Key Insights

- The crypto market is declining, and the shrimps are panicking. However, the whales appear to see an opportunity.

- Bitcoin: Addresses holding 1,000+ BTC have reached the highest point since August 2022, possibly signalling buy confidence.

- A Dormant whale just woke up and withdrew $13.76 million in ETH from Coinbase.

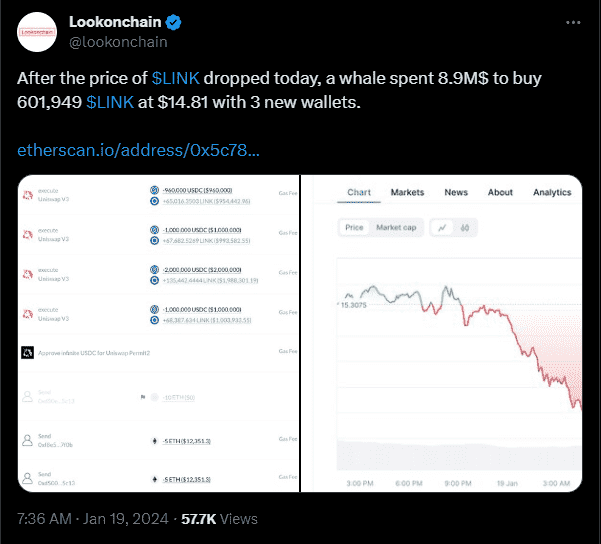

- A whale dropped $8.9 million on 601,949 LINK at $14.81, looking to cash in on an incoming breakout

- Daily large transactions on Cardano have hit $13 billion, with whales becoming increasingly active. Cardano could also possibly rally to $7 soon.

The crypto market’s performance has not been a pretty sight over the last week, considering the heavy decline that currently plagues Bitcoin and the others.

Several cryptocurrencies are down on all timeframes, and the short sellers have been in panic mode ever since.

However, where a shrimp sees panic, the whales see opportunity.

This has been the case with Bitcoin, Ethereum, Chainlink and Cardano, with several cases of whales buying them, springing up all over the internet.

Here are some of the most interesting and recent buys on these cryptocurrencies, that you should know about.

1. Crypto: Bitcoin

The Bitcoin whales have been making the biggest moves over the last few days, as outlined by this recent tweet from Ali.

The number of addresses with more than 1,000 Bitcoin has increased to its highest point since August 2022, according to data from Glassnode.

As of the time of writing, there are now about 1,510 of these addresses in total, showing a rising trend, as well as the possibility that traders are becoming more confident in the ability of Bitcoin to change its direction and rally further upwards.

According to the chart above, Bitcoin has tested the $40,450 resistance, and the whale addresses buying at this point may signal an incoming change in direction.

2. Ethereum

According to a recent tweet from SpotOnChain, a whale address that had been dormant for two years suddenly came back to life.

SpotOnChain notes that this address promptly withdrew 5,580 ETH from Coinbase, (which is valued at $13.76 million at the time of writing).

This whale’s actions may mean a lot of things. However, the most prominent is that they have no desire to sell.

Notably, before going dormant, this whale was a large gainer, with an estimated profit of nearly $31 million from ETH between September 8, 2020, and March 9, 2022.

Just like Bitcoin, Ethereum is also testing the 2,500 resistance and may be about to rebound from here, if this turns out to be a turning point for Ethereum.

3. Chainlink

Quite recently, a single whale spent 8.9M$ to buy 601,949 $LINK at an average price of $14.81, using 3 new wallets according to a tweet from IntoTheBlock.

If this isn’t belief in LINK’s abilities, then nothing else is.

According to the charts, there might be a good reason why this whale chose to buy now of all times.

Chainlink became stuck in a consolidation between $12.8 and $16.6, ever since breaking above the former on 7 November.

As shown above, Chainlink has tried and failed severally, to break above the $16.6 resistance. And at the time of writing, Chainlink appears to be about to break out.

This presents a very bullish scenario for Chainlink because a breakout from here would signal a possible rally to $20 for a start.

Chainlink’s price prediction

If this outlook on LINK pans out, we can see a rally as high up as $28, in what would be a 72% rally.

4. Cardano

A recent tweet from IntoTheBlock shows that Cardano whales have been quite jacked up for the past few months.

IntoTheBlock says that nowadays and on a daily basis, about $13B in large transactions is being settled on the Cardano network.

This shows that the big players are becoming more active on the Cardano network every day, and like Chainlink, there is an even better reason for this sudden interest from whales:

In a recent tweet, Ali, an analyst, notes that Cardano’s current consolidation phase is very similar to how it behaved in late 2020.

Ali says that if we see a replay of this price performance, we might see ADA rallying strongly upwards sometime around April.

Ali says that this rally would likely lead Cardano up to $0.80 before we experience a brief correction to $0.60.

Soon after this, Cardano is expected to explode upwards to as high as $7!

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.