Key Insights:

- Ethereum has been grossly underperforming the markets since last few months.

- Experts have called Ethereum grossly undervalued with fair valuations at $10k.

- This makes gives us an opportunity to accumulate ETH while the price is still in the undervalued zone.

Ethereum Slows Down, Loses Critical Levels

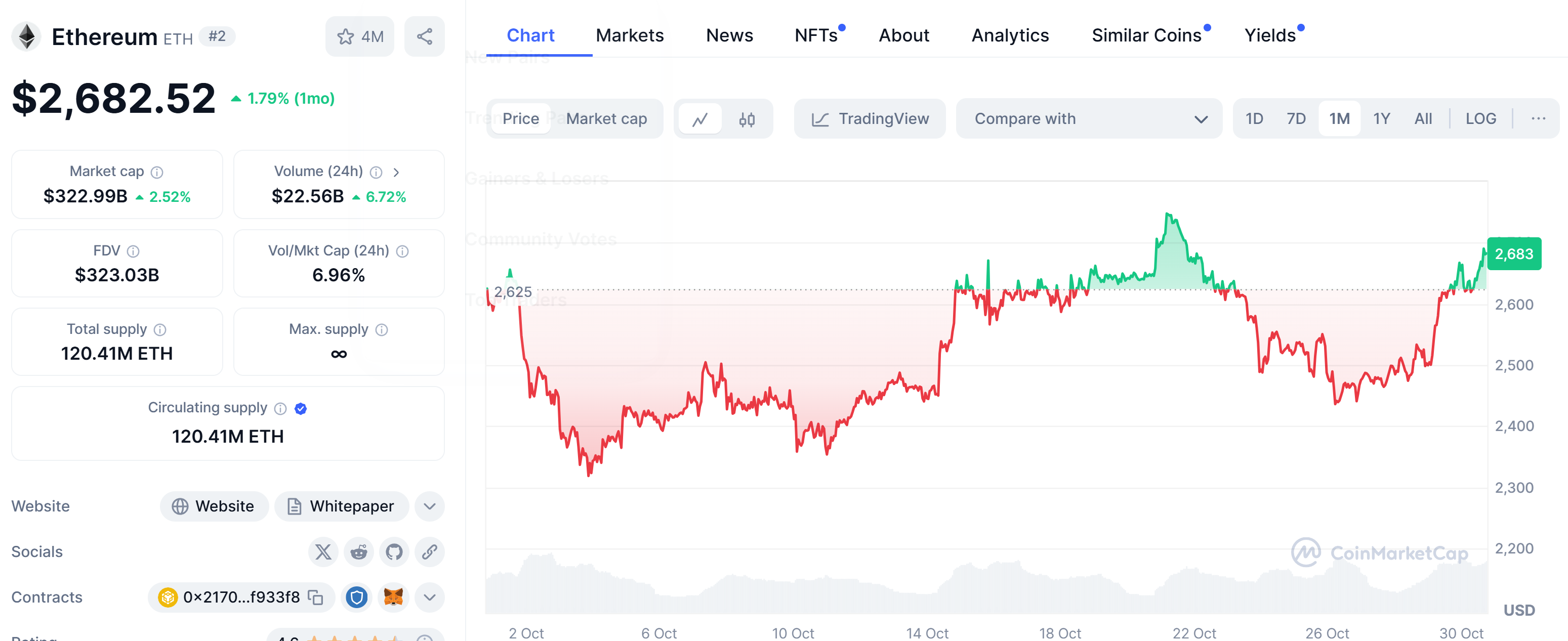

Ethereum has slowed down and failed to cross beyond $3000 despite Bitcoin touching all-time highs. At press time ETH had gained 1.8% over the entire month despite Bitcoin gaining 12% in the same time frame.

