Key Insights

- Michael van de Poppe believes a bull rally is coming based on Bitcoin’s recent price action.

- Bitcoin recently broke above the key $61,000-$62,000 range, which might trigger this run.

- Van de Poppe expects the altcoins to surge in tandem with Bitcoin.

- The DeFi sector is a major part of the market to choose from because of its many opportunities.

- He says the best altcoins include Compound Finance ($COMP), Rocket Pool ($RPL), and Ether.fi ($ETHFI).

Recently, crypto trading expert Michael van de Poppe posted a YouTube video sharing his latest market insights.

In the video, he explained his trading strategies and highlighted some of the current altcoins he’s eyeing as Bitcoin gears up to hit new highs.

Here is an analysis of the current market, the factors that could trigger a bull rally, and some of the best altcoin picks according to one of the most widely followed crypto analysts across Twitter and YouTube.

Bitcoin’s Critical Price Range and Bullish Outlook

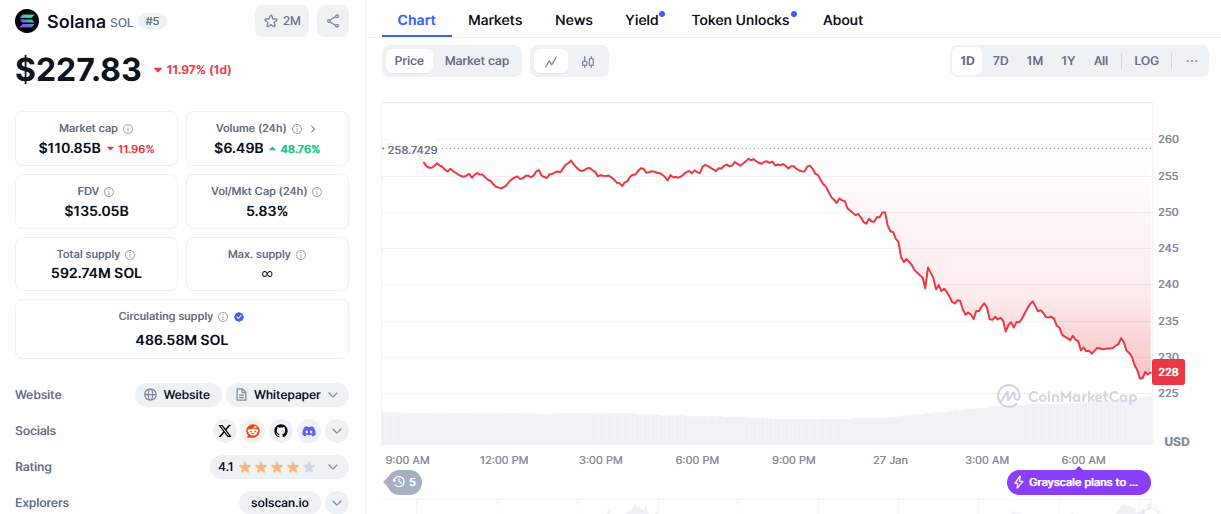

When van de Poppe released the video, Bitcoin was trading between $61,000 and $62,000—a crucial level he identified as necessary for Bitcoin to hit a new all-time high soon.

This condition has been met since, with Bitcoin briefly tapping $65,000 and now trading at around $64,000.

Bitcoin’s price

Van de Poppe also commented on the market’s generally bearish sentiment and how it has caused Ethereum to decline against Bitcoin.

However, the downtrend is expected to reverse soon and spark an altcoin season.

DeFi’s Role in the Crypto Strategy

As with investing in altcoins, the analyst was especially interested in the Defi sector, especially within the Ethereum ecosystem.

According to the analyst, the Defi sector is a powerful investment alternative, especially given the current challenges facing the Trad-Fi niche.

Interestingly, while he acknowledged the Defi sector as a whole, he says that Aave is a strong performer.

However, there are more “asymmetrical opportunities” that disqualify the lending protocol’s cryptocurrency.

Some of these include:

1. Compound Finance ($COMP currently at $50)

According to van de Poppe, COMP has a market cap of around $400 million and an impressive TVL of around $2 billion.

