Solana started the year at around $200 and declined along with other crypto tokens like AVAX through the year’s first half. However, SOL has finally gained momentum as the institutional adoption is rising

Solana Price Analysis

Solana currently trades at $32.27 and has dropped 79% from its ATH. Around Mid august, the cryptocurrency reached a high of around $47, forming the tip of an ascending channel it had been in since late July, as illustrated by the 4-h chart below.

Following a bearish breakout from the channel the pair formed, prices declined to the $30k level and are currently in a range around the $35 – $30 mark.

The overall trend of Solana is down, but things are expected to change soon.

Institutional Bets On Solana Surges

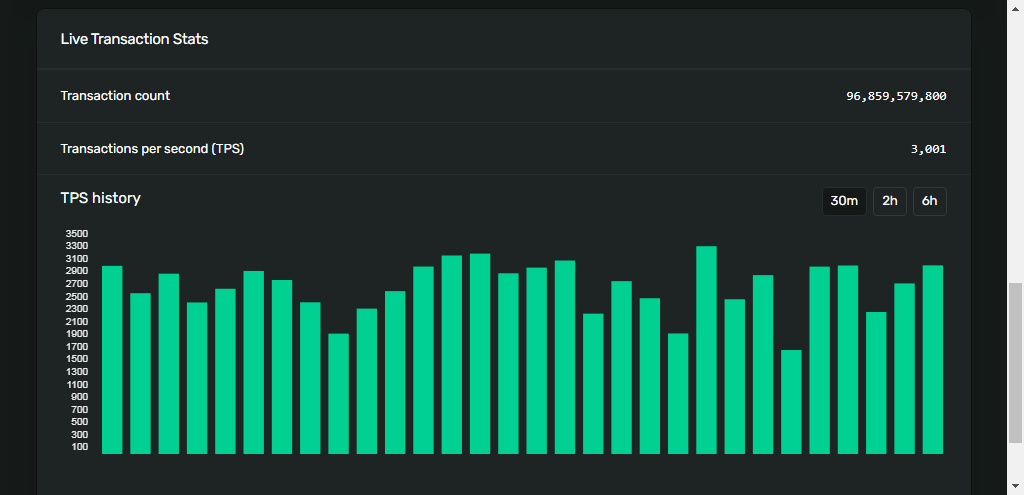

Despite the setbacks Solana has experienced since 2021, institutional bets on the token are starting to grow, as the total transactions conducted on the network have grown to $100 million.

This comes when institutional interest in cryptocurrencies grows despite the current bear market.

According to data from explorer.solana.com, the chain has processed transactions worth about 96.8 million. A figure that is ridiculously close to the $100 million mark.

The network currently processes about 3000 transactions every second, making it easy to see where these figures are coming from. Even though this “3000 transactions per second†figure is well below the network’s touted capacity of 50,000 transactions per second.

The Solana network uses a delegated Proof-of-Stake mechanism to order its transactions. This mechanism is known as Proof-of-History and uses verifiable delay functions in its hashing, enabling it to handle thousands of transactions per second.

As mentioned earlier, the global cryptocurrency market is in a downtrend. Bitcoin, the benchmark cryptocurrency, has dropped about 60% from its ATH and is showing no signs of stopping.

As a result, investors’ interest in bitcoin and Ethereum has reduced over the past three months. They are now looking for alternative investments in other altcoins like Solana, Cardano, and Ripple Coin (XRP).

For example, in the past week, products on the Solana network experienced inflows of about $500,000. Products related to Ripple Coin saw inflows of $200,000, and the same applies to Cardano, with inflows of about $100,000. On the other hand, multi-asset products saw inflows of a whopping $3.3 million.

Disclaimer:The author’s comments and recommendations are solely for educational and informative purposes. They do not represent any financial or investment advice. Always DYOR  (do your own research)