Key Insights

- The overall crypto market has crashed by 3.69% today.

- Bitcoin and Ethereum are struggling and could drop further down if the bulls fail to act.

- The crypto fear and greed index has also moved closer to the fear zone.

- Aave is showing choppy but bullish signals and could possibly see a massive price increase soon.

- Flare is at a crucial resistance level, and a breakout in either direction could lead to a price jump or dump.

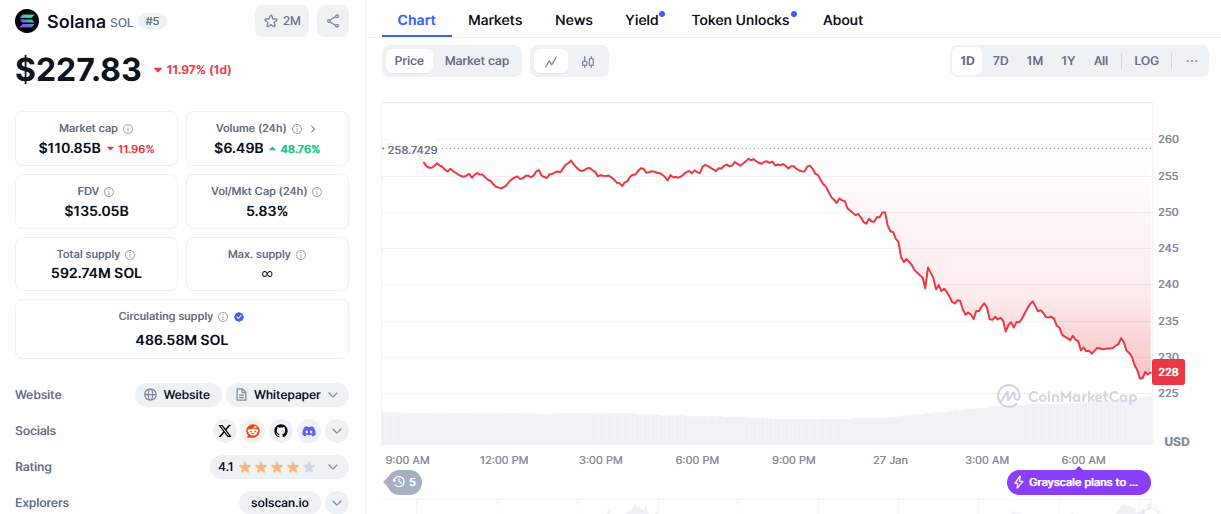

The crypto market has slid downwards again today by another 3.69% by market cap. This figure now sits at around $2.06 trillion, along with Bitcoin sitting at only a few dollars above the $58,000 mark.

The crypto heatmap has turned up a great deal of red, with Bitcoin and Ethereum trading at declines of more than 4% each.

The crypto heatmap

The crypto fear and greed index has also declined further towards the fear level around 43, down from a reading of 55 yesterday, as shown.

The crypto fear and greed index

So far, some of the top losers include Ordi, Sats, Brett, DogWifHat, and Celestia, all of which had declined between 8.3% and 9.34% at the time of writing.

On the flipside, some of the top gainers include Aave, Flare and eCash, with Aave being the top gainer after rising by 7.4% in the last 24 hours.

The crypto liquidation heatmap

According to data from Coinglass, the liquidation figure has spiked from a little over $80 million to around $137 million today, with the bulls suffering the worst.

While the bears lost a relatively sensible $26 million, the bulls lost around $110 million.

This means that the bears are mostly in control of the market today.

Bitcoin Trends Lower and Lower

As shown in the charts, Bitcoin failed to break above the $62,000 mark once again and is now trading further downwards after its rejection from $58,000.

Bitcoin’s price rejection

The cryptocurrency is now at risk of breaking below the $57,600 mark once again if the bulls fail to take control of the situation.

According to the daily RSI, a bearish crossover is also looming, which means that if Bitcoin drops below this $57,600 mark, the resulting drop might be harsh.

Ethereum’s Rejection from $2,800

Just like Bitcoin, Ethereum is also in the middle of a rejection and is now trending lower after its latest rejection from the resistance block illustrated below:

Ethereum’s price action

The upper wick of yesterday’s candlestick was noticeably longer than the lower one, which means that the bears were active in their rejection.

The drop might be devastating if Ethereum breaks again below its short-term low of around $2,510.

Ethereum’s RSI, on the daily chart, sits in bearish territory, which means that the bulls might have to fight extra hard to defeat the bears.

