Key Insights

- Bitcoin has fallen drastically, breaking below $40,000 for the first time in 2024, triggering panic selling and market anxiety.

- Despite the bearish trend, analysts see a fierce battle between bulls and bears

- Bitcoin spot ETFs are experiencing massive outflows, particularly Grayscale’s GBTC, with FTX selling over half its shares.

- Technical indicators suggest Bitcoin could drop further, potentially retesting $31,800

- The current market dynamics present strong arguments for a potential short- and medium-term decline in Bitcoin’s price.

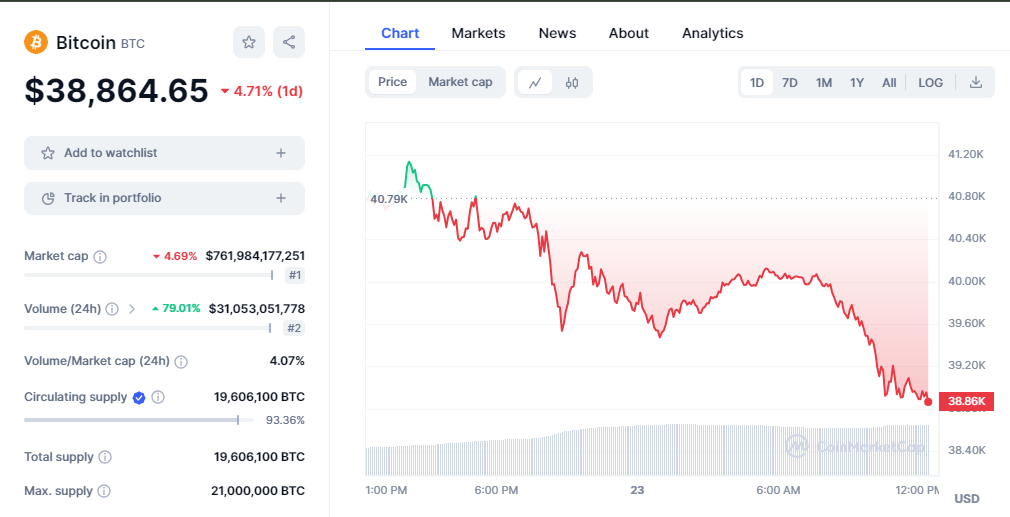

A massive wave of selling hit the crypto market on Friday when Bitcoin first started to lose its footing at around $41,000.

The “reds” became even more serious, when on Monday, the crypto market suffered another blow when Bitcoin broke below the $40,000 support level for the first time this year.

This move has created a wave of panic throughout the market, with thousands of traders rushing to sell their holdings and lock in what little profits they’d managed to gather.

Analysts See a Fierce Game Between Bulls And Bears

Attention to this wave of panic selling was first drawn by the crypto data aggregation service, Greeks.live.

The firm sent out a tweet on Monday, noting that Bitcoin’s Volatility Risk Premium (VRP) had declined massively, as the Skew curve bent towards the bears.

Greeks.live notes that these metrics were behaving this way because several traders panic-sold their holdings, further worsening the market decline.

Furthermore, Greeks.live states that despite this wave of panic selling, the long and short positions remained balanced on a relative scale.

This indicates that in spite of the bears’ behaviour, there is still an ongoing battle between the bulls and bears for dominance.

The Bears may not have won yet. Not fully, at least.

This outlook from Greeks.live comes after a similar tweet from the previous day, that showed that the current market dynamics are mainly influenced by the launch and the market dynamics behind the several spot ETFs in the US.

Bitcoin Spot ETFs Suffer Massive Outflows Amid Market Downturn

The much-hyped ETF market has not been spared either.

According to a recent tweet from Bloomberg ETF analyst James Seyffart, even the ETF market has seen massive ouflows of about $76 million on its seventh day of trading.

According to Seyffart, Grayscale’s ETF (GBTC) took the worst beating among the others, with a $3.45 billion drop in AUM so far, since the general launch of the ETFs.

This represents as much as 10% of its total AUM of around $35 billion as of Jan. 21, 2024.

In fact, Seyffart describes grayscale’s outflows as “unceasing”, with the largest amount of outflows occurring on Monday, 23 January.

Most of these outflows can be ascribed To FTX, which has reportedly sold more than half of its 22.8 million GBTC shares as of Jan. 22 according to Bloomberg.

Bitcoin Suffers A Setback At $40,000

Bitcoin is currently suffering from a 4.5% decline over the last day. The cryptocurrency currently trades at around $38,835, and things do not look pretty.

According to Bitcoin’s weekly chart shown below, its 20-day EMA sits at around $37,400.

The above outlook suggests that we might see Bitcoin decline further down, from where it currently sits.

This is without mentioning the longer-term ascending trendline that suggests a Bitcoin retest of $31,800.

The bullish outlooks for Bitcoin remain valid over the long term. However, for the short and medium-term outlooks, Bitcoin presents strong cases for a possible decline from current prices.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.