Ethereum’s Price At Press Time

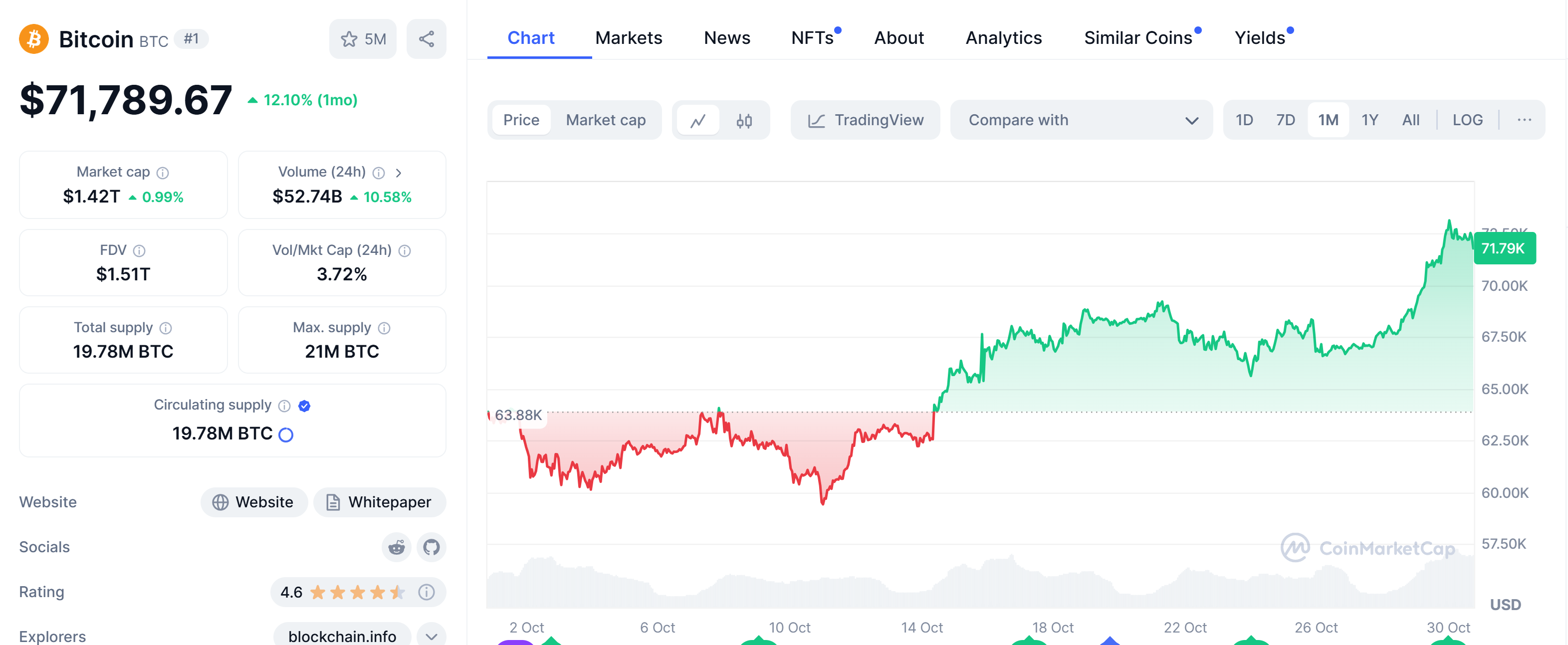

Bitcoin Almost Touches All-Time High

Bitcoin recently touched $73.5k and remained just 0.33% shy from making a new all-time high.

Bitcoin Gains 12% in a Month

The euphoria in the cryptocurrency was primarily driven by institutional interest in it. Lately, Bitcoin ETFs and Whales have been buying in record numbers. Bitcoin ETFs hold $52 billion in Bitcoins while whales hold around $48 billion in Bitcoins. Both whales and ETF holdings are at record highs.

The surge in Bitcoin accumulation by whales and ETFs were likely driven by the US Fed rate cut which pumped liquidity in the crypto markets after 4 years. The second factor that supports this euphoric accumulation is the likelihood of Donald Trump being the US President once again ushering a period of pro-crypto regulations.

Why Is There a Slowdown in ETH?

ETH has been held down due to several reasons, most of which are temporary but highly impacting.