As indicated, the cryptocurrency’s TVL vastly outweighs its market cap, making it an attractive option.

Compound Finance’s price action

According to the charts, we are looking at a very recent breakout on COMP from the upper trendline of the descending wedge shown.

Moreover, the cryptocurrency appears to be in the late stage of a post-breakout correction and should rebound soon.

This means that it is poised for more than a 60% rally to the $80 zone or even higher as soon as the bulls take action.

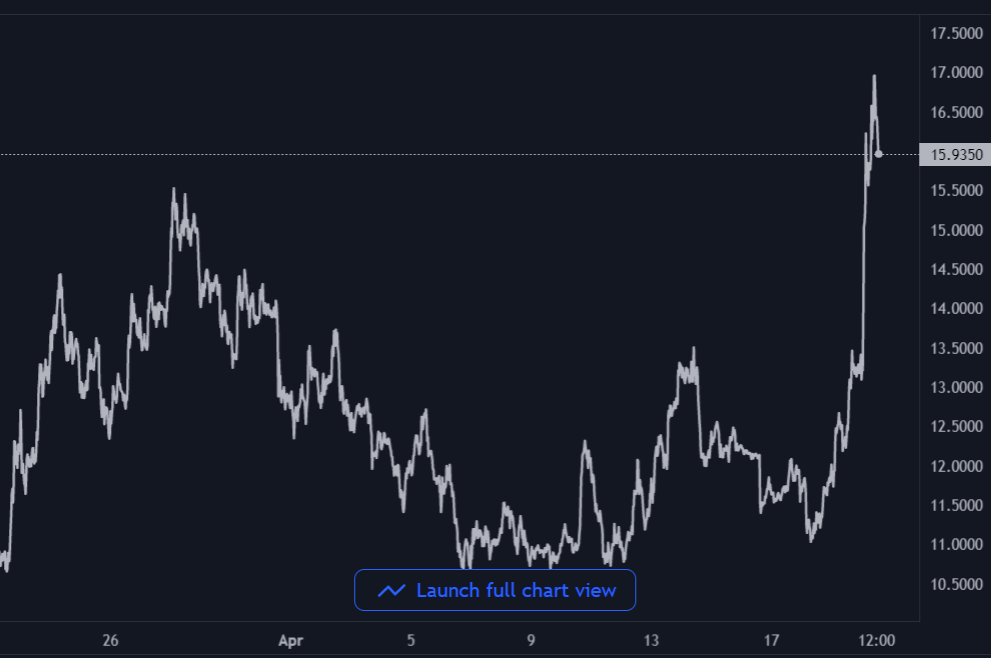

2. Rocket Pool ($RPL currently at $13.33)

According to data from DefiLlama, the cryptocurrency has a market cap of around $274 million and a TVL of around $3.4 billion.

This puts the cryptocurrency in the same “asymmetric” scenario as Compound Finance’s coin.

Rocket Pool’s price action

According to the charts, cryptocurrency is trading inside a descending channel, with a break above and retest of the $13.33 price level.

If the cryptocurrency holds its ground above this price level, we should see it rebound further up, retest the upper trendline of the channel around $20 and possibly break out to the upside.

3. Ether.fi ($ETHFI currently at $1.16)

Ether.fi is the third cryptocurrency van de Poppe mentions.

Like Rocket Pool, the analyst describes this as a high-risk, high-reward opportunity—a less established but powerful alternative that could gain traction soon in the market.

Ether.fi has a similar market cap to Rocket Pool, currently around $283 million.

Interestingly, this project’s TVL trumps the other two by far.

We have a TVL value of a whopping $6.83 billion, which makes the cryptocurrency the most asymmetrical of all.

Ether.fi’s price action

In the charts, we are looking at what appears to be a valid rebound from a descending trendline.

If this rebound is valid and the bulls are truly back in action, we should expect to see the formation of a new higher high around the $2.7 high from 23 July.

This break above would be the trigger that investors need to ride the possible cup-and-handle formation that takes the cryptocurrency back up to $8.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.