The crypto markets are down today, but aside from Celsius repaying all their debt and avoiding a massive liquidation there’s little to support prompting crypto investors to buy Bitcoin (BTC) and altcoins.

One of the many things weighing on crypto markets right now is a collapse in DeFi protocols, investment funds and BTC trading 60% below its all-time high. However, there are some positive tidbits that could be signs that the market will enter into consolidation mode soon.

expect people will shift from a comatose state of fear to the realization that tens of billions of $ in forced spot selling (LFG, 3AC, lenders, miners) were a capitulation/risk transfer rivaled only by the Covid crash https://t.co/vAj7HfTKxf

— light (@lightcrypto) July 7, 2022

Crypto Investors HODL

The recent collapse in the crypto market has left many investors holding onto their investments. A survey by Appinio found that despite this, more than half (55%) of them are still invested despite the recent crypto-asset market sell-off – with only 8% deciding it’s time for them to sell.

The market for crypto-assets remains strong with 33% of American investors investing in this space. In addition, there are high levels of conviction among those who do invest – 40% believe Bitcoin presents the best investment opportunity right now.

American Investors Show Resiliency

In a recent survey, it was found that 65% of American investors maintained their confidence in the markets even after experiencing a broad pullback.

The majority of those polled identified rising inflation as their most pressing short-term concern with 66%, followed closely by the state of the global economy at 39%. The international conflict came in third place at 34%.

Investors in the US have been hit with a perfect storm of setbacks due to increased cost of living and housing expenses, according to Callie Cox from eToro.

Cox said:

“Despite these factors, investors across generations are demonstrating a level of maturity and understanding and are not letting emotions dictate important money decisions.â€

Bitcoin Enters Oversold Territory

The market may be due for some consolidation after hitting oversold territory according to several on-chain metrics.

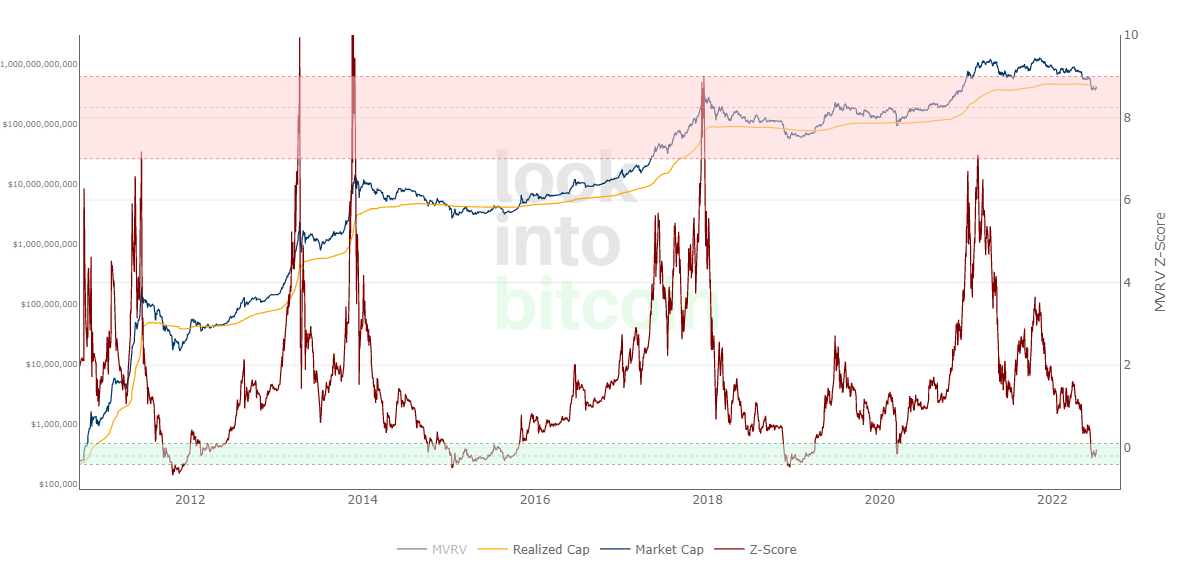

The MVRV Z-score uses a combination of Bitcoin’s market value and z score to identify when bitcoin is “extremely over or undervalued relative” according to LookIntoBitcoin.

The above chart shows when it is best to buy bitcoin. When the red z-score enters the lower green band, this means that there are good buying opportunities for bitcoins; likewise with periods where the market price drops below realized prices shown at the top by blue and yellow lines

The Bitcoin investor tool offered by LookIntoBitcoin can give you insight when buying or selling bitcoins to produce outsized returns.

The green shaded areas on this chart represent periods where Bitcoin’s price has been depressed and may offer good opportunities to buy.

With the Bitcoin investor tool and MVRV’s Z-Score, we can see that time spent in bear market conditions varies. It may be long or short depending on what you’re looking for as an investment thesis. So, investors should not rely on any one indicator when making their investment decisions.