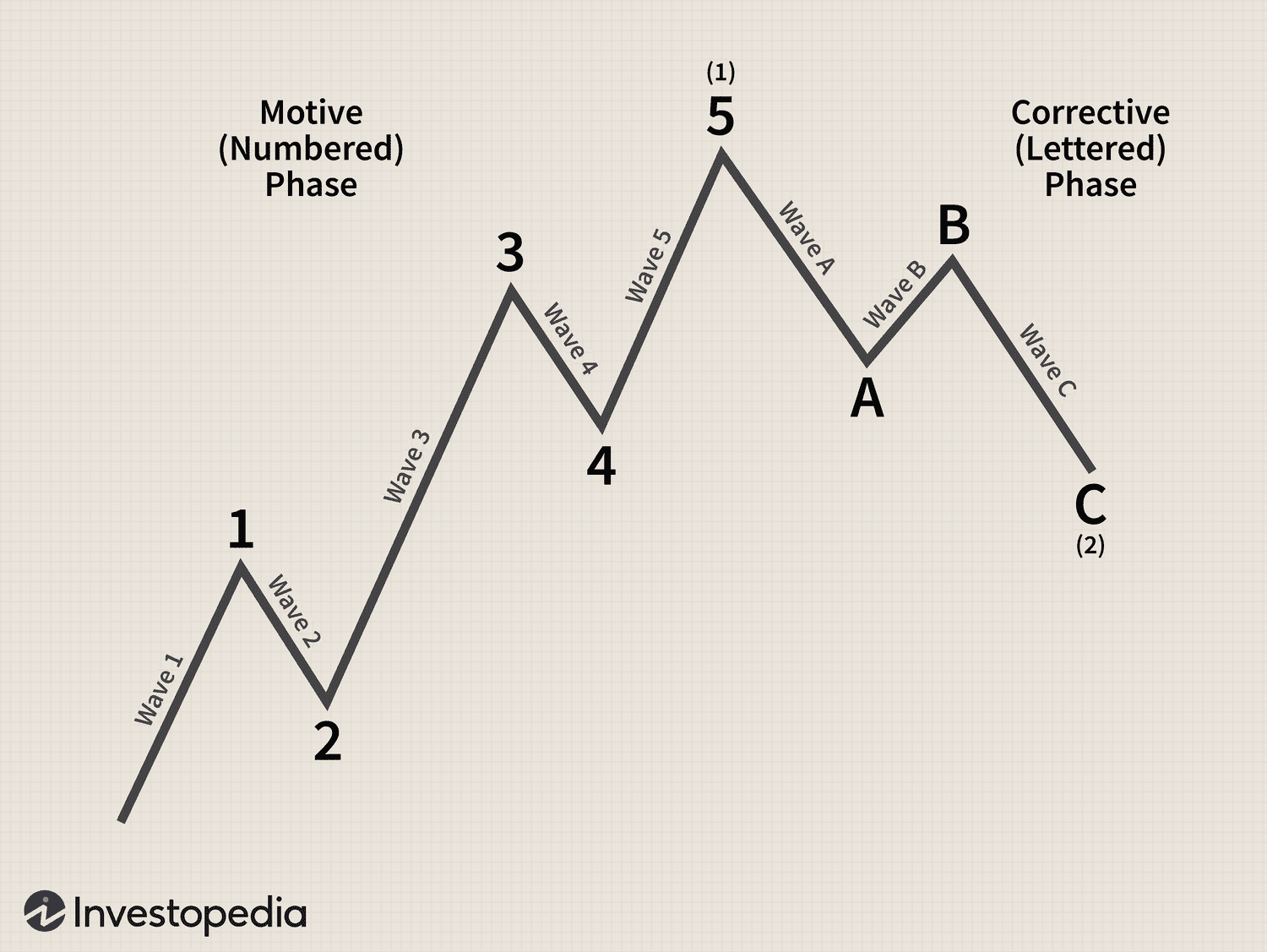

For the unfamiliar, Bluntz’s analysis is based on the Elliott Wave Theory. A form of technical analysis that proposes that any stock or asset (crypto in this case) follows a set of five major waves.

The first three major waves are price movements in the direction of the general market trend (waves 1, 3, and 5 illustrated below) and are followed by short corrections (waves 2 and 4), while the other two waves are longer corrective waves (Waves A, B, and C).

Bluntz’ Analysis

According to Bluntz’s analysis, Bitcoin is in a descending wedge and may be in the last phase of a minor uptrend before reversing to the downside as soon as it hits the $18,000 zone at most.

From this point, Bluntz predicts that the cryptocurrency price may reverse to the $15,000 zone before rebounding and going further down to the $14,500 zone.

Meanwhile, the stablecoin premium and traders’ long-to-short metrics on Bitcoin suggest that leveraged bulls were relatively uninvolved in the Bitcoin price rally to $17,400.

Without the full backing of the Bitcoin bulls, the recent price rally of the flagship cryptocurrency to the $17,300 zone may be as good as dead. This alone supports Bluntz’s theory that a massive dip “may†be inbound.

Disclaimer: Voice of crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.