Key Insights

- Bitcoin Likely To Make New ATH in the Next 24 Hours

- Short Squeezes from $69k to $72k Pushes Bitcoin Towards $73.5k

- Whales Accumulate Record 670k Bitcoin, ETFs Enter Buying Spree

- Fear and Greed Index Reaches 72

- When Can We See a New ATH?

- Falling Bitcoin Domination Despite Rally Indicates Strong Undercurrent of Altcoins

- Bitcoin has tocuhed $73.5k earlier this morning.

- Remains shy of making a new ATH by $200.

- A new all-time high is likely within the next 24 hours.

- Bitcoin gained $4k in a single day because of successive short squeezes at $69k and $73k.

- In the next few days or even hours, Bitcoin might cross $73.7k and make a new ATH.

Bitcoin Likely To Make New ATH in the Next 24 Hours

Bitcoin Almost Touches ATH, Returns From $73.5k

Bitcoin almost touched ATH($73.7k) late last night but had to return to $73.5k. Yesterday, it crossed $71k and $72k due to successive short squeezes from $69k to $72k. In the next 24 hours, Bitcoin is likely to make a new ATH.

Short Squeezes from $69k to $72k Pushes Bitcoin Towards $73.5k

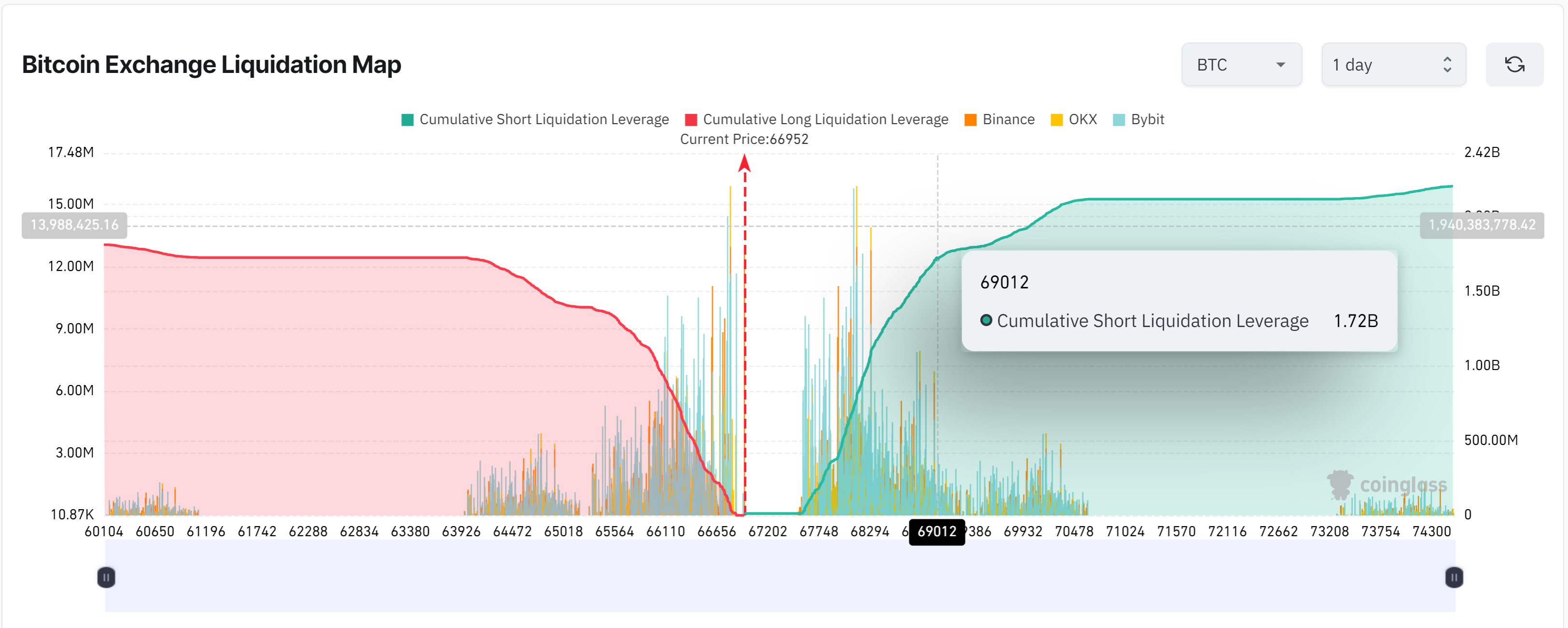

Cumulative Shorts at $69k in Bitcoin

A few days earlier, we showed how Bitcoin options indicated the presence of $1.72 billion worth of shorts at a $69k strike price that could trigger a short squeeze at any time.