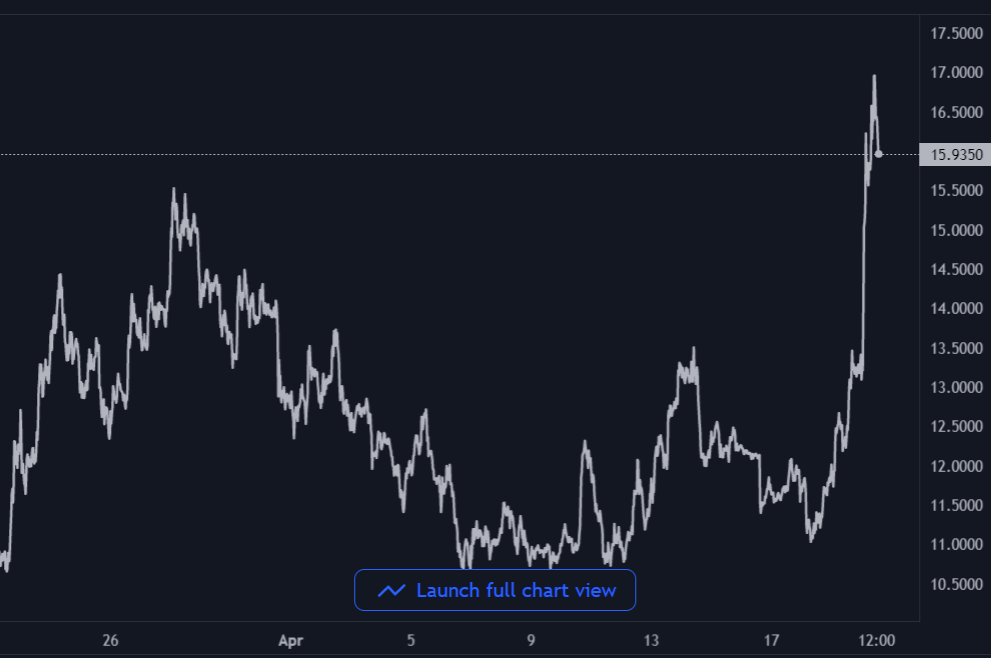

Watch Out For Aave

Aave is very choppy on lower timeframes, making it difficult to determine its actual trend.

However, in the weekly timeframe, the cryptocurrency has been trading on top of an ascending trendline since the beginning of the year, as illustrated.

Aave is choppy but bullish.

As it stands, Aave is now attempting a rebound from this trendline, as well as a break above the psychological resistance range between $100 and $120.

Suppose Aave successfully breaks through this choppy price action and continues its ascent to the upside. In that case, it will likely hit the $200 price resistance pretty quickly if the bulls can maintain momentum.

However, in the short to medium term, a break above its choppy phase would lead to a possible 45% price increase from current levels to around $170.

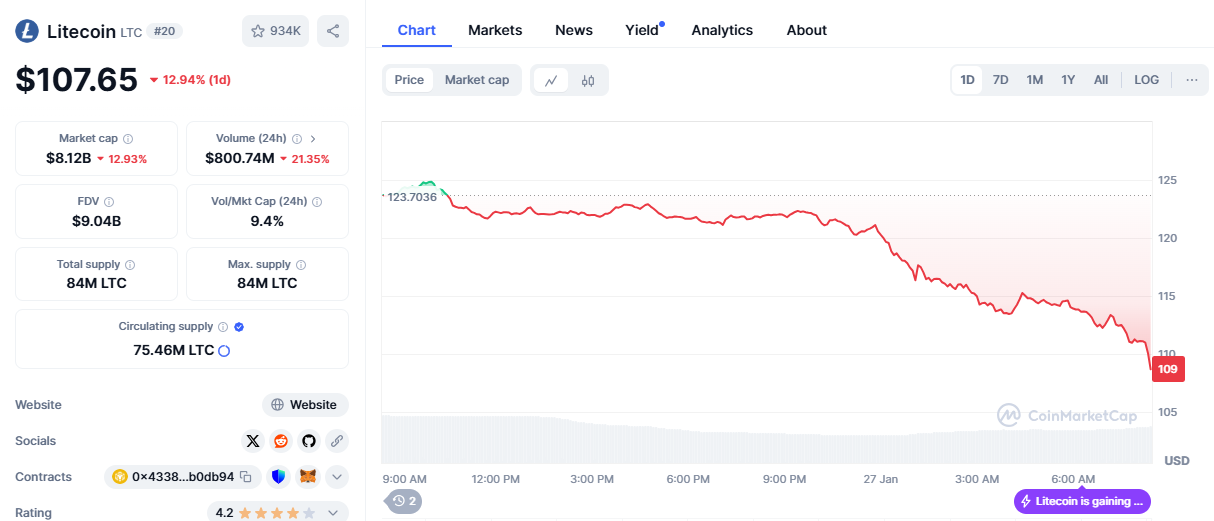

The Bulls Are Fighting Hard on Flare (FLR)

According to the charts, Flare is trending around the $0.0156 resistance level, which is a very important price point considering its relative strength in keeping the cryptocurrency stable between December 2022 and January 2023.

Flare’s price action

This time around, we are looking at one last stand on Flare. A breakout from either side will determine the strength of Flare’s trend going forward.

Investors should consider monitoring the cryptocurrency from here because a break and close might determine if it rallies by 270% to $0.056 or declines to $0.01.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.