Key Insights:

- Buterin reduced the validator threshold from 32 ETH to 1 ETH.

- The reduced threshold would help better disperse Ethereum’s validators across the world.

- It could respond to Eric’s statement where he proposed that the US government could shut down Ethereum.

Vitalik Proposes to Reduce Validator Entry Barrier

Vitalik Buterin

Ethereum blockchain has a 32 ETH requirement to become a validator and this always has been a significant hurdle for many small time investors in the community who wish to join the network. But that might change soon, as Vitalik Buterin has proposed lowering this barrier.

Vitalik aims to bring down this to 1 ETH so that anyone with an ETH can become a validator and earn rewards by verifying transactions.

Currently, you need 32 ETH, which is roughly about $84,000 at press time to become a validator on Ethereum. Clearly, only whales can afford that in today’s economy.

But, we do not want Ethereum to be whale-controlled. Another option is to pool with others, where stakes contribute to your validator. However, you must share validator rewards that will then reduce your earnings.

Greater Decentralization, More Validators

With the proposed change, the number of validators could increase dramatically—from the current 1 million to 10 or even 15 million. A lower entry point would open the door for many more participants decentralizing the network even further. The accessibility of becoming a validator would dramatically improve, allowing individuals who previously couldn’t meet the 32 ETH requirement to finally participate.

More validators mean a more decentralized Ethereum. Right now, large validator pools dominate, and while pooling enables access for smaller players it concentrates control. A lower barrier would empower independent validators, spreading influence and helping Ethereum achieve its goal of a truly decentralized network.

Was It in Response to Eric Balchunas’s Statement?

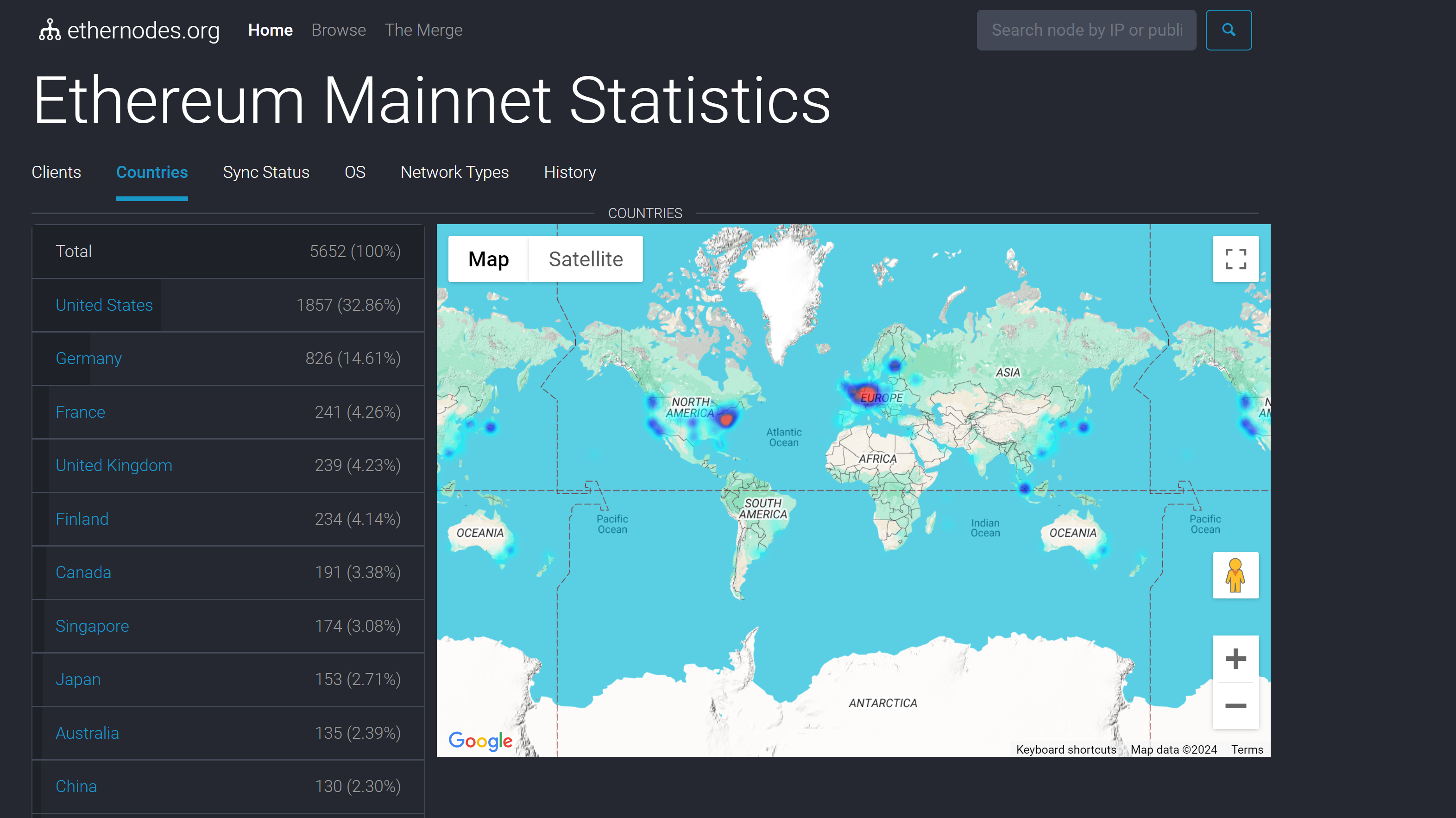

Eric Balchunas, a senior ETF analyst at Bloomberg, has pointed out a centralization risk, even though he was referring to something else. As high as 28% of Ethereum’s validators are hosted on Amazon Web Services (AWS). Further 32% are within the USA.

Data on Ethereum Validator’s Global Presence

This gives AWS, and by law, the US government, potential leverage over the network. If AWS were compromised or restricted, a significant portion of Ethereum’s infrastructure could be at risk.

With the elections approaching and the likelihood of a better Ethereum policy despite a government change, Ethereum has chosen to act faster before fate forces it to choose something undesirable.

Vitalik’s proposal might be a step toward addressing concerns like this. Presently, 32% of Ethereum validators are based in the US By lowering the entry requirement, Ethereum could reduce its reliance on large, centralized hosting services like AWS, as more validators from around the world could join. This would diversify the validator base, making Ethereum less vulnerable to region-specific risks, and reinforcing its decentralized nature.

The Ethereum validator push by Buterin is more focused on reducing the reliance on a handful of validators. With the possibility of boosting validator numbers into the millions, this change could change the current Ethereum’s validator landscape, making it more secure, more decentralized, more dispersed, and less reliant on large entities like AWS or even be concentrated in territories like USA.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.