As soon as Bitcoin crossed $69k yesterday, these shorts were liquidated, pushing the markets higher due to a phenomenon called “short squeeze.” Further, as the price has crossed $70k and is now at $73k, we expect more shorts to be triggered and the markets to witness a flash rally toward $73.7k.

A flash rally occurs when, due to excessive shorts or demand shock, the price of an asset tends to rise severalfold within a couple of days. We saw such a flash rally earlier in 2022 during the US Sanctions on Russia when the latter was cut off from buying stablecoins, pushing their price higher.

Whales Accumulate Record 670k Bitcoin, ETFs Enter Buying Spree

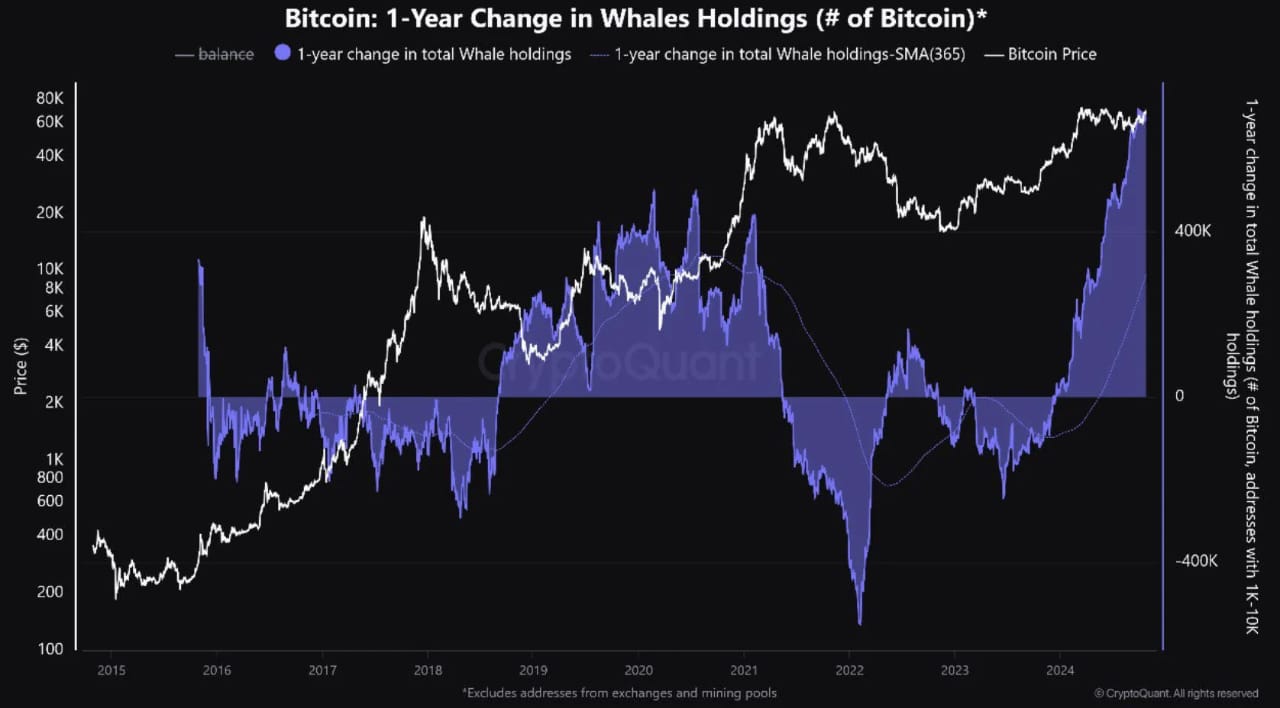

A CryptoQuant insight from a couple of days ago showed that whales were accumulating Bitcoin, and this accumulation has reached unprecedented levels.

Bitcoin Whale Accumulation at All-Time High

Many factors drove this accumulation, such as increased market liquidity, institutional buying, Bitcoin’s post-halving rally, and the growth of users with active Bitcoin addresses.

In September, the US Federal Reserve’s decision to reduce interest rates by 0.5% released much-needed liquidity in the markets. Driven by this high liquidity, large investors like whales and institutions accumulated Bitcoin in large numbers.

Another factor contributing to Bitcoin’s growth was the possibility that Donald Trump might win the US Presidential elections. After a painful series of investigations by the SEC, the markets have long longed for a pro-crypto president.