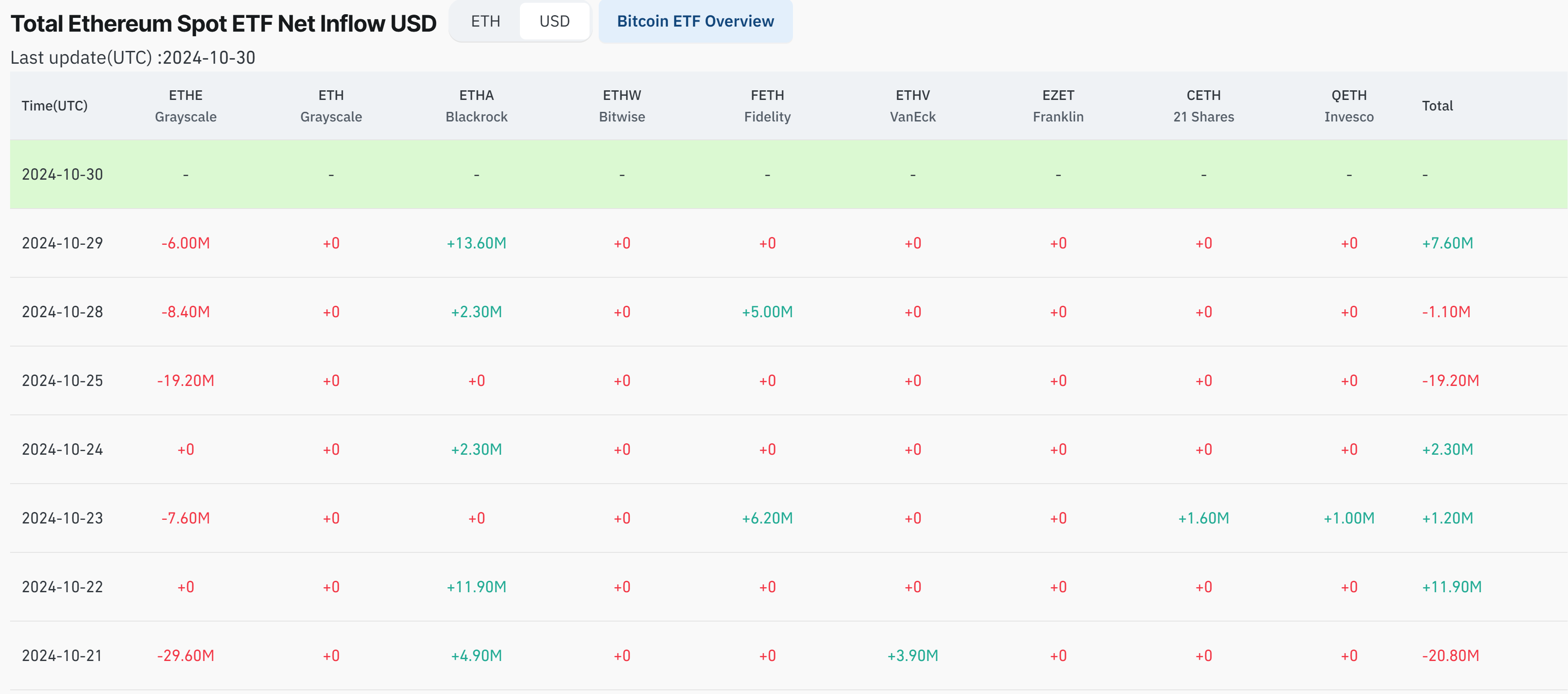

Firstly, the Ethereum ETFs have been grossly underperforming. At a time when Bitcoin ETFs have seen inflows of $500 million per day, Ethereum ETFs on the other hands barely cross $10 million daily inflows.

Ethereum ETF Last Week Inflow Data

Secondly, the focus of the market is on Bitcoin which enjoys high institutional interest and is yet to gauge the value of Ethereum.

Thirdly, Ethereum has sold way too much crypto in recent times and this includes Vitalik Buterin. Rather than making an economic impact, this had made more of a psychological impact.

Why This Could Be a Golden Opportunity?

Ethereum’s value and role in the crypto markets are irreplaceable. The blockchain and its EVM not only power $130 billion worth of DeFi assets but also provide a virtual running environment to over 50 blockchains, including the BNB Chain.

Further, the total combined market cap of ERC-20 coins stands at $365 billion, with a lion’s share coming from stablecoins. These cryptocurrencies need Ethereum to function daily, and together, they constitute a trading volume of $2 trillion per day.

Next, when we look at Ethereum’s future, we see two major upgrades. The first is increased decentralization with the Verge series of upgrades, which will enable even laptops to run an Ethereum node with just 1 ETH staked. The second is the Surge series of upgrades, which would virtually eliminate Ethereum gas fees. Both these upgrades will transform Ethereum, making it much more desirable than any other blockchain.

Finally, Ethereum’s security is unparalleled. This is because of the presence of 1 million plus validators, who ensure that every transaction on the blockchain is vetted through an arduous process that leaves no stone unturned.

All of these fundamental aspects make Ethereum irreplaceable and truly undervalued at $2500. Bankless co-founder Ryan Sean Adams also shares this view, thinking the fair value of Ethereum at current markets is around $10,000.

ETH to $10k

The market is massively undervaluing Ethereum rn

— RYAN SΞAN ADAMS – rsa.eth (@RyanSAdams) October 16, 2024

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.