It seems Dogecoin returned to its consolidation phase after a momentary pump last week.

While Dogecoin remains one of the most easily influenced cryptocurrencies in the market, any cryptocurrency’s growth must be organic and backed by actual buying pressure.

Soon after billionaire entrepreneur Elon Musk announced that Dogecoin would be listed as a payment system in his company’s new fragrance venture, investors began to flock in. The price of Doge pumped momentarily like it always has since 2020 under the influence of Musk.

It seems that DOGE has lost said momentum and returned to its previous dormancy. Investors have cashed in profits, and the whales seemingly have stopped trading their holdings altogether.

Dogecoin in Consolidation

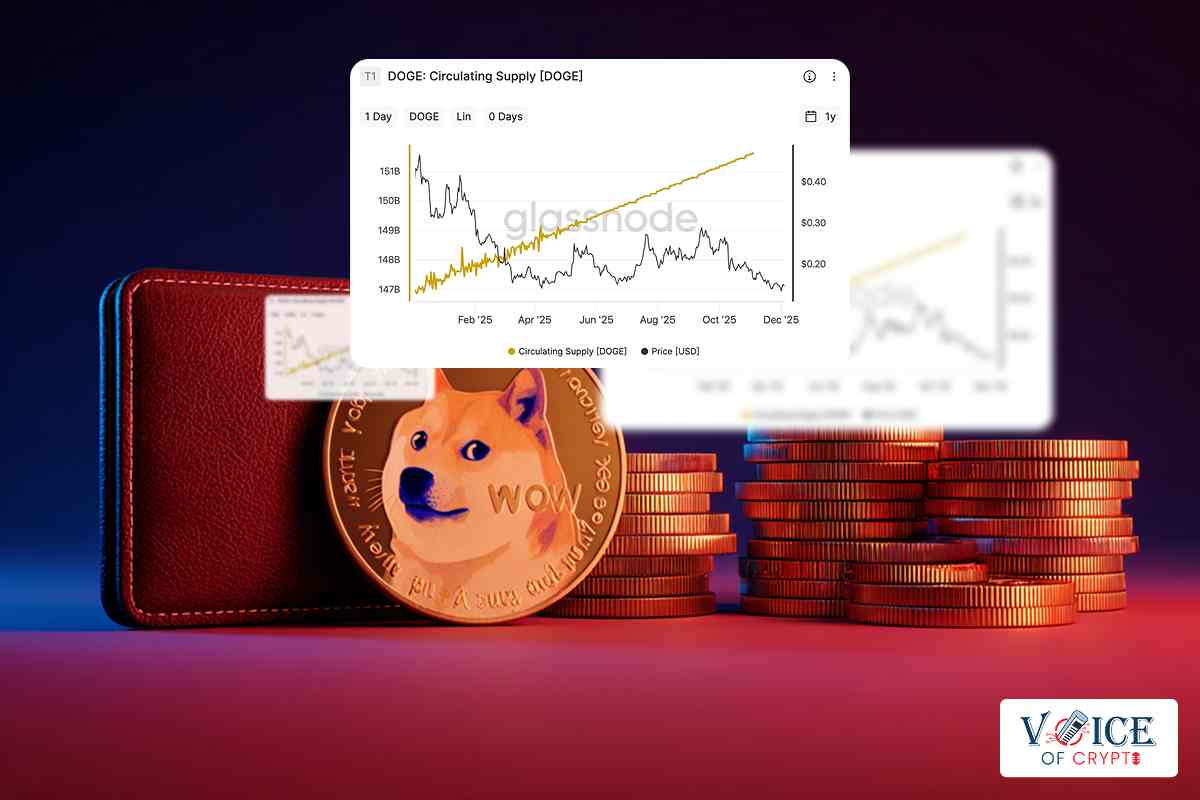

Over the long term, DOGE appears to be trading in an overextended range. Since mid-August this year, the volatility on DOGE appears low, save for a few momentary bumps. Overall, it seems that DOGE may continue to trade sideways for the foreseeable future.

Dogecoin fell through the 38.2% Fibonacci level around $0.0677 in late August and has failed to break above this point ever since. As a result, the cryptocurrency has traded inside a range between the 38.2% Fibonacci level ($0.0677) and the local low of its Fibonacci retracement (around the $0.05504 mark) ever since.

Dogecoin currently trades at $0.0599 at the time of writing and, judging by the current price action, is unlikely to break above or below this range anytime soon.

On the RSI, the signal line on Dogecoin appears to be testing the neutral level, indicating that the bulls may be stepping up to push against the bears.

Dogecoin’s Missing Whales

The Dogecoin whales have swum away to explore bluer waters. Either that, or they have simply become dormant.

The involvement of whales is crucial, especially in a cryptocurrency like Dogecoin. This is because whales alone hold almost 50% of the total supply. For context, the whales hold about 66.7 billion Doge.

However, their observed activity has been relatively low since the beginning of the year. Since January, the transaction volumes of Dogecoin have fallen drastically from an average of $10 – $15 to less than $1 billion.

At the same time, the number of long-term holders (HODLers) has been observed to have grown from 41% to about 68%, indicating that instead of trading their holdings, the whales are accumulating more DOGEÂ and HODLing.

In conclusion, until the whales start to trade their holdings again, the price of Dogecoin may see more consolidation between the $0.0677 resistance and the $0.055 support.

Disclaimer: The author’s comments and recommendations are solely for educational and informative purposes. They do not represent any financial or investment advice. Always DYOR  (do your own research)