Next, the possibility of war in multiple countries in the Middle East and Eastern Europe might also have prompted the drive to accumulate Bitcoin. This year, Bitcoin has been the top-performing asset, beating gold, real estate, bonds, and stocks.

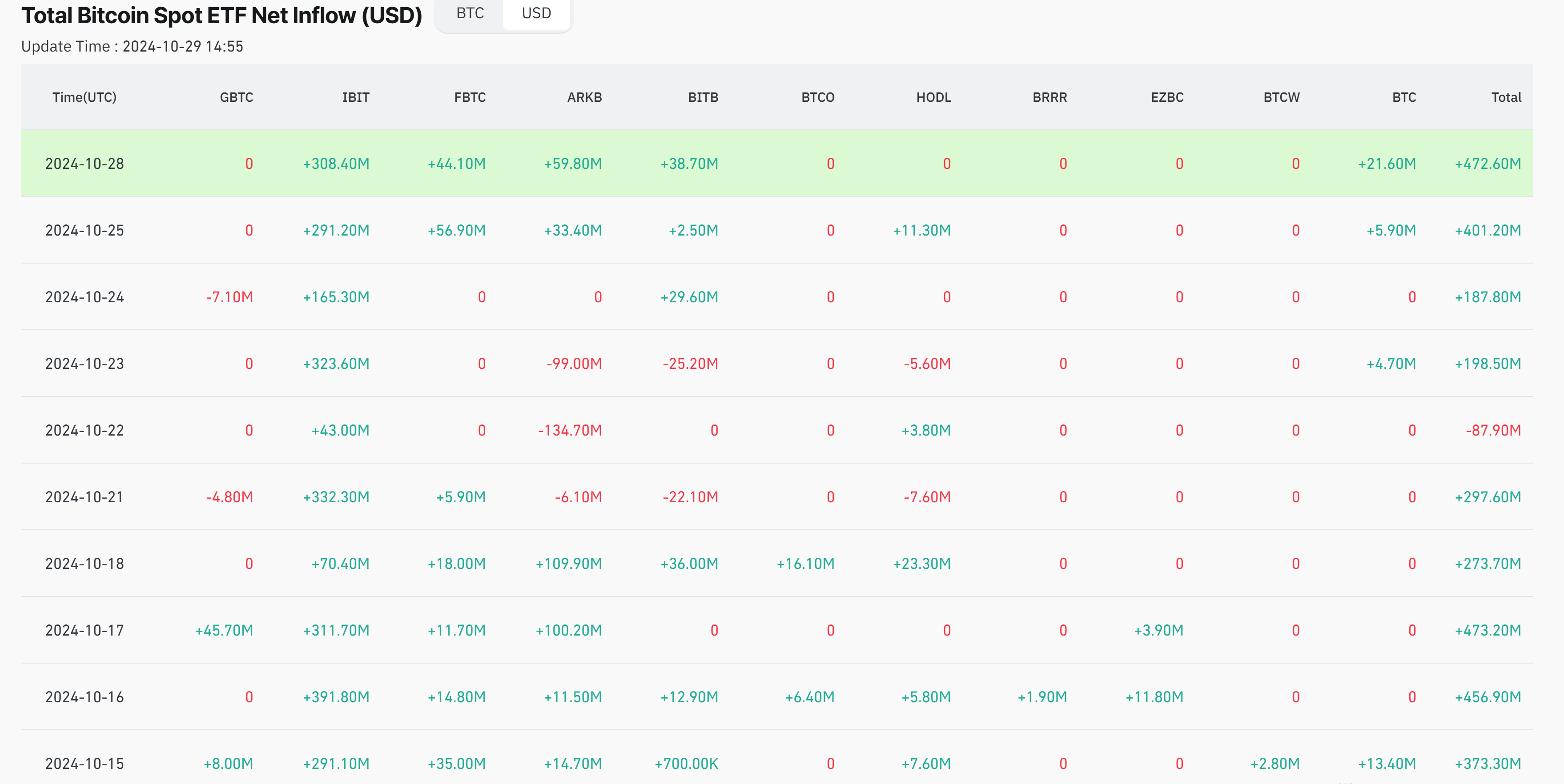

ETFs too played a major part in pushing Bitcoin prices higher. To date, the total number of Bitcoins accumulated by the ETFs stands at $52 billion. This accumulation was accelerated in the last two days where inflows exceeded $400 million per day.

Bitcoin ETF Inflows

Finally, a post-halving rally, which has been the signature of every Bitcoin bull season, was long overdue after the halving event in April 2024.

Fear and Greed Index Reaches 72

The Bitcoin Fear and Greed Index, too, has risen to 72, long after March. Despite short bullish bouts between March and the present, the indicator was mostly below 50.

However, now that it has gone above 72, it clearly indicates that the bulls are ready for the next leg of gains.

When Can We See a New ATH?

As per our expectations, we might see a new ATH this week or perhaps even tonight. This is due to the earlier-mentioned “flash rally” that was triggered by successive short squeezes at $69k, $70k, and $71k.

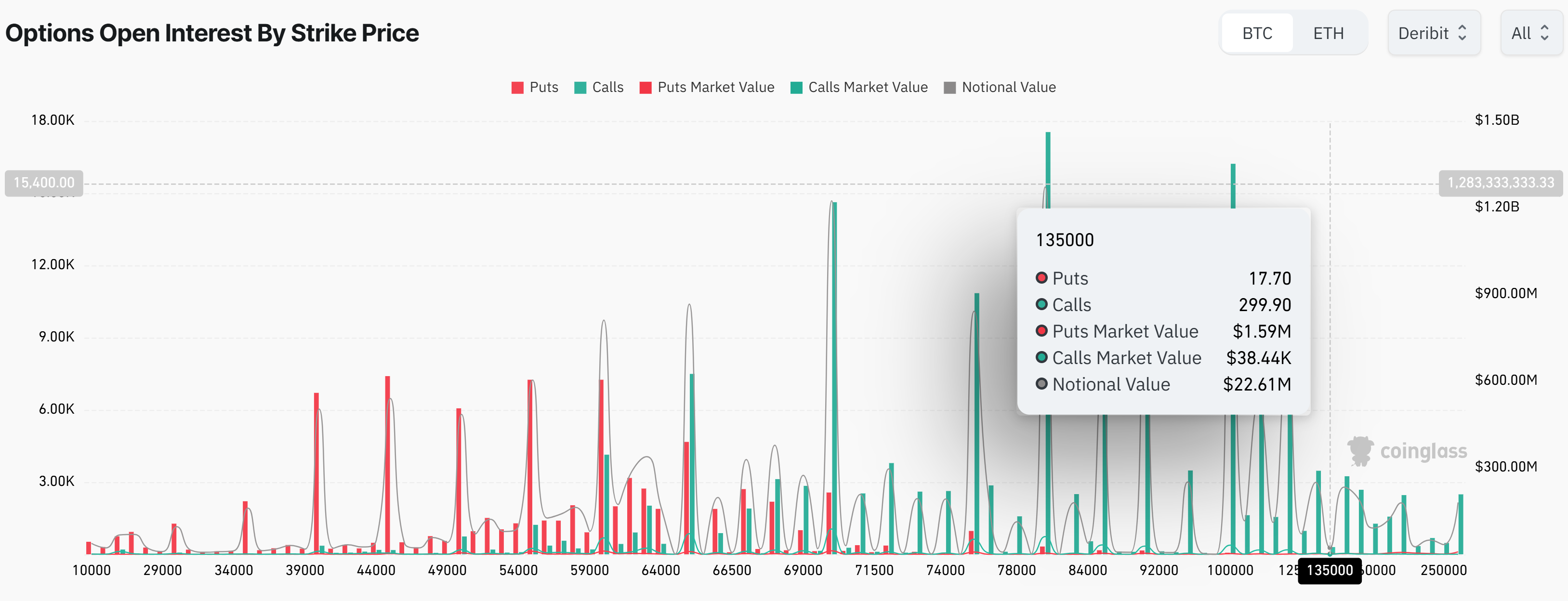

If we take an even closer look at Bitcoin Options data from Coinglass, we see that the next significant strike with high open interest is $80k.

Bitcoin Open Interest at $80k

The highest call open interest at $80k indicates that the current rally may push Bitcoin towards $80k in November.

Falling Bitcoin Domination Despite Rally Indicates Strong Undercurrent of Altcoins

Amid all these, there has been an interesting development. After reaching a 3.5-year high on 16 October 2024, Bitcoin’s market dominance has fallen for the first time in 2024. However, there was no fall in price, which had only gained momentum since that day.

This situation is only possible when altcoins grow more strongly than Bitcoin. Such strong growth in altcoins indicates the presence of a strong undercurrent in the markets.

In the coming weeks, we might see the alt season mature with strong rallies in the broader markets despite new all-time highs in Bitcoin